Waste-to-Power Model for ERP

Photo Credit: Image by Freepik

On this page: Waste-to-Power leveraging a New-Build-Finance-Bulk-Tariffs model - Model 9 in the ERP Project Guidelines. Read more below, or download the following reports: Strategic Guidance for Country System Assessments and Guidance for Countries in Assessing ERC Projects, or the Mobilizing ERC Finance Report.

Project Type: Tech-based avoidance project

Sector: Waste

Applicable Project Methodology: ACM0001 – Consolidated baseline and monitoring methodology for landfill gas project activities

The activities under the project are designed to establish a system that can collect, transport, and treat landfill gas, with the purpose of generating electricity for the project's own use and selling any surplus power to the grid.

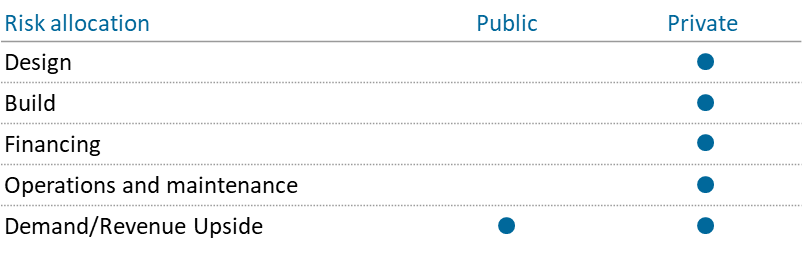

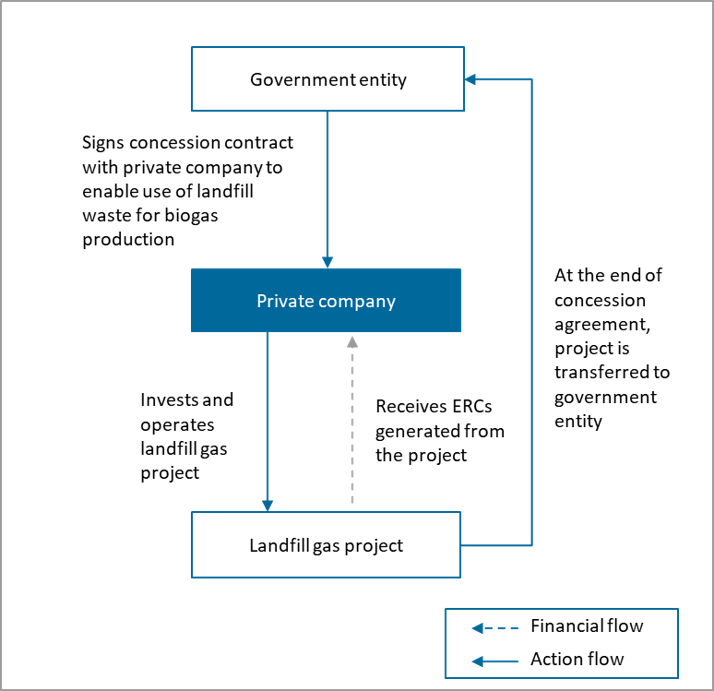

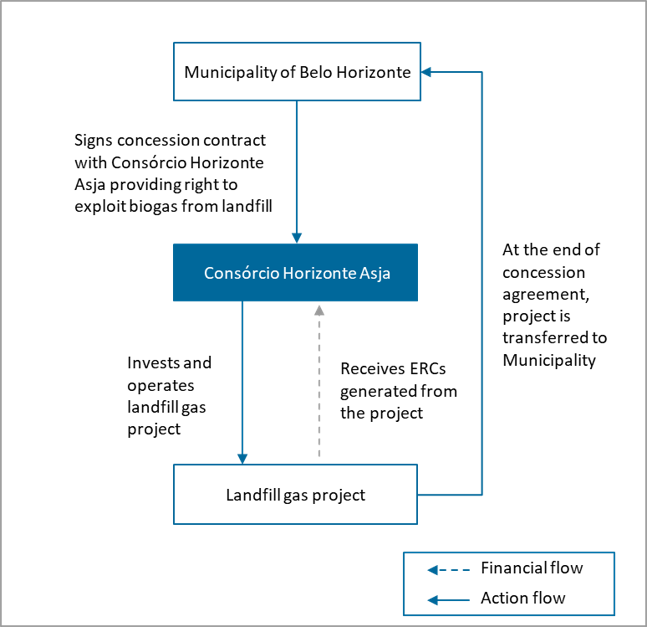

The project will be leveraging a New-Build-Finance-Bulk-Tariffs model. To enable alignment of interests, a new project company may be formed in which the operator of the landfill partners with an experienced power producer. The waste will be collected from the landfill to the new facility to be built, requiring tipping fees to be paid by the current landfill operator for the reduction of waste under its management. In return, the landfill operator may benefit from the sale of the emission reduction credits (ERCs) in the voluntary carbon markets, as well as the sale of power to distributors via the new project company, of which it holds equity interest. The grantor will provide the concession to build and operate the waste-to-power facilities for a fixed period, after which it will take over ownership and operation. Table 1: Model Attributes Business New This model assumes that the private entity currently provided the concession to operate the landfill will be provided the authorization to engage in this project in partnership with an experienced power producer, creating a new entity that will enable alignment of interests. Existing Construction Build The model involves building new infrastructure to enable the landfill gas capture, as well as the waste-to-power plant in the vicinity of the landfill. Refurbish Private Funding Finance The project company will be charged with raising financing for the new installation, both from financial institutions as well as the voluntary carbon markets. Service Bulk Revenues of the project company will be coming from the power distributors that it engages with for the sale of power generated by the plant. User Revenues Fees Revenues in this model will originate from the electricity tariffs to be paid as contracted by power distributors Tariffs Proposed risk allocation of the Public Private Partnership Model Key features of PPP structure Expected ERC end use Key considerations/risks for proposed project Figure 1: Financing and Activity Flows for the Model Project description This project includes a system to collect, transport, and treat landfill gas, generating electricity for self-use and feeding into the national grid. The project reduces greenhouse gas (GHG) emissions by destroying methane in high-temperature flares, which has 21 times greater GHG potential than carbon dioxide, and replacing electricity from fossil fuels. The landfill site in which landfill gas is collected occupies a total area of 114.9 hectares (ha), with 65 ha planned for municipal waste treatment and disposal. The landfill serves the municipality of Belo Horizonte in Brazil which has a population of 2.7 million (M) residents. Targeted results Expected annual ERCs generated from the program will be 112,011 tonnes. Figure 2: Structure of Case Study PPP Consórcio Horizonte Asja signed a concession contract between Municipality of Belo Horizonte to have the right to exploit the landfill gas arising from wastes from the CTRS / BR.040 landfill. Consórcio will invest and operate its landfill gas electricity plant that collects waste from the CTRS / BR.040 landfill. The renewable electricity generated from the plant will be sold to the national grid. At the end of concession agreement, the project will be transferred back to municipality