EV Charging Systems Installation Model for ERP

Photo Credit: Image by Freepik

On this page: EV Charging Systems Installation leveraging a New-Build-Finance-User-Tariff arrangement - Model 7 in the ERP Project Guidelines. Read more below, or visit Strategic Guidance for Country System Assessments, Guidance for Countries in Assessing ERC Projects, or Mobilizing ERC Finance.

Project Type: Energy efficiency (Transportation)

Sector: Energy - Transport

Applicable Project Methodology: VM0038 Methodology for Electric Vehicle Charging Systems

The objective of this project is to enhance the availability of electric vehicle (EV) charging infrastructure in a particular region with the aim of promoting the adoption of electric vehicles. The project will involve the installation of various types of EV chargers, such as slow and fast chargers. Through the increased use of EVs and EV chargers, the project seeks to enable motorists to switch from traditional fossil-fuel vehicles, thereby reducing the overall consumption of fossil fuels. As a result, this will lead to the reduction of greenhouse gas (GHG) emissions associated with the transport sector.

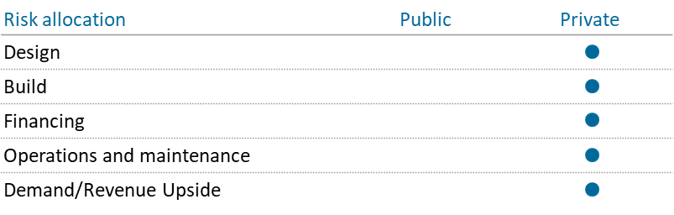

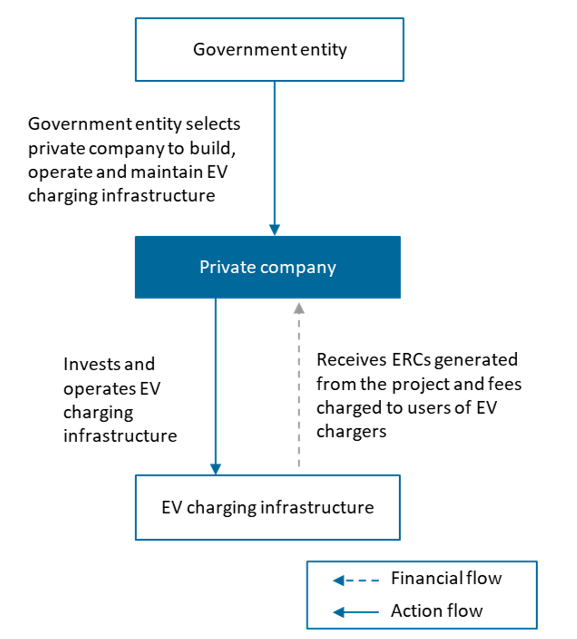

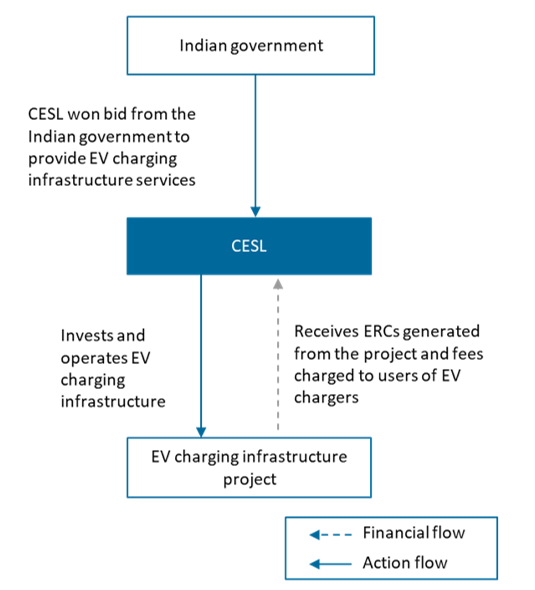

The model will be leveraging a New-Build-Finance-User-Tariff arrangement for this project type. Given the highly technical and nascent nature of such charging infrastructure for this geography, the government may be best placed to support a private company with the appropriate experience to take on the core obligations in this model. The private-sector company in this model designs, finances and develops public transport program to generate emission reduction credits (ERCs). This company will also be tasked with owning the operation and maintenance of the public transport program under a long-term agreement from the government. Table 1: Model Attributes Business New The model involves the creation of a new business entity to build and operate the new EV charging infrastructure Existing Construction Build The model involves installing EV charging stations across a region that would otherwise only have fuel stations Refurbish Private Funding Finance The private partner will be sourcing the financing for installing the EV infrastructure Service Bulk The resulting project company in the model will be servicing retail customers in this region, and, hence, will be assuming the commercial risks User Revenues Fees Revenues in this model will originate from the tariffs paid by the vehicle owners using the charging ports Tariffs Proposed risk allocation of the Public Private Partnership Model Key features of PPP structure Figure 1: Financing and Activity Flows for the Model Key considerations/risks for proposed project Project description CESL, a wholly owned subsidiary of Energy Efficiency Services Limited (EESL) under the Ministry of Power, Government of India, is undertaking a project to install, operate, and maintain EV charging infrastructure across India through partnerships with public and private sectors. This project aims to scale up the EV market in the country. Chargers installed under this project include ARAl- certified slow chargers, Bharat EV chargers, a combination of fast chargers, and standalone CCS2 and Type-2 AC chargers. A total of 3,766 EV chargers will be installed across different locations across India which are New Delhi, Kolkata, Nagpur, Chennai, Kochi, and Thiruvananthapuram. Targeted results Expected annual ERCs generated from the program will be 150,928 tonnes. Figure 2: Structure of Case Study PPP Assuming a similar project context as the case study above, the estimated project’s Net Present Value (NPV) without ERC in- and outflows – only considering non-ERC inflows through other revenue streams or cost savings enabled by the project – is positive at $1.4 million (M1). With ERC cashflows, the financial viability of the total project marginally improves to have a positive NPV of $1.6 M, which highlights the potential for ERCs to make at costly projects more financially viable. Incorporating ERC generation into these types of projects help to offset he high