Rural Electrification Model for ERP

Photo Credit: Image by Freepik

On this page: Rural Electrification leveraging a New-User-Tariff - Model 2 in the ERP Project Guidelines. Read more below, or visit Strategic Guidance for Country System Assessments, Guidance for Countries in Assessing ERC Projects, or Mobilizing ERC Finance.

Type: Energy efficiency

Sector: Energy

Applicable Project Methodology: AMS-III.BB.: Electrification of communities through grid extension or construction of new mini grids

This model describes a project that facilitates the expansion of electricity grid network and the installation of power lines in a region with inadequate access to electricity and having to rely on diesel generators for power. The objective of the project is to offer a consistent, affordable, and sustainable energy source to these communities with lower carbon emissions, thereby replacing the usage of fossil fuels and decreasing greenhouse gas emissions associated with fossil fuel combustion.

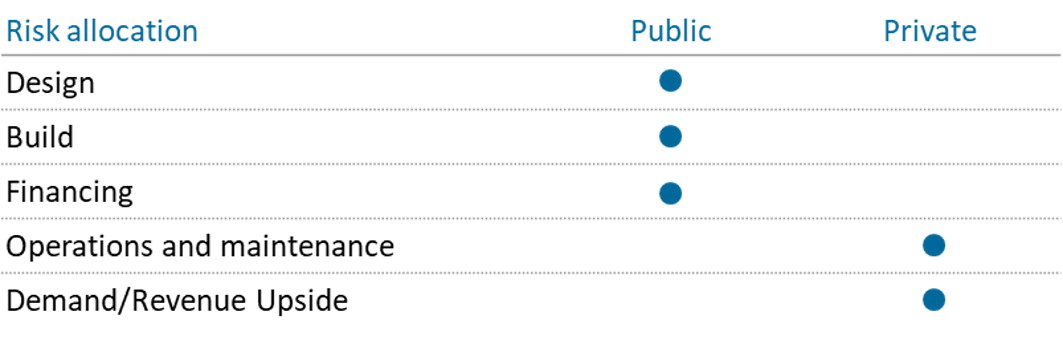

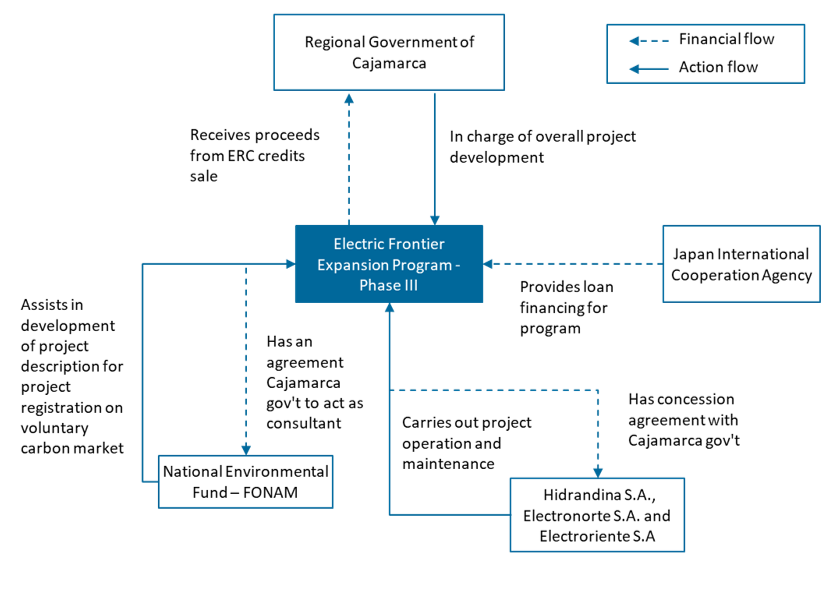

The project will be leveraging a New-User-Tariff model. Given the higher risk of installing new transmission infrastructure in a region with lower average electrification rates, which is also an effect of lower household incomes, allocating the fund-raising obligation to the private sector participant may result to limited or expensive financing options. Hence, in this case the government entity designs, finances, and leads project development. The private sector company can be contracted via concession agreement to carry out operations and maintenance of project under a long-term lease from the government. Once the long-term lease ends, the private-sector partner transfers management of project back to the government entity. Financing can be provided by 3rd party financiers in exchange for a portion of the ERCs generated from the project. Table 1: Model Attributes Business New The model involves the creation of a new business entity to manage and operate the new transmissions infrastructure Existing Construction Build The model involves the government partner undertaking the build of the new transmission infrastructure Refurbish Private Funding Finance The government partner will be sourcing the financing for the project development in this model Service Bulk The resulting project company in the model will be servicing retail customers in this region, and, hence, will be assuming billing and collection therefrom User Revenues Fees Revenues in this model will originate from the tariffs paid by the new retail electricity customers to the project company for power supplied Tariffs Proposed risk allocation of the Public Private Partnership Model Key features of PPP structure Key considerations/risks for proposed project Figure 1: Financing and Activity Flows for the Model Project description The implementation of the Electric Frontier Extension Program Phase III (PAFE III) in 2013 was planned to increase electric coverage in Cajamarca, the least electrified region in Peru. The aim of the project activity was to supply electric energy for 24 hours a day, continuously, permanently, and reliably, to localities included in the 19 rural electric systems (SERs). The project included the construction of primary lines from the national grid, allowing power to be supplied to 65 districts, in the following provinces: Cajabamba, San Marcos, Cajamarca, Celendin, Contumaza, San Miguel, San Pablo, Chota, Cutervo, Santa Cruz, Jaen and San Ignacio. Impact The project was estimated to result to annual emissions reductions of 12,113 tonnes over the 10 year crediting period as the electricity supplied replaced emissions from fossil fuel combustion. The project also enabled 43,508 new households to be connected to the grid as of 2018, contributing 6% to the electrification ratio in the area. The ERC component of the project enabled the electrification project to become financially feasible given that there will additional revenues from the carbon market, as assessed by Spanish Association for Standardisation and Certification (AENOR) in the 2015 Validation Report. Figure 2: Structure of Case Study PPP JICA provides a loan to Cajamarca regional government to partially finance the project. FONAM PERU, a non-profit organization promoting investment in environmental projects, is developing requirements for registering PAFE III in the VCS Standard. FONAM works with the government to create the Project Description. The regional government of