Concessions, Build-Operate-Transfer (BOT) Projects, and Design-Build-Operate (DBO) Projects are types of public-private partnerships that are output focused. BOT and DBO projects typically involve significant design and construction as well as long term operations, for new build (greenfield) or projects involving significant refurbishment and extension (brownfield). See below for definitions of each type of agreement, as well as key features and examples of each. This page also includes links to checklists, toolkits, and sector-specific PPP information.

Overview of Concessions, BOTs, DBO Projects

A Concession gives a concessionaire the long term right to use all utility assets conferred on the concessionaire, including responsibility for operations and some investment. Asset ownership remains with the authority and the authority is typically responsible for replacement of larger assets. Assets revert to the authority at the end of the concession period, including assets purchased by the concessionaire. In a concession the concessionaire typically obtains most of its revenues directly from the consumer and so it has a direct relationship with the consumer. A concession covers an entire infrastructure system (so may include the concessionaire taking over existing assets as well as building and operating new assets). The concessionaire will pay a concession fee to the authority which will usually be ring-fenced and put towards asset replacement and expansion. A concession is a specific term in civil law countries. To make it confusing, in common law countries, projects that are more closely described as BOT projects are called concessions.

A Build Operate Transfer (BOT) Project is typically used to develop a discrete asset rather than a whole network and is generally entirely new or greenfield in nature (although refurbishment may be involved). In a BOT Project the project company or operator generally obtains its revenues through a fee charged to the utility/ government rather than tariffs charged to consumers. In common law countries a number of projects are called concessions, such as toll road projects, which are new build and have a number of similarities to BOTs .

In a Design-Build-Operate (DBO) Project the public sector owns and finances the construction of new assets. The private sector designs, builds and operates the assets to meet certain agreed outputs. The documentation for a DBO is typically simpler than a BOT or Concession as there are no financing documents and will typically consist of a turnkey construction contract plus an operating contract, or a section added to the turnkey contract covering operations. The Operator is taking no or minimal financing risk on the capital and will typically be paid a sum for the design-build of the plant, payable in instalments on completion of construction milestones, and then an operating fee for the operating period. The operator is responsible for the design and the construction as well as operations and so if parts need to be replaced during the operations period prior to its assumed life span the operator is likely to be responsible for replacement.

This section looks in greater detail at Concessions and BOT Projects. It also looks at Off-Take/ Power Purchase Agreements, Input Supply/ Bulk Supply Agreements and Implementation Agreements which are used extensively in relation to BOT Projects involving power plants.

This section does not address the complex array of finance documents typically found in a Concession or BOT Project.

Key Features

-

Concessions

- A concession gives a private concessionaire responsibility not only for operation and maintenance of the assets but also for financing and managing all required investment.

- The concessionaire takes risk for the condition of the assets and for investment.

- A concession may be granted in relation to existing assets, an existing utility, or for extensive rehabilitation and extension of an existing asset (although often new build projects are called concessions).

- A concession is typically for a period of 25 to 30 years (i.e., long enough at least to fully amortize major initial investments).

- Asset ownership typically rests with the awarding authority and all rights in respect to those assets revert to the awarding authority at the end of the concession.

- General public is usually the customer and main source of revenue for the concessionaire.

- Often the concessionaire will be operating the existing assets from the outset of the concession - and so there will be immediate cashflow available to pay concessionaire, set aside for investment, service debt, etc.

- Unlike many management contracts, concessions are focused on outputs - i.e., the delivery of a service in accordance with performance standards. There is less focus on inputs - i.e., the concessionaire is left to determine how to achieve agreed performance standards, although there may be some requirements regarding frequency of asset renewal and consultation with the awarding authority or regulator on such key features as maintenance and renewal of assets, increase in capacity and asset replacement towards the end of the concession term.

- Some infrastructure services are deemed to be essential, and some are monopolies. Limits will probably be placed on the concessionaire – by law, through the contract or through regulation – on tariff levels. The concessionaire will need assurances that it will be able to finance its obligations and still maintain a profitable rate of return and so appropriate safeguards will need to be included in the project or in legislation. It will also need to know that the tariffs will be affordable and so will need to do due diligence on customers.

- In many countries there are sectors where the total collection of tariffs does not cover the cost of operation of the assets let alone further investment. In these cases, a clear basis of alternative cost recovery will need be set out in the concession, whether from general subsidies, from taxation or from loans from government or other sources.

- The concept of a "concession" was first developed in France. As with affermages, the framework for the concession is set out in the law and the contract contains provisions specific to the project. Emphasis is placed in the law on the public nature of the arrangement (because the concessionaire has a direct relationship with the consumer) and safeguards are enshrined in the law to protect the consumer. Similar legal frameworks have been incorporated into civil law systems elsewhere.

- Under French law the concessionaire has the obligation to provide continuity of services (“la continuité du service public”), to treat all consumers equally (“l’égalité des usagers”) and to adapt the service according to changing needs ("l’adaptation du service"). In return, the concessionaire is protected against new concessions which would adversely affect the rights of the concessionaire. It is therefore important when considering concessions in civil law systems to understand what rights are already embodied in the law.

- Within the context of common law systems, the closest comparable legal structure is the BOT, which is typically for the purpose of constructing a facility or system.

-

BOT Projects

- In a BOT project, the public sector grantor grants to a private company the right to develop and operate a facility or system for a certain period (the "Project Period"), in what would otherwise be a public sector project.

- Usually a discrete, greenfield new build project.

- Operator finances, owns and constructs the facility or system and operates it commercially for the project period, after which the facility is transferred to the authority.