of Belo Horizonte. Assuming a similar project context as the case study, the estimated Net Present Value (NPV) without ERC in- and outflows – only considering non-ERC inflows through other revenue streams or cost savings enabled by the project – is negative at $1.7M1. With ERC cashflows, the total project will still have a negative NPV of $1.5M, which helps make landfill gas projects a bit more financially viable. It should be noted that the overall NPV of project will likely improve beyond ERC crediting period as revenue generated from electricity sale continue to recur. Table 2: Summary of sources of inflows and outflows and key assumptions ERC revenues or inflows Average price of Waste Disposal project in Asia, VCS and GS Non-ERC revenues or inflows Brazil landfill gas benchmark Project investment and implementation cost Brazil landfill gas benchmark ERC generation Verra Fee Schedule Table 3: Net cashflows summary (in USD) ERC Component Revenues/Inflows 0 653,987 653,987 Costs/Outflows 0 -52,522 -52,522 Net value 0 601,465 601,465 Primary/Non-ERC Component Revenues/Inflows 0 10,257,674 10,257,674 Costs/Outflows -5,086,037 -6,506,543 -11,592,579 Net value -5,086,037 3,751,131 -1,334,906 Net Present Values NPV -$1,541,960 NPV (ERC Component) $178,826 NPV (Non-ERC Component) -$1,720,787 Footnote 1: All prices are expressed in United states Dollars (USD)Proposed Structure of this Public Private Partnership (PPP) Model

Dimension

Attribute

Description

Case study: Exploitation of the Biogas from Controlled Landfill in Solid Waste Management Central, Brazil

Summary of the model financials

Value component

Assumptions

Sources

Components

Sum of initial outlays

Sum of in- or outflows from crediting period

Total cashflow

This section is intended to be a living document and will be reviewed at regular intervals. The Guidelines have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions. Unless expressly stated otherwise, the findings, interpretations, and conclusions expressed in the Materials in this Site are those of the various authors of the Materials and are not necessarily those of The World Bank Group, its member institutions, or their respective Boards of Executive Directors or member countries. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the PPPLRC at ppp@worldbank.org.

Updated: April 5, 2024

TABLE OF CONTENTS

UNLOCKING GLOBAL EMISSION REDUCTION CREDIT

Guidance for Countries in Assessing ERC Projects

1. Introduction to Emission Reduction Credits

• The World Bank's Emission Reduction Program

•Classification of Emissions Reduction Credit

• Policy Context of Emissions Reduction Credit

2. Objective of the Guidance for Countries in Assessing ERC Projects

• Objective of Project Preparation Guidelines

• Introduction to the Project Assessment Framework

• Process to Conducting Assessments

• S1: Green Economy Priorities

• S3: Article 6 Readiness and Eligibility

4. Conducting the Initial Profiling and Making a Preliminary Decision

• F2: Additional Value Enabled by Project

• C1, C2, and C3: Carbon Integrity and Environmental and Social Risk Management

5. Conducting the Project Assessment and Making the Final Decision

• F1: Project ERC value and F2: Additional Value Enabled by Project

• Q2: Marketing, Sales, and Pricing

• Q3: Project Governance and Structure

• C2: Environmental Risk Management

• C3: Social Risk Management and Benefits

6. Further Guidance for Application

• Country Context-driven Factors

• Considerations for Future Scope

Abbreviations: Guidance for Countries in Assessing ERC Projects

• B: Project Assessment Template

- Model 1: MRT Energy Efficiencies Model for ERP

- Model 2: Rural Electrification Model for ERP

- Model 4: Rooftop Solar Installation Model for ERP

- Model 5: LED Streetlight Deployment Model for ERP - for Specific Technologies

- Model 6: E-bus Deployment Model for ERP

- Model 7: EV Charging Systems Installation Model for ERP

- Model 8: Biodigesters Deployment Model for ERP

- Model 9: Waste-to-Power Model for ERP

- Model 10: Waste Treatment Facility Model for ERP

- Model 11: Climate Smart Farming Deployment Model for ERP

- Model 12: Reforestation Program Model for ERP