Emission Reduction Credits

Photo Credit: Image by Freepik

On this page: Find the key concepts on World Bank's ERP, the ERC ecosystem, the different types of crediting programs, and requirements that must be met. Read more below, or visit Strategic Guidance for Country System Assessments, Guidance for Countries in Assessing ERC Projects, or Mobilizing ERC Finance.

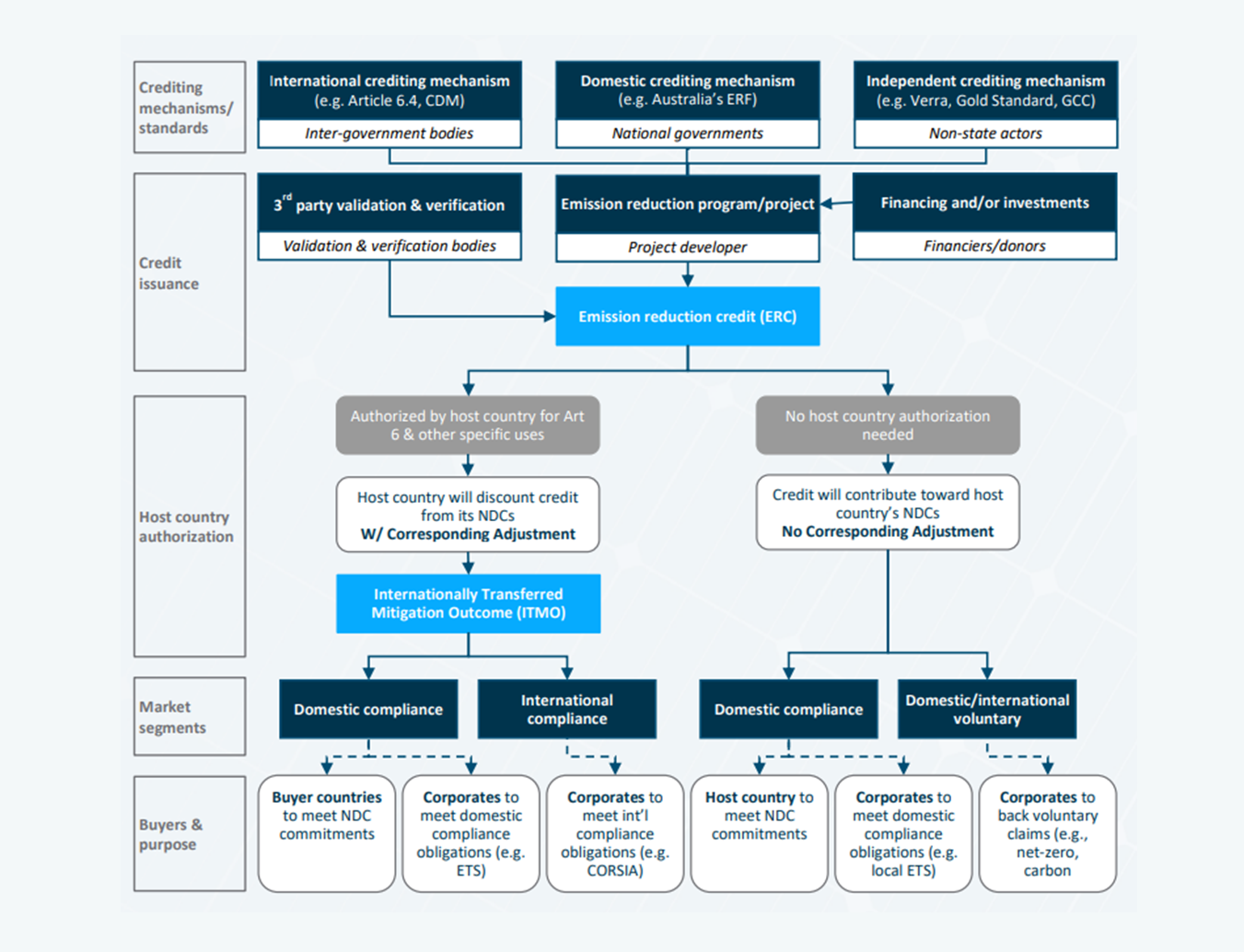

Emission reduction credits (ERCs) can be a key component of a country’s decarbonization strategy, enabling them to avoid/mitigate greenhouse gas emissions, and attract climate finance and capital for the development and protection of communities and ecosystems. An Emission Reduction Credit (ERC) represents a standard unit to measure an emission reduction equivalent to one metric ton of carbon dioxide (tCO2e). Emission reductions credits can be generated through either avoidance or removal projects. Avoidance involves activities that reduce emissions by preventing the release of carbon dioxide or other greenhouse gases into the atmosphere. Examples include the construction of renewable energy capacity rather than fossil fuel-based infrastructure and avoided deforestation/REDD+ projects. Removals refer to activities that pull carbon dioxide out of the atmosphere such as GHG sequestration via reforestation or climate smart agriculture. ERCs can be generated via three types of crediting programs: Multi-lateral crediting mechanisms established by multilateral agreements or platforms, such as the Clean Development Mechanism (CDM) set up under the Kyoto Protocol, which will be replaced by a new mechanism under Article 6.4 of the Paris Agreement; Domestic crediting mechanisms established by governments; and Independent crediting mechanisms established by non-state actors such as Verra, Plan Vivo and Gold Standard. The generation of an ERC requires a certification standard, a measurement, reporting, and verification mechanism (MRV) and an authorization entity to approve of its issuance. Issuance refers to a specified quantity of serialized units of ERCs being deposited into project participants’ accounts under the registry system operated by the certification standard providing its accreditation. Certification Standard outlines a set of detailed requirements that must be met for a mitigation activity to generate ERCs against that standard. Standards are typically established under a specific crediting 6 program; for example, a few prominent certification standards under independent crediting mechanisms are Gold Standard, Verra, and PlanVivo, to name a few. Domestic or national crediting programs, on the other hand, could set up their own certification standards; for example, Australia’s Emissions Reduction Fund (ERF) implemented the Australia Carbon Credit Unit (ACCU) scheme, which governs their own certification mechanism. MRV (Monitoring, reporting, verification) is the methodologies and audit processes used to verify that the project is delivering upon its stated benefits, both during and after the implementation of the project. Authorization entity is the entity responsible for providing the final approval on an ERC project and the issuance of ERCs. The entity can be ministries such as the Ministry of Environment, the entity that manages the certification/MRV standard, the Central Government, and/or others. The quality and integrity of an ERC is dependent upon the robustness of the certification standard and the MRV mechanism. A high-quality ERC meets the following requirements: Additionality: Ensuring that the emission reductions achieved by the project are additional to what would have happened if the project had not been carried out (business as usual scenario) Permanence: Ensuring that the emission reduction outcomes achieved as a result of the ERC project are not reversed in the future. For ex. ensuring that a planted forest is not cleared in the future Avoidance of Double Counting: Ensuring that only one party uses the ERC towards its decarbonization goals and/or compliance targets (e.g., corresponding adjustments) Measurable and Verifiable: Ensuring the use of an approved methodology to calculate and monitor the emission reduction ERCs once issued can be traded through trading platforms and exchanges, or through direct purchases (over the counter). The ERCs can be sold either in the compliance or the voluntary market, depending on the crediting program they are generated