Marketing, Sales, and Pricing

Photo Credit: Image by Freepik

On this page: Effective marketing, sales, and pricing strategies to ensure that its value is maximized and that the project can secure demand once ERCs are generated. Read more below, or visit Strategic Guidance for Country System Assessments, Guidance for Countries in Assessing ERC Projects, or Mobilizing ERC Finance.

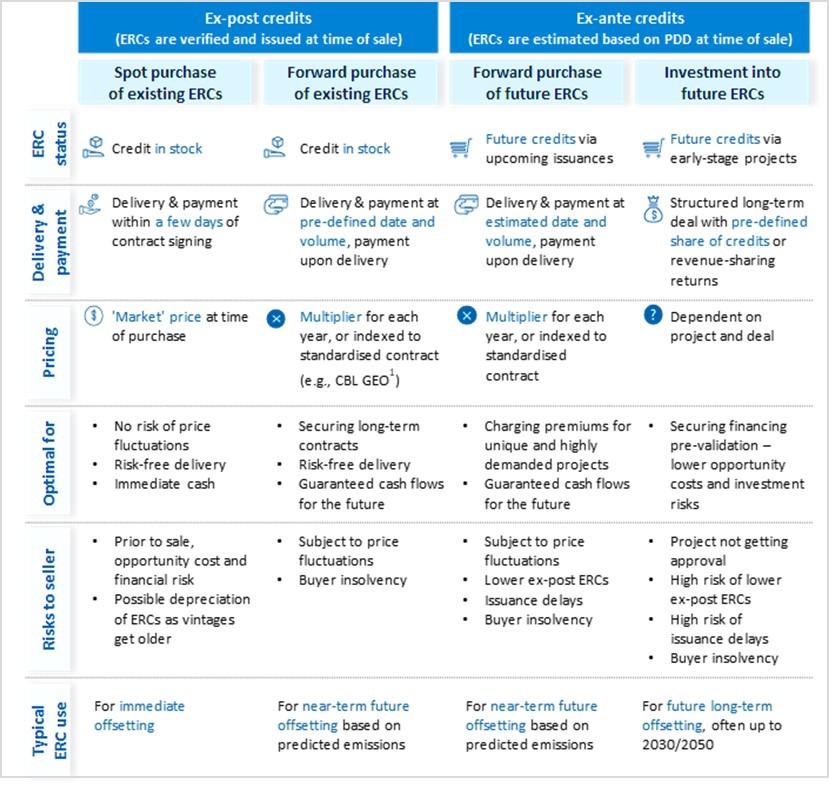

Q2: Marketing, sales, and pricing: Once the project achieves confidence of delivery, it requires effective marketing, sales, and pricing strategies to ensure that its value is maximized and that the project can secure demand once ERCs are generated. This criterion assesses the robustness of the fundamental elements required for strong marketing, sales, and pricing that enable projects to attract high demand and best-value pricing in a global market. While the marketing, sales, and pricing of ERCs rely largely on the entity with the rights to sell the ERCs generated from the project (the 'seller') and its capabilities, this assessment also considers the inputs required for executing these strategies at a project-level. The following sources and analyses can serve as a guide for the assessment: Review the comprehensiveness and completeness of project information in the project documents, and how information is structured. Review the description of the project activity, how ERCs are generated, and how Sustainable Development Goal (SDG) contributions are communicated in the project documents. Review the availability of graphics and visual elements in the project documents. Review the intended ERC seller of project in terms of their marketing capabilities and sales and pricing strategies. There are five assessable subcomponents to this criterion, where three subcomponents focused on assessing the project’s elements for marketing, and the marketing capabilities and strategy of the seller, against the guideposts provided in Figure 4.6: Completeness and transparency of information: Clarity and structure of information set up for marketing project. Storytelling and impact: Framing of project activity and context for communicating its story and impact. Visuals: Ability of project to illustrate activities and impact visually, and capabilities of the seller to leverage on visuals to complement project information and storytelling. The other two subcomponents review the sales and pricing strategy of the seller: Sales: Strategy, presence, and track record of the seller to bring ERCs to global markets and diverse buyers. Pricing: Strategy of the seller to achieve sales target through competitive and well-informed, benchmarked pricing in line with market rates. Figure 4.6. Guideposts for rating marketing, sales, and pricing Project fully discloses information pertaining to attributes including its location, size, type of ERCs generated, technology and methodology, and project proponents in a clear and organized manner that requires no or little refinement. Project has an experienced team responsible for documentation in a standardized manner. If the project does not follow an ICROA-approved standard, the standard that the project is considering registration under transparently and publicly provides information on its program, rules, approach and requirements, and has intentions to seek approval from ICROA or the upcoming standard by the Integrity Council for the Integrity of the Voluntary Carbon Market (ICVCM). Project fully discloses information on attributes including its location, size, type of ERCs generated, technology and methodology, and project proponents, where reorganization or refinements are needed to improve accessibility. Project has a team with reasonable experience responsible for documentation. If the project does not follow an ICROA-approved standard, the standard that the project is considering registration under transparently and publicly provides information on its program, rules, approach, and requirements. Project clearly and comprehensively describes its context and need for carbon finance, how ERCs are generated, and its impact on climate, environment, and community. Project clearly communicates and, to the extent possible, quantifies its SDG contributions. Project briefly describes its context and need for carbon finance, how ERCs are generated, and its impact on climate, environment, and community, where in alignment with similar project types (i.e., may be generic). Project briefly communicates and, to the extent possible, quantifies its SDG contributions in alignment with similar project types. Project has specific activities directly related to ERC generation that can be captured via photos or videos in an ethical and legal manner. The seller has an online and public site to share the project profile, and has extensive capabilities in preparing marketing materials for such projects demonstrated by having most marketing elements incorporated. Project has plans to capture activities via photos or videos in an ethical and legal manner, that relate to elements of the ERC project. The seller has capabilities to enable wider sharing of the project information (e.g., online website/platform). The seller has moderate capabilities in preparing marketing materials in alignment with similar project types. The seller has an international market reach and presence in key regions, and tailors its sales efforts to the local demand. The seller has multiple sales channels and transaction models, to enable access to wide array of buyers, including individuals, corporates, intermediaries, and exchanges. The seller has a track record and strong reputation for selling credible ERCs. The seller has international market reach in key regions. The seller has capabilities to tap multiple sales channels, including for accessing corporate buyers. The seller has a reputable portfolio of ERC projects that have not been criticized for credibility, and which the project may reasonably expect to be included in. The seller follows best-practice pricing schemes and strategies leveraging on pricing benchmarks to ensure fair pricing based on project type. The seller has multiple transaction