- BOT is the typical structure for project finance. As it relates to new build, there is no revenue stream from the outset. Lenders are therefore anxious to ensure that project assets are ring-fenced within the operating project company and that all risks associated with the project are assumed and passed on to the appropriate actor. The operator is also prohibited from carrying out other activities. The operator is therefore usually a special purpose vehicle.

- The revenues are often obtained from a single "offtake purchaser" such as a utility or government, who purchases project output from the project company (this is different from a pure concession where output is sold directly to consumers and end users). In the power sector, this will take the form of a Power Purchase Agreement. For more, see Power Purchase Agreements. There is likely to be a minimum payment that is required to be paid by the offtaker, provided that the operator can demonstrate that the facility can deliver the service (availability payment) as well as a volumetric payment for quantities delivered above that level.

- Project company obtains financing for the project, and procures the design and construction of the works and operates the facility during the concession period.

- Project company is a special purpose vehicle, its shareholders will often include companies with construction and/or operation experience, and with input supply and offtake purchase capabilities. It is also essential to include shareholders with experience in the management of the appropriate type of projects, such as working with diverse and multicultural partners, given the particular risks specific to these aspects of a BOT project. The offtake purchaser/ utility will be anxious to ensure that the key shareholders remain in the project company for a period of time as the project is likely to have been awarded to it on the basis of their expertise and financial stability.

- Project company will co‑ordinate the construction and operation of the project in accordance with the requirements of the concession agreement. The off-taker will want to know the identity of the construction sub-contractor and the operator.

- The project company (and the lenders) in a power project will be anxious to ensure it has a secure affordable source of fuel. It will often enter into a bulk supply agreement for fuel, and the supplier may be the same entity as the power purchaser under the Power Purchase Agreement, namely the state power company. For examples, click on Fuel Supply/Bulk Supply Agreements. Power is also the main operating cost for a water or wastewater treatment plant and so operators will need certainty as to cost and source of power.

- The revenues generated from the operation phase are intended to cover operating costs, maintenance, repayment of debt principal (which represents a significant portion of development and construction costs), financing costs (including interest and fees), and a return for the shareholders of the special purpose company.

- Lenders provide non‑recourse or limited recourse financing and will, therefore, bear any residual risk along with the project company and its shareholders.

- The project company is assuming a lot of risk. It is anxious to ensure that those risks that stay with the grantor are protected. It is common for a project company to require some form of guarantee from the government and/ or, particularly in the case of power projects, commitments from the government which are incorporated into an Implementation Agreements.

- In order to minimize such residual risk (as the lenders will only want, as far as possible, to bear a limited portion of the commercial risk of the project) the lenders will insist on passing the project company risk to the other project participants through contracts, such as a construction contract, an operation and maintenance contract

Contractual Structure

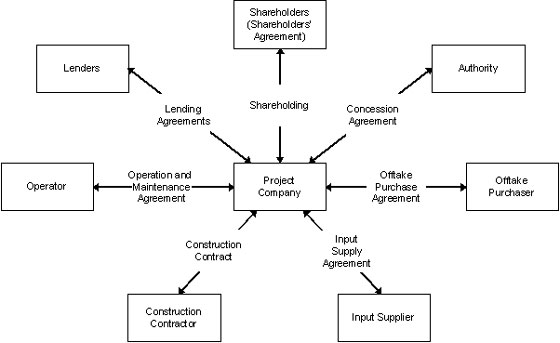

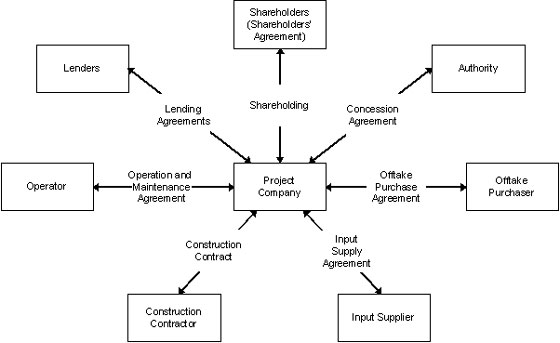

The chart below shows the contractual structure of a typical BOT Project or Concession, including the lending agreements, the shareholder's agreement between the Project company shareholders and the subcontracts of the operating contract and the construction contract, which will typically be between the Project company and a member of the project company consortium.

Each project will involve some variation of this contractual structure depending on its particular requirements: not all BOT projects will require a guaranteed supply of input, therefore a fuel/ input supply agreement may not be necessary. The payment stream may be in part or completely through tariffs from the general public, rather than from an offtake purchaser.

Examples

Checklists for Concessions

Further Reading

- PPP Contract Management, the reference tool is intended to be user-friendly and interactive, providing guidance to public sector teams around the world responsible for contract management of PPPs from financial close to handback.

- Typologie des PPP: Comparaison juridique et terminologique des PPP dans les conceptions française et anglo-saxonne (Comparison of French and International Concepts of PPPs), Mission d'appui aux partenariats public-privé (MAPPP), Mai 2013 (Français)

- Private Sector Investment in Infrastructure: Project Finance, PPP Projects and Risk. J. Delmon, 2nd Edition, 2008.

- Project Finance, BOT Projects and Risk, V. Delmon, 2005.

- Les Contrats de partenariat en France, Institut de la Gestion Délégué (IGD) - French PPP Institute, Maîtrise des coûts et performance pour les collectivités locales, Septembre 2008

- Paradoxes et Piège Financiers des Concessions(The Paradoxes and Financial Pitfalls of Utility Concessions) by Olivier Ratheaux, Repères pour le non souverain, no. 8, September 2005 (French).

- Project Finance, A Legal Guide, Graham D. Vinter, 3rd Edition.

For more information about finance agreements, visit the Finance section.