Cajamarca will develop and promote all 19 electrification components, while three concessionaries, Hidrandina S.A., Electronorte S.A, and Electroriente S.A, will handle operation and maintenance of the project. Assuming similar scale, context, and project arrangements as in the case study of electrifying an additional 40,000 households, the model’s Net Present Value (NPV) without ERC in- and outflows – only considering non-ERC inflows through other revenue streams or cost savings enabled by the project – is positive at $222.5 million (M)1. With ERC cashflows, the total project will have a positive NPV of $222.9M, which provides added value to make these types of projects more financially attractive, given the large capital outlay to finance the installation of the mini-grid. Table 2: Summary of sources of inflows and outflows and key assumptions ERC revenues or inflows Average price of Transport project in Asia, registered under Verified Carbon Standard (VCS) Non-ERC revenues or inflows PAFE expansion case study benchmark, World Bank database - Cost of doing business, Global Petrol Prices Project investment and implementation cost PAFE expansion case study benchmark ERC generation Verra Fee Schedule Table 3: Net cashflows summary (in USD) ERC Component Revenues/Inflows 0 950,097 950,097 Costs/Outflows 0 -71,958 -71,958 Net value 0 878,139 878,139 Primary/Non-ERC Component Revenues/Inflows 0 46,045,253 46,045,253 Costs/Outflows -59,702,496 -2,985,125 -62,687,621 Net value -59,702,496 43,060,129 -16,642,367 Net Present Values Total Project $2,701,686 ERC Component $418,600 Non-ERC Component $2,283,086 Footnote 1: All prices are expressed in United States Dollars (USD)Proposed Structure of this Public Private Partnership (PPP) Model

Dimension

Attribute

Description

Case Study: Electric Frontier Expansion Program Phase III in Peru

Summary of the Model Financials

Value component

Assumptions

Sources

Components

Sum of initial outlays

Sum of in- or outflows from crediting period

Total cashflow

This section is intended to be a living document and will be reviewed at regular intervals. The Guidelines have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions. Unless expressly stated otherwise, the findings, interpretations, and conclusions expressed in the Materials in this Site are those of the various authors of the Materials and are not necessarily those of The World Bank Group, its member institutions, or their respective Boards of Executive Directors or member countries. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

Updated:

TABLE OF CONTENTS

UNLOCKING GLOBAL EMISSION REDUCTION CREDIT

Guidance for Countries in Assessing ERC Projects

1. Introduction to Emission Reduction Credits

• The World Bank's Emission Reduction Program

•Classification of Emissions Reduction Credit

• Policy Context of Emissions Reduction Credit

2. Objective of the Guidance for Countries in Assessing ERC Projects

• Objective of Project Preparation Guidelines

• Introduction to the Project Assessment Framework

• Process to Conducting Assessments

• S1: Green Economy Priorities

• S3: Article 6 Readiness and Eligibility

4. Conducting the Initial Profiling and Making a Preliminary Decision

• F2: Additional Value Enabled by Project

• C1, C2, and C3: Carbon Integrity and Environmental and Social Risk Management

5. Conducting the Project Assessment and Making the Final Decision

• F1: Project ERC value and F2: Additional Value Enabled by Project

• Q2: Marketing, Sales, and Pricing

• Q3: Project Governance and Structure

• C2: Environmental Risk Management

• C3: Social Risk Management and Benefits

6. Further Guidance for Application

• Country Context-driven Factors

• Considerations for Future Scope

Abbreviations: Guidance for Countries in Assessing ERC Projects

• B: Project Assessment Template

- Model 1: MRT Energy Efficiencies Model for ERP

- Model 2: Rural Electrification Model for ERP

- Model 4: Rooftop Solar Installation Model for ERP

- Model 5: LED Streetlight Deployment Model for ERP - for Specific Technologies

- Model 6: E-bus Deployment Model for ERP

- Model 7: EV Charging Systems Installation Model for ERP

- Model 8: Biodigesters Deployment Model for ERP

- Model 9: Waste-to-Power Model for ERP

- Model 10: Waste Treatment Facility Model for ERP

- Model 11: Climate Smart Farming Deployment Model for ERP

Related Content

Additional Resources

Climate-Smart PPPs

Type of ResourceFinance Structures for PPP

Type of ResourceFinancing and Risk Mitigation

Type of Resource