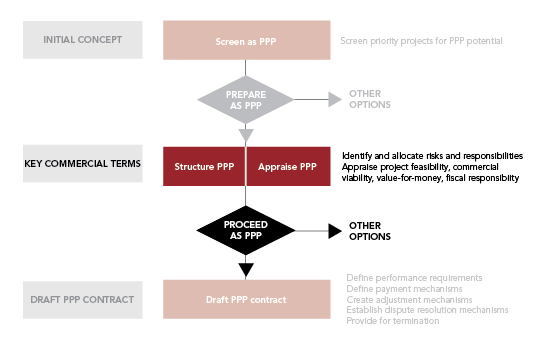

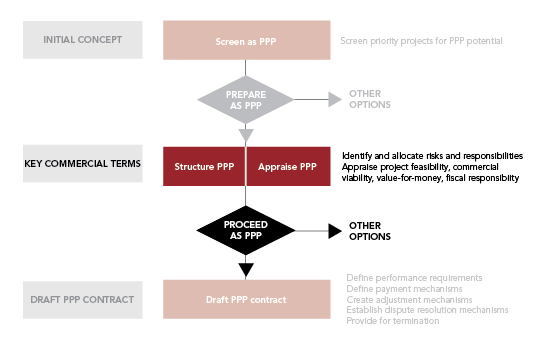

"Structuring a PPP project" means allocating responsibilities, rights, and risks to each party to the PPP contract. This allocation is defined in detail in the contract. Project structuring is typically developed through an extended process, rather than by drafting a detailed contract straight away. The first step is to develop the initial project concept into key commercial terms—that is, an outline of the required outputs, the responsibilities and risks borne by each party, and how the private party will be paid. The key commercial terms are typically detailed enough to enable practitioners to appraise the proposed PPP, as described in Identifying PPP Projects, before committing the resources needed to develop the draft PPP contract in detail.

Structuring PPP Projects

Structuring PPP Projects shows how PPP structuring—to the level of key commercial terms—fits into the overall development process. Information from the feasibility study and economic viability analysis is a key input to PPP structuring—for example, identifying the key technical risks, and providing estimates for demand and users' willingness to pay for services. The PPP structure then feeds into commercial viability, affordability and value for money analysis—which may find that changes are needed to the proposed risk allocation. The aim is typically to structure a PPP that will be technically feasible, economically and commercially viable, fiscally responsible, and provide value for money.

The starting point for PPP structuring is the project concept: that is, the project's physical outline, the technology it is expected to use, the outputs it will provide, and the people it will serve. These are often developed before deciding whether to implement the project as a PPP, as described in Identifying PPP Projects.

The specification of output requirements in the PPP contracts is described in Designing PPP Contracts. PPP project structuring focuses on identifying and allocating risks. This makes sense since appropriate risk allocation is behind many of the PPP Value Drivers described in PPP Value Drivers. Following this approach, the other elements of the PPP structure—such as the allocation of responsibilities and the payment mechanism—stem from the risk allocation. For example, construction risk may be allocated to the private party, on the basis that it is best qualified to manage construction. This means that the private party should also be allocated the responsibility and right to make all construction-related decisions. The mechanism for allocating commercial risk to the private party may take the form of a user-pays payment mechanism.

This section follows the literature, starting with identifying and prioritizing project risks (Identifying Risks) then describing how risks are allocated (Allocating Risks) then explaining how the risk allocation relates to the other aspects of project structure (Translating Risk Allocation into Contract Structure).

Key References

- Identifying Risks

- Allocating Risks

- Translating Risk Allocation into Contract Structure

Key References

Structuring PPP Projects

- Irwin, Timothy C. 2007. Government Guarantees: Allocating and Valuing Risk in Privately Financed Infrastructure Projects. Directions in Development. Washington, DC: World Bank. Chapter 4 defines risk, and explains the principles of allocating risk under PPP projects. Chapter 5 provides examples of putting those principles into practice for three risks: exchange-rate risk, insolvency risk, and policy risk.

- Yescombe, E.R. 2007. Public-Private Partnerships: Principles of Policy and Finance. Oxford: Butterworth-Heinemann. Chapter 14 on risk evaluation and transfer describes types of risk that are common to PPP projects.

- Delmon, Jeffrey. 2015. Private Sector Investment in Infrastructure: Project Finance, PPP Projects and PPP Frameworks. 3rd ed. Alphen aan den Rijn, Netherlands: Wolters Kluwer. Chapter 5 on risk allocation goes into more detail on PPP risk categories.

- AU. 2016a. National Public Private Partnership Guidelines - Volume 4: Public Sector Comparator Guidance. Canberra: Commonwealth of Australia. Section 16: Identifying, Allocating, and Evaluating Risk describes in detail different methodologies for quantitatively valuing risk in PPPs.

- ADB. 2002. Handbook for Integrating Risk Analysis in the Economic Analysis of Projects. Manila: Asian Development Bank. Chapter 2 describes quantitative techniques for assessing risk.

- VIC. 2015. Victorian Government Risk Management Framework. Melbourne, Australia: Victorian Government, Secretary Department of Treasury and Finance. A general guide on risk management frameworks, developed for public sector managers in the State of Victoria, Australia. Includes examples of risk assessment, and risk management templates.