by. This is firstly determined by whether the ERC is authorized by the host country to meet its Nationally Determined Contribution (NDC) goals or be sold to other countries to attract climate related investments. The authorization of ERCs to be used by another country to meet their NDCs is governed by Article 6 of the Paris Agreement, which was introduced in 2015. Under the Paris Agreement, Parties set non-binding climate targets through their Nationally Determined Contributions (NDCs). Article 6 of the Paris Agreement recognizes cooperation among countries for achieving their NDCs and raising climate ambition. Article 6.2 lays down guidelines for the trading and accounting of ERCs, to be implemented by individual countries. Article 6.4 will establish a new international crediting mechanism replacing the CDM and Joint Implementation (JI) crediting mechanisms created by the Kyoto Protocol. The authorization of ERCs under Article 6 enables the trading of ERCs at a government to government level, where such ERCs are called Internationally Transferred Mitigation Outcomes or ITMOs1 . A host country must first decide whether to retain ERCs generated domestically to use against its own NDC targets or to trade some of these ERCs with a buying country to count towards their Nationally Determined Contribution (NDC) goals. Where the buying country is allowed to use the ERC for their Nationally Determined Contributions, a Corresponding Adjustment (CA) must be made that stipulates that the party selling the ERCs must not count these ERCs towards its own NDC goals and should subtract it from its inventory of ERCs. This ensures that the emission reductions are not “double counted” towards the NDCs of two countries. ERCs with corresponding adjustments can be traded at a government-to-government level, or to foreign-based corporates for their compliance obligations. Where ERs are sought to satisfy legal obligations to reduce emissions, for example through regulatory obligations, or carbon taxes, this is known as a Compliance Carbon Markets (CCM) as the ER obligation is legal. There are two types of CCMs, at a domestic or international level. Domestic compliance markets refer to regulated systems where national, regional, or provincial authorities mandate emissions sources to comply with GHG emission reduction requirements such as their NDC. For example, national and regional governments may establish emission trading systems (ETS) to ensure compliance with mitigation outcome targets and incorporate mechanisms to facilitate the trading of ERCs. These typically drive the set-up of domestic crediting mechanisms. Domestic compliance markets could also be established via carbon taxes, where governments stipulate regulations for the use of ERCs in lieu of taxable emissions. Where ERCs are not transferred to offset emissions outside of its host country, Article 6 authorization and corresponding adjustments (CAs) may not be required for compliance by the host country for domestic NDC purposes or by corporates for domestic compliance obligations. At an international level, compliance markets have been implemented for high-emission sectors where rules are set by global industry associations. For example, the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) was established by the International Civil Aviation Organization to set standards for the use of ERCs to compensate for the aviation sector’s emissions above 2020 levels, requiring that airlines based in participating member states monitor, report and compensate for their emissions. On the other hand, the Voluntary Carbon Market (VCM) is primarily driven by demand from non-state actors, such as corporations, institutions, and individuals that wish to offset their greenhouse gas (GHG) emissions or contribute to the reduction of GHGs within their jurisdictions. Unlike the Compliance Carbon Markets, activity in the Voluntary Carbon Market is not currently regulated by a state or supervisory body. Therefore, demand is driven by voluntary buyers, who may have varied objectives. Independent crediting mechanisms are the key platforms for setting standards for the eligibility and MRV (Monitoring, reporting, verification) requirements for the Voluntary Carbon Market (VCM). As the rules around Article 6 evolve and the interactions between Compliance Carbon Markets and the Voluntary Carbon Market become increasingly intertwined, some of these crediting