models to ensure that best value for any transaction is achieved, including contracting models that allow for forward purchases and options to secure early financing. The seller has a pricing strategy based on at least one credible pricing benchmark to ensure reasonable and fair pricing based on project type. The seller has a basic transaction model for spot purchases. While this assessment takes a holistic approach to assess a given project’s capabilities to tailor to any type of buyer, it is important to note that the importance of each subcomponent depends on the buyer archetype and should be targeted accordingly. For example, investors who are looking at ERCs to establish carbon-neutral funds would be more concerned about the seller’s market access and track record. On the other hand, corporates considering the purchase of ERCs for offsetting to meet their climate-neutrality or net-zero goals may be more interested in the project’s storytelling and impact and visuals. In general, having an ERC seller with well-rounded capabilities to execute the best practices of marketing, sales, and pricing subcomponents will enable a project to attract demand from different buyer archetypes. In addition, the project’s ability to reach out to different buyers also depends on the contracting models offered by its ERC seller. Leading ERC sellers offer multiple contracting models to buyers to balance delivery risks, price fluctuations, and need for early financing, as each contracting model is optimal for specific circumstances but carry consequent risks. See Figure 4.7. For example, offering spot purchases of existing, issued ERCs can enable risk-free delivery given that the ERCs already exist in the seller’s account, and will also not be subject to price fluctuations given that the sold price is the market price at the time of sale. However, such models mean that the seller takes on the financial risk and opportunity cost until the ERCs are issued and sold. This could also risk the depreciation of ERCs over time if sales are not made upon issuance, given that some buyers tend to prefer vintages closer to the year they are compensating their emissions for. A mix of these models would enable the seller to capture interest from different buyer archetypes, achieve sales at multiple points of the project’s timeline, and manage potential risks that they take on. Figure 4.7. Overview of contracting models offered by ERC sellers (non-exhaustive) Finally, a seller’s engagement with the market is crucial for understanding market prices, enabling them to set fair prices that buyers will be willing to pay. Each seller has its own method of setting prices, largely dependent on their scale, set up, and the projects they sell, but it is also important for sellers to track market prices and ensure that they are competitive with market rates. This is especially important given secondary markets are gaining traction and driving greater price transparency among buyers, particularly those who have higher market awareness who tend to be buyers of large volumes of ERCs. Sellers may consider the following sources and analyses when setting benchmark ERC prices: Reviewing their internal inventory to set premiums on project types that are less common; Accounting for the average cost per tonne of the ERC; Monitoring the sales price of their contracted deals and the indicative budget of potential buyers; Tracking prices on market exchanges such as AirCarbon and CBL Market, or from other brokers and intermediaries they interact with; and Analyzing the total issued and retired volume of various registries to indicate market supply and demand. These benchmark prices could be set based on willingness-to-pay factors such as the ERC’s certification, subtype, geography, and vintage. Box 3 Case Study: Vietstar Waste Treatment Figure 4.8. Image used by the International Monetary Fund’s 2021 Sustainability Report The Vietstar Waste Treatment project in Vietnam began operations in 2013, with the goal of leveraging composting technology to sort municipal solid waste, recycle plastic wastes, and use thermal aerobic treatment for the remaining organic wastes to produce aerobic compost to be used as fertilizers for local farmers. In doing so, the project avoids methane emissions from anaerobic decay of waste that would otherwise have been released into the atmosphere in the business-as-usual scenario. The project, registered under the Gold Standard, has sold and retired all of its issued credits as of 2023, including its latest issuance in December 2021. The ERCs from the project have been sold to corporates such as Ayden and Wavemaker Partners, as well as international organisations such as the International Monetary Fund, who have featured their support for the project on their websites. The Vietstar project’s ability to attract demand from corporate buyers is driven by its best-practice marketing, sales, and pricing strategy, specifically, its impactful story and visuals and reputation as an ERC seller with strong marketing capabilities. In the project’s marketing material, the seller informs buyers transparently of the project’s activities and context, and illustrates its impact via authentic and relevant visuals and quantifying its SDG contributions. Figure 4.9. Examples of best practice marketing, sales and pricing elements and strategies of the Vietstar Waste Treatment project (Source: Gold Standard, Project 2525; South Pole) Completeness and transparency of information Project fully discloses information on attributes across PDD and monitoring reports, where reorganization is needed. 3 Storytelling and impact Project documents clearly describe project's context. SDG contributions are quantified, monitored, and clearly communicated. 5 Visuals Project has images of waste treatment plant and compost produced. Seller has an online site to feature project where key marketing elements are incorporated. 5 Sales Seller has international market reach. Seller has multiple sales channels and track record of selling to large multinational corporations. 5 Pricing Seller has multiple transaction models for forward purchases to secure early demand. 5

