Current Landscape of ERC Financing

Photo Credit: Image by Freepik

On this page: Emission Reduction Credit activity-level investment has steadily increased over the last ten years and needs to scale significantly to meet exponentially increasing ERC demand. Read more below, or visit Strategic Guidance for Country System Assessments, Guidance for Countries in Assessing ERC Projects, or Mobilizing ERC Finance.

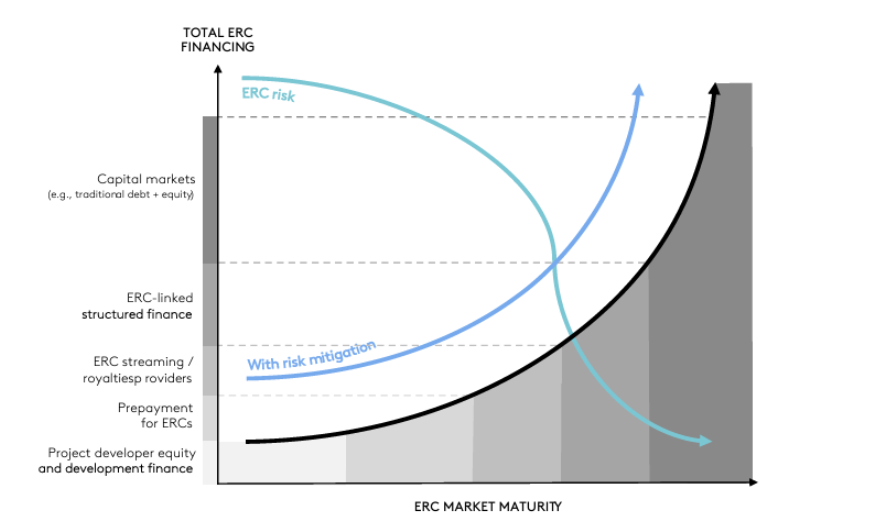

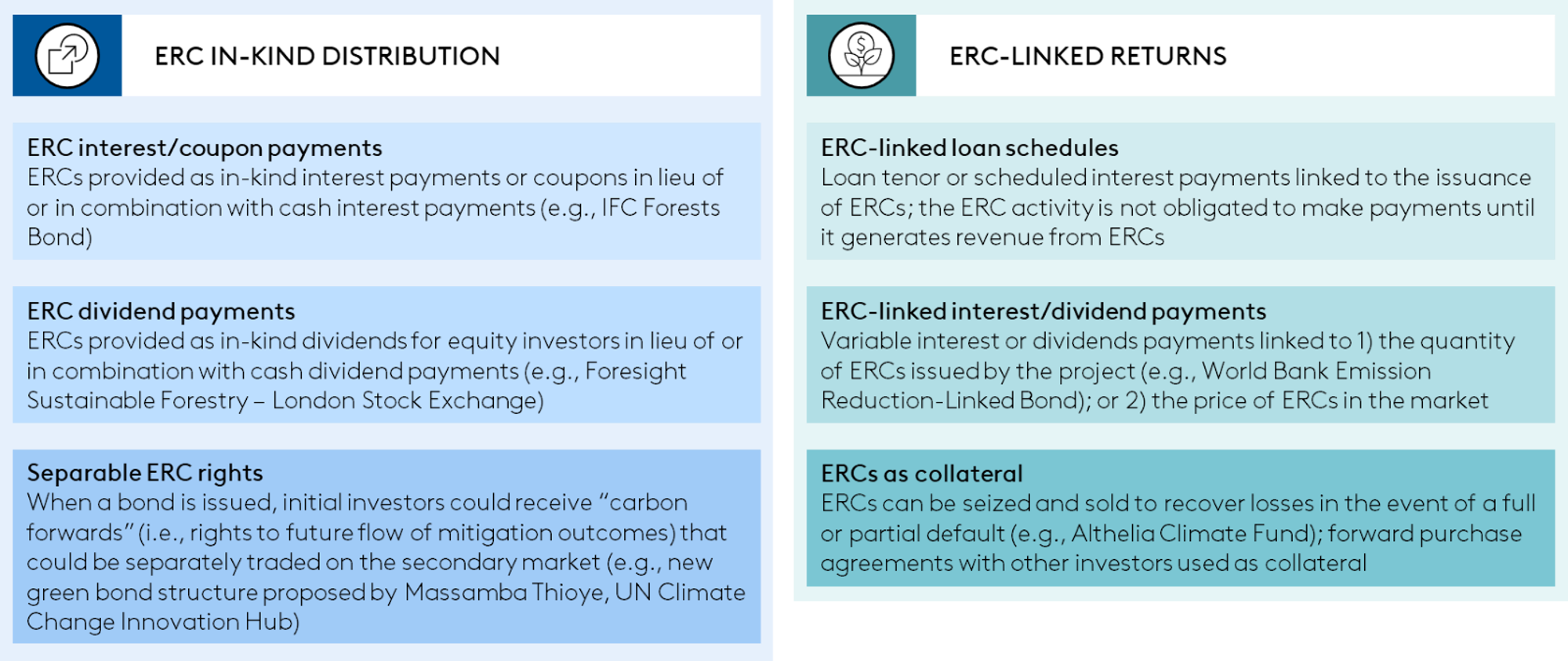

Finance available for ERC generation is increasing and mostly targeting nature-based activities. Publicly disclosed upstream financing for ERC generation — i.e., finance raised for or otherwise committed to ERC-generating activities — increased from $7 billion in 2021 to $10 billion in 2022. Including the estimated value for deals publicly announced but without disclosing the transaction value, total ERC financing potentially increased from $12 billion in 2021 to a record $26 billion in 2022.1 This covers deals that involved carbon investors or project developers across (i) corporate finance (e.g., equity fundraising, M&A), (ii) project finance (including emissions reduction purchase agreements (ERPAs)), (iii) ERC fund investment, and (iv) corporate procurement. Underneath the headline numbers, there is some indication that significant M&A helped drive up numbers, 2 while capital raising by funds was down.3 Nature-based activities were the target of the large majority of capital raised in 2022. ERC activity-level investment has steadily increased over the last ten years and needs to scale significantly to meet exponentially increasing ERC demand. Capital deployed for ERC activity feasibility work, project development, and capital expenditure is estimated to have steadily increased since 2013 to $5 billion in 2021 and $7.5 billion in 2022. An estimated $90 billion in investment is needed in 2023-2030 to meet credit demand associated with a high demand scenario aligned with a global 1.5oC path as of 2030, which implies maintaining investment of over $11 billion annually. But the needed investment increases exponentially beyond that, with $310 billion total by 2035 or an average $24 billion in 2023-2035 in the high demand scenario.4 Historically, ERC project design and implementation has relied on project equity and grant finance. The primary financiers of early-stage ERC activities were (and continue to be) project developers and development finance or conservation-oriented institutions, and activities typically only gained access to corporate buyers once they were verified and marketed by a third-party certifier.5 The demand for ERCs was relatively small, so most financing was done through simple offtake agreements with individual ERC activities and spot-market transactions. However, as the market grows and matures, financing solutions are becoming more sophisticated. Today, upfront financing for future delivery of ERCs is a key source of capital for ERC activities and increasingly includes additional securities for the financier. The volume of forward transactions reported to Ecosystem Marketplace increased by 65% between 2020 and 2021.6 This type of upfront financing is typically provided by corporate offtakers seeking to lock in a guaranteed source of future ERCs at a predetermined, below-market price. To the extent these offtakes include a pre-payment, ERC activities benefit from access to capital for early-stage ERC generation, which can help attract additional investors and reduce the risk of project failure due to lack of capital. It is increasingly the market norm for upfront financing structures to include parameters or covenants that provide additional security for the investor or offtaker. Forward transactions from large, creditworthy buyers can also serve as a basis for increasing appetite from commercial financiers who will assess the credit profile of an ERC activity or developer