mechanisms may choose to label units to indicate the eligible uses or claims or highlight other key attributes. For example, ERCs issued under some of these certification standards without Corresponding Adjustments are labelled as ‘non-authorized’, which can help indicate the use of ERCs for compliance obligations where ERCs from independent crediting mechanisms are accepted. Labeling can therefore help distinguish among different use cases by transparently listing the characteristics of units. These labels and use cases are still evolving and are expected to become more well-defined over time. In essence, ERCs are generated by three types of crediting programs that can be authorized or not authorized for Article 6 transactions, including for Corresponding Adjustments, which then determines its eligibility for use under various domestic and voluntary carbon markets. Across these, the development, issuance, and trading of ERCs involves coordinated action among various stakeholder groups in the ERC ecosystem. (Figure 1.1). Find a list of Key ERC-related terms here. The key stakeholder groups are: Governments: Ministries and Government bodies in country that regulate and enable the market through direct and complementary policies, defining the requirements around the development, issuance and trading of ERCs. Credit Buyers: companies and organizations that purchase ERCs either directly or through retailers and brokers. Based on their needs, credit buyers can fall into two categories: Voluntary Buyers: Purchase ERCs to meet voluntary climate commitments (e.g., carbon-neutral, net-zero commitments) Compliance Buyers: Purchase ERCs to meet requirements set by a regulator/government agency to reduce or avoid emissions usually for a set compliance period (e.g., ETS, cap-and trade, carbon taxes) Market Intermediaries: organizations, institutions and platforms that facilitate financing against ERC generating projects or initiatives. These include: Financiers (Lenders, Asset Managers and Social Impact Funds) that provide financing to a project either in the form of loans or as investments. Retailers/Brokers that purchase ERCs on behalf of end buyers based on requirements such as type of project, volume of ERCs, certification standard etc. Trading Platforms (Carbon Exchanges) which facilitate the sale of ERCs. Donors (Countries, Funds, Multilateral Organizations, and Concessional Finance) that provide funding to projects based on their respective charters, international commitments, and resources. Suppliers: organizations that can provide, certify and feed ERCs into the market. These are mostly: Project Developers that are responsible for identifying, developing, and executing a project end to end to ensure the avoidance and/or removal of carbon resulting in ERC asset generation. Validation and Verification Bodies (VVBs) that are independent bodies that assess whether a project meets pre-defined standards and verify the progress over the lifecycle of the project. Footnote 1: Such bilateral or multilateral trades would also require the trading parties to arrive at a common understanding of key attributes such as permanence, additionality, avoidance of double counting and establish robust MRV systems to ensure that the ERCs are high-quality and accepted under the conditions of Article 6.

The ERC Ecosystem

This section is intended to be a living document and will be reviewed at regular intervals. The Guidelines have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions. Unless expressly stated otherwise, the findings, interpretations, and conclusions expressed in the Materials in this Site are those of the various authors of the Materials and are not necessarily those of The World Bank Group, its member institutions, or their respective Boards of Executive Directors or member countries. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

Updated:

TABLE OF CONTENTS

UNLOCKING GLOBAL EMISSION REDUCTION CREDIT

Introduction to Emission Reduction Credits

Strategic Guidance for Country System Assessments

Guidance for Countries in Assessing ERC Projects

Related Content

Additional Resources

World Bank Group Climate Toolkits for PPPs

Page Specific DisclaimerFind more at Climate-Smart PPPs or Download the Full Report and its sector-specific toolkits for Roads, Renewables, Hydropower, ICT and Water Production and Treatment.

Climate & Disaster Risk Screening Tools

PPP Reference Guide