Project Governance and Structure

Photo Credit: Image by Freepik

On this page: Assess the capabilities, structure, and counterparty risks of the project team that ensure that they are well resourced and appropriately organized to carry out respective responsibilities throughout the lifetime of the project. Read more below, or visit Strategic Guidance for Country System Assessments, Guidance for Countries in Assessing ERC Projects, or Mobilizing ERC Finance.

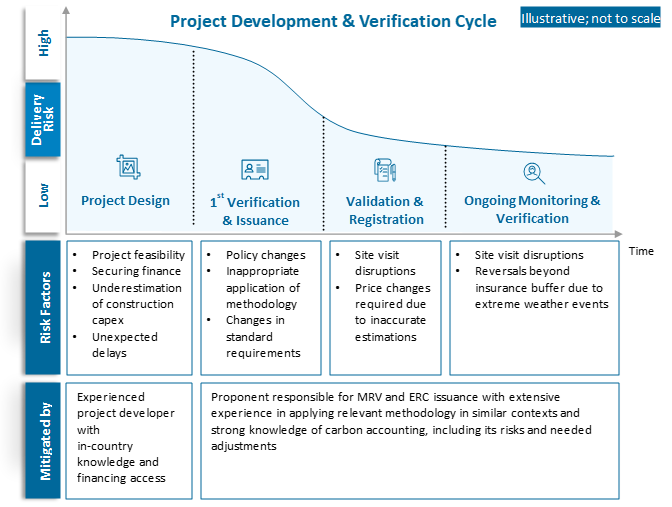

Q3: Project governance and structure: This criterion assesses the capabilities, structure, and counterparty risks of the project team that ensure that they are well resourced and appropriately organized to carry out respective responsibilities throughout the lifetime of the project. This assessment focuses on the project proponent(s) and participant(s) involved in the management and coordination of the project activities, the monitoring and reporting of the ERCs in alignment with the methodology and relevant standard, and the financing of the project. The following sources and analyses can serve as a guide for the assessment: There are four assessable subcomponents to this criterion, where the credibility of the project’s governance and management are assessed by these qualities, against the guideposts provided in Figure 4.10: Figure 4.10. Guideposts for rating project governance and structure Responsibility for the MRV process is assigned to a project participant that has demonstrable experience with carbon accounting for the project type through at least one verified and issued ERC project approved by the same methodology in the country. Project participant responsible for the MRV process for the issuance of ERCs has a portfolio of several verified and issued ERC projects of a similar volume. Entity responsible for MRV process has demonstrated experience with carbon accounting for the project type through at least one verified and issued ERC project of approved by the same methodology in the region, who could be an ad-hoc contracted consultancy with the necessary expertise. Entity responsible for the MRV process for the issuance of ERCs has achieved verification and issuance for one ERC project of a similar volume. Project participant(s) responsible for the facilitation of project activities have expertise in the relevant field, as proven by past projects, including non-ERC projects of a similar project type Project appraisal or initial risk assessment expects low institutional risks for its implementation. Project participant(s) responsible for the facilitation of project activities have limited expertise in the relevant field, but will be supported with technical assistance or contract the necessary service providers to support the technical needs for the project implementation. Project appraisal or initial risk assessment expects high institutional risks for its implementation, and will implement the necessary mitigation measures to manage these risks. At least one project proponent is a local entity with understanding of local relationships, culture, legal frameworks, and governance structures. At least one project participant has experience engaging with host country national, subnational bodies around Article 6 considerations. Project has access to knowledge of local relationships, culture, legal frameworks, and governance structures, such as through engaging local consultancies. Project proponent(s) have procedures to avoid, identify, and resolve conflicts of interest in its operations, as well as with and within the contracted VVB. Project proponent(s) do(es) not have any ongoing lawsuits or disputes and have not been involved in litigation. Project proponent(s) do(es) not have evidence of integrity risks related to corruption, fraud, money laundering, tax evasion, undue political influence, etc. Project proponent(s) have evidence of legal documents and approvals, including documentation of land rights where applicable, for the lifetime of the project. Project proponent(s) have not faced or are not otherwise at risk of facing local and/or international media criticism. Project proponent(s) have evidence of sufficient cash flows to carry out project activities and verification cycle throughout the lifetime of the project. Project proponent with rights to sell ERCs has a know-your-customer (KYC) process to avoid potential reputational risks associated with buyers, as well as anti-money laundering (AML)/Combating the financing of terrorism (CFT) processes. Project proponent(s) have procedures to avoid, identify, and resolve conflicts of interest in its operations, as well as with and within the contracted VVB. Project proponent(s) do(es) not have any ongoing lawsuits or disputes and have not been involved in litigation due to an ERC project. Project proponent(s) do(es) not have evidence of integrity risks related to corruption, fraud, money laundering, tax evasion, undue political influence, etc. Project proponent(s) have evidence of legal documents and approvals, including documentation of land rights where applicable, for the first crediting period. Where project proponent(s) have faced local and/or international media criticism, they have responded with substantial evidence to refute allegations. Project proponent(s) have a credible plan to raise funds that will enable it to carry out project activities and verification cycle throughout the lifetime of the project. Figure 4.11. ERC project’s delivery risk through project development and verification cycle Good governance and structure reduces the delivery and reputational risks for a given project, which provides confidence in its quality. ERC projects, by their nature, have high delivery risks before validation and registration given the challenges around feasibility, securing finance, and potential for unexpected delays, which can be minimized by a well-equipped team with a track record of delivering ERC projects. Once a project achieves its first verification and issuance, although delivery risks are significantly reduced thereafter, the risk of site-visit disruptions, reversals, policy changes, and other external factors still pose uncertainties for future issuances, where ongoing governance by an experienced team is needed to manage these risks across the project’s crediting period. See Figure 4.11. This is important to ensure that the value of the ERC project is realized and that buyers—especially buyers looking for forward purchasing options—have confidence that their purchased credits will be delivered, and be of the required quality, with assurance as well that their support of the project will not have significant reputational risks.