- Farquharson, Edward, Clemencia Torres de Mästle, E. R. Yescombe, and Javier Encinas. 2011. How to Engage with the Private Sector in Public-Private Partnerships in Emerging Markets. Washington, DC: World Bank. Appendix B is risk register for a PPP project, providing an example of a risk allocation matrix, and of a qualitative approach to assessing and prioritizing risks.

- Iossa, Elisabetta, Giancarlo Spagnolo, and Mercedes Vellez. 2007. Best Practices on Contract Design in Public-Private Partnerships. Washington, DC: World Bank. Section 3: Risk Allocation Incentives, and Types of PPP describes typical types of risk in PPP contracts, the principles of effective risk allocation as well as its limitations, and typical risk allocations under different types of PPP contract.

- OECD. 2008a. Public-Private Partnerships: In Pursuit of Risk Sharing and Value for Money. Paris: Organisation for Economic Co-operation and Development. Chapter 3: "The Economics of Public-Private Partnership" includes a section on the role and nature of risk, which describes the concept of optimum risk transfer.

- Ng, A., and Martin Loosemore. 2007. "Risk allocation in the private provision of public infrastructure." International Journal of Project Management 25(1) 66-76. Describes classification and allocation of risk in PPP projects, and provides a case study of risk allocation for a railway PPP project in Australia.

- Bing, Li, A. Akintoye, P.J. Edwards, and C. Hardcastle. 2005. "The allocation of risk in PPP/PFI construction projects in the UK." International Journal of Project Management 23 (1) 25-35. Assesses how risks have been allocated in practice in PPP projects in the United Kingdom.

- Rebollo, Andres, ed. 2009. Experiencia española en concesiones y asociaciones público-privadas para el desarrollo de infraestructuras públicas: Marco general. Research for Programa para el Impulso de Asociaciones Público-Privadas en Estados Mexicanos (PIAPPEM). Madrid: Deloitte España. Review of the Spanish PPP experience. Includes a description of typical project structure divided by sectors and includes multiple examples of successful PPP projects.

- Ke, Yongjian, ShouQing Wang, and Albert P. C. Chan. 2010. '"Risk Allocation in PPP Infrastructure Projects: Comparative study." Journal of Infrastructure Systems 16(4) 343-351. Compares risk allocation for PPP projects in China, Hong Kong, Greece, and the United Kingdom, exploring how country characteristics affect the risk allocation that can be achieved in practice.

- AU Guidelines. Accessed March 20, 2017. “National Guidelines for Infrastructure Project Delivery.” Canberra: Australian Government, Department of Infrastructure and Regional Development. URL. Volumes 3 and 7 describe in detail how the risks and responsibilities will be allocated in social and economic infrastructure projects. The Roadmap describes how the principles should be used—as a starting point for developing contracts for particular projects.

- HK. 2008. An Introductory Guide to Public Private Partnerships. Hong Kong, China: Efficiency Unit. Section 6 provides guidance on managing risk. Annex E provides an example risk allocation matrix for a water treatment plant.

- RJ. 2008. Manual de Parcerias Público-Privadas - PPPs. Conselho Gestor do Programa Estadual de Parcerias Público-Privadas. Rio de Janeiro: Governo do Estado do Rio de Janeiro. Annex 2 provides an example of a typical risk matrix.

- ZA. 2004a. Public Private Partnership Manual. Pretoria: South African Government, National Treasury. Annex 3 provides guidance on how to calculate the value of risk. Annex 4 presents a standardized PPP risk matrix—listing risks, and describing for each risk a typical risk mitigation mechanism and allocation.

- PPIAF. 2006. Approaches to Private Sector Participation in Water Services: A Toolkit. Washington, DC: Public-Private Infrastructure Advisory Facility. Section 6: Allocating Risks and Responsibilities describes a process and principles for allocating both risks and responsibilities, as well as how the allocation can be defined in the contract, including through tariff rules.

- IN. Accessed March 15, 2017. "PPP Toolkit for Improving PPP Decision-Making Processes." Public-Private Partnerships in India. New Delhi: Government of India, Ministry of Finance. Module 1: PPP Background has a section on PPP modal variants that describes typical risk allocations under different PPP contract types.

- ES. 2011. "Real Decreto Legislativo 3/20111, de 14 de noviembre, por el que se aprueba el texto refundido de la Ley de Contratos del Sector Público." Boletín Oficial del Estado, 276 (1) 117729-117913. Madrid: Gobierno de España, Ministerio de la Presidencia. The Spanish Procurement law regulates the public procurement PPP contracts that can be used in Spain. Some of them are partially structured by the law and some of them have a flexible risk allocation.

- Toro Cepeda, Julio. 2009. Experiencia Chilena en Concesiones y Asociaciones Público-Privadas para el desarrollo de Infraestructura y la Provisión de Servicios Públicos: Informe Final. Research for Programa para el Impulso de Asociaciones Público-Privadas en Estados Mexicanos (PIAPPEM). Santiago, Chile. Review of the Chilean PPP experience. Includes a description of typical project structure divided by sectors and includes multiple examples of successful PPP projects.

- GIH. 2016a. Allocating Risks in Public-Private Partnership Contracts. Sydney: Global Infrastructure Hub. Outlines risk allocation and risk mitigation measures in several sectors, distinguishing between developed and emerging markets.

Visit the PPP Online Reference Guide section to find out more.

Note(s):Find in pdf at PPP Reference Guide - PPP Cycle or visit the PPP Online Reference Guide section to find out more.