upfront capital requirements (e.g., investments and installation of EV chargers) before the continuous recurring fee for EV charger use helps make the project profitable. Table 2: Summary of sources of inflows and outflows and key assumptions ERC revenues or inflows Based on average price of Transport project in, Verified Carbon Standard (VCS) and Gold Standard (GS) Non-ERC revenues or inflows International Energy Association (IEA), Press search Project investment and implementation cost Press search ERC generation Verra Fee Schedule Table 3: Net cashflows summary (in USD) ERC Component Revenues/Inflows 0 737,334 737,334 Costs/Outflows 0 -76,130 -76,130 Net value 0 661,204 661,204 Primary/Non-ERC Component Revenues/Inflows 165,709 66,821,435 66,987,144 Costs/Outflows -208,612 -77,747,966 -77,956,578 Net value -42,903 -10,926,531 -10,969,434 Total Net Value NPV $1,622,156 NPV (ERC Component) $198,724 NPV (Non-ERC Component) $1,423,432 Footnote 1: All proces are expressed in United States DollarsProposed Structure of this Public Private Partnership (PPP) Model

Dimension

Attribute

Description

Case Study: Convergence Energy Services Ltd. (CESL) EV Charging Infrastructure Project, India

CESL was one among the selected bidders by the Indian government for implementing electric vehicle charging infrastructure at selected locations across India. CESL is given the mandate through established legally binding project agreements to install, own, operate, and maintain EV charging infrastructure in locations where it has installed EV chargers. CESL has ownership of the emission reductions that result from this project.

Summary of the model financials

Value component

Assumptions

Sources

Components

Sum of initial outlays

Sum of in- or outflows from crediting period

Total cashflow

This section is intended to be a living document and will be reviewed at regular intervals. The Guidelines have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions. Unless expressly stated otherwise, the findings, interpretations, and conclusions expressed in the Materials in this Site are those of the various authors of the Materials and are not necessarily those of The World Bank Group, its member institutions, or their respective Boards of Executive Directors or member countries. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the PPPLRC at ppp@worldbank.org.

Updated: June 4, 2024

TABLE OF CONTENTS

UNLOCKING GLOBAL EMISSION REDUCTION CREDIT

Guidance for Countries in Assessing ERC Projects

1. Introduction to Emission Reduction Credits

• The World Bank's Emission Reduction Program

•Classification of Emissions Reduction Credit

• Policy Context of Emissions Reduction Credit

2. Objective of the Guidance for Countries in Assessing ERC Projects

• Objective of Project Preparation Guidelines

• Introduction to the Project Assessment Framework

• Process to Conducting Assessments

• S1: Green Economy Priorities

• S3: Article 6 Readiness and Eligibility

4. Conducting the Initial Profiling and Making a Preliminary Decision

• F2: Additional Value Enabled by Project

• C1, C2, and C3: Carbon Integrity and Environmental and Social Risk Management

5. Conducting the Project Assessment and Making the Final Decision

• F1: Project ERC value and F2: Additional Value Enabled by Project

• Q2: Marketing, Sales, and Pricing

• Q3: Project Governance and Structure

• C2: Environmental Risk Management

• C3: Social Risk Management and Benefits

6. Further Guidance for Application

• Country Context-driven Factors

• Considerations for Future Scope

Abbreviations: Guidance for Countries in Assessing ERC Projects

• B: Project Assessment Template

- Model 1: MRT Energy Efficiencies Model for ERP

- Model 2: Rural Electrification Model for ERP

- Model 4: Rooftop Solar Installation Model for ERP

- Model 5: LED Streetlight Deployment Model for ERP - for Specific Technologies

- Model 6: E-bus Deployment Model for ERP

- Model 7: EV Charging Systems Installation Model for ERP

- Model 8: Biodigesters Deployment Model for ERP

- Model 9: Waste-to-Power Model for ERP

- Model 10: Waste Treatment Facility Model for ERP

- Model 11: Climate Smart Farming Deployment Model for ERP