Rationale for rating

Rating

MRV capabilities

Implementation capabilities

Local knowledge and engagement

Counterparty risk

This section is intended to be a living document and will be reviewed at regular intervals. The Guidelines have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions. Unless expressly stated otherwise, the findings, interpretations, and conclusions expressed in the Materials in this Site are those of the various authors of the Materials and are not necessarily those of The World Bank Group, its member institutions, or their respective Boards of Executive Directors or member countries. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the PPPLRC at ppp@worldbank.org.

Updated: June 4, 2024

TABLE OF CONTENTS

UNLOCKING GLOBAL EMISSION REDUCTION CREDIT

Guidance for Countries in Assessing ERC Projects

1. Introduction to Emission Reduction Credits

• The World Bank's Emission Reduction Program

•Classification of Emissions Reduction Credit

• Policy Context of Emissions Reduction Credit

2. Objective of the Guidance for Countries in Assessing ERC Projects

• Objective of Project Preparation Guidelines

• Introduction to the Project Assessment Framework

• Process to Conducting Assessments

• S1: Green Economy Priorities

• S3: Article 6 Readiness and Eligibility

4. Conducting the Initial Profiling and Making a Preliminary Decision

• F2: Additional Value Enabled by Project

• C1, C2, and C3: Carbon Integrity and Environmental and Social Risk Management

5. Conducting the Project Assessment and Making the Final Decision

• F1: Project ERC value and F2: Additional Value Enabled by Project

• Q2: Marketing, Sales, and Pricing

• Q3: Project Governance and Structure

• C2: Environmental Risk Management

• C3: Social Risk Management and Benefits

6. Further Guidance for Application

• Country Context-driven Factors

• Considerations for Future Scope

Abbreviations: Guidance for Countries in Assessing ERC Projects