Introduction to the Project Assessment Framework

Photo Credit: Image by Freepik

On this page: Introduction to the framework for the identification and selection of high-quality ERC projects, most likely to attract high demand and best value pricing. Read more below, or visit Strategic Guidance for Country System Assessments, Guidance for Countries in Assessing ERC Projects, or Mobilizing ERC Finance.

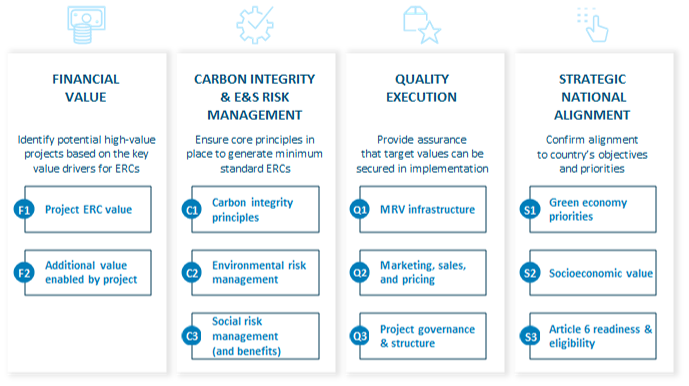

Framework for the identification and selection of high-quality ERC projects, most likely to attract high demand and best value pricing.1 Figure 1.2. Project Assessment Framework The Project Assessment Framework consists of four overarching objectives that set 11 assessable criteria to evaluate the project’s attributes and mechanisms in alignment with global market best practices and national priorities. See Figure 1.2. Financial Value: The first objective of the Framework seeks to identify potential high-value projects based on key value drivers for ERCs. This objective considers two components that reflect a project’s financial value: Carbon Integrity & Environmental and Social Risk Management: The second objective of the Framework ensures that core principles and risk management measures are in place for the project to generate ERCs above a minimal standard, and that any risk factors that could affect the quality of the ERCs can be addressed. This objective is guided by three fundamental carbon-quality criteria: Quality Execution: The third objective intends to provide assurance that the potential value of the project can be secured in implementation. This requires the project to generate ERCs that are perceived as high-quality in the VCM and to secure buyers at an optimum target price. This objective therefore first examines the set-up of the project’s MRV infrastructure and plans regardless of its project type and activities, and is distinct from the second objective, which looks at the project’s carbon integrity risks given the nature of its project activities and the emission reductions or removals it generates. Second, it looks at the potential of the project to secure its value and target demand given its go-to-market strategy. Finally, it considers the governance and track record of the project team to ensure the project’s continuity and provide confidence to buyers that the project’s impacts will be sustained, and that buying its ERCs will not result in reputational risks. To this end, the analysis examines three key quality execution criteria: Strategic National Alignment: The final objective of the Framework aims to confirm the project’s alignment to the objectives and priorities of the country. The objective focuses on three criteria that define project attributes that demonstrate strategic national alignment: Footnote 1: This section provides an overview of the criteria used for the two levels of project assessment described in Section 1.4. Users of the guidelines that are familiar with the terms and concepts in the carbon markets may proceed directly to Section 1.4, which focuses on the project assessment process.

This section is intended to be a living document and will be reviewed at regular intervals. The Guidelines have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions. Unless expressly stated otherwise, the findings, interpretations, and conclusions expressed in the Materials in this Site are those of the various authors of the Materials and are not necessarily those of The World Bank Group, its member institutions, or their respective Boards of Executive Directors or member countries. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the PPPLRC at ppp@worldbank.org.

Updated: June 4, 2024

TABLE OF CONTENTS

UNLOCKING GLOBAL EMISSION REDUCTION CREDIT

Guidance for Countries in Assessing ERC Projects

1. Introduction to Emission Reduction Credits

• The World Bank's Emission Reduction Program

•Classification of Emissions Reduction Credit

• Policy Context of Emissions Reduction Credit

2. Objective of the Guidance for Countries in Assessing ERC Projects

• Objective of Project Preparation Guidelines

• Introduction to the Project Assessment Framework

• Process to Conducting Assessments

• S1: Green Economy Priorities

• S3: Article 6 Readiness and Eligibility

4. Conducting the Initial Profiling and Making a Preliminary Decision

• F2: Additional Value Enabled by Project

• C1, C2, and C3: Carbon Integrity and Environmental and Social Risk Management

5. Conducting the Project Assessment and Making the Final Decision

• F1: Project ERC value and F2: Additional Value Enabled by Project

• Q2: Marketing, Sales, and Pricing

• Q3: Project Governance and Structure

• C2: Environmental Risk Management

• C3: Social Risk Management and Benefits

6. Further Guidance for Application

• Country Context-driven Factors

• Considerations for Future Scope

Abbreviations: Guidance for Countries in Assessing ERC Projects