Rationale for rating

Rating

Marketing (Completeness and transparency of information)

Marketing (Storytelling and impact)

Marketing (Visuals)

Sales

Pricing

Subcomponents

Examples of best practice mechanisms

Score

This section is intended to be a living document and will be reviewed at regular intervals. The Guidelines have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions. Unless expressly stated otherwise, the findings, interpretations, and conclusions expressed in the Materials in this Site are those of the various authors of the Materials and are not necessarily those of The World Bank Group, its member institutions, or their respective Boards of Executive Directors or member countries. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the PPPLRC at ppp@worldbank.org.

Updated: June 4, 2024

TABLE OF CONTENTS

UNLOCKING GLOBAL EMISSION REDUCTION CREDIT

Guidance for Countries in Assessing ERC Projects

1. Introduction to Emission Reduction Credits

• The World Bank's Emission Reduction Program

•Classification of Emissions Reduction Credit

• Policy Context of Emissions Reduction Credit

2. Objective of the Guidance for Countries in Assessing ERC Projects

• Objective of Project Preparation Guidelines

• Introduction to the Project Assessment Framework

• Process to Conducting Assessments

• S1: Green Economy Priorities

• S3: Article 6 Readiness and Eligibility

4. Conducting the Initial Profiling and Making a Preliminary Decision

• F2: Additional Value Enabled by Project

• C1, C2, and C3: Carbon Integrity and Environmental and Social Risk Management

5. Conducting the Project Assessment and Making the Final Decision

• F1: Project ERC value and F2: Additional Value Enabled by Project

• Q2: Marketing, Sales, and Pricing

• Q3: Project Governance and Structure

• C2: Environmental Risk Management

• C3: Social Risk Management and Benefits

6. Further Guidance for Application

• Country Context-driven Factors

• Considerations for Future Scope

Abbreviations: Guidance for Countries in Assessing ERC Projects