based on the credit profile of committed buyers. Though ERC activities are tapping a growing diversity of financing sources, in general they still cannot easily access deeper pools of debt or sufficient levels of equity available in more mature commercial sectors, absent significant risk mitigation support (Figure 5). Despite the eagerness of investors to finance ERC activities and, for some, to secure access to a future supply of ERCs, most ERC activities are still too small and risky to meet the requirements of typical non-ERC-specialist financiers. ERC financing totaled an estimated $8.1 billion in the first half of 2023, but over a larger number of deals than in H2 2022, and ticket sizes were mostly $40 million or below.7 Overall ERC risk will decrease as the market matures and the enabling environment for ERC transactions improves. However, ERC activities that are seeking debt to scale today, particularly in EMDEs, are often considered too risky and do not have sufficient equity or working capital for lenders' risk appetites. In some cases, lenders have specifically signaled that they need to see more project equity rather than pre-payment agreements or other structures to secure debt. Figure 5. Conceptual ERC financing curve, illustrating relationship between market maturity, total risk, and types and scale of capital available. In the face of ERC financing challenges, more and new financial intermediaries have emerged to connect a larger pool of potential end users and financiers to a steady supply of ERCs. This includes ERC-focused funds and ERC trading desks, as well as ERC streaming and royalties providers who provide upfront financing to ERC activities in exchange for a predetermined portion of future ERC flows (streaming) or revenue generated from ERC sales (royalties) (Box 1). These intermediaries offer ERC activities new ways to unlock capital earlier in the project development process, while providing investors access to a portfolio of high-quality ERC activities that generates a steady stream of ERCs and potential for strong financial returns, with the security that the intermediary has done the requisite due diligence on underlying ERC activities and associated market and political risks. ERC intermediaries have potential to scale further but will be limited by their specialist nature and intensive transaction process to reach relatively small ticket size investments. Box 1 Examples of ERC financial intermediaries The Carbon Opportunities Fund, launched in 2022 through a partnership between IFC, Cultivo, Aspiration, and Chia Network, is raising private capital to source, tokenize, and sell high-quality, verified ERCs generated by nature-based projects in emerging markets.10 In June 2023, Sumitomo Corporation of Americas purchased the first batch of ERCs that were tokenized on the Climate Action Data Trust (Market Risk for ERCs), which leverages Chia’s DataLayer network. This was one of the first examples of an ERC transaction utilizing blockchain infrastructure.11 Climate Asset Management (CAM), a dedicated natural capital investment manager co-founded by HSBC and Pollination, raised more than $650 million in commitments across its two natural capital strategies in 2022. The Natural Capital Strategy seeks to invest in regenerative landscape management in agriculture, forestry, and environmental assets to deliver long-term financial returns and environmental impact. The Nature-based Carbon Strategy targets early-stage, nature-based carbon projects in developing countries to restore landscapes at scale and deliver biodiversity improvements, climate resilience, and community benefits alongside high-quality ERCs. The strategy targets investment sizes between $10 million and $30 million across multiple nature-related sectors, including agriculture, forestry, and other land use (AFOLU); conservation, restoration, and regeneration of mangroves, wetland, and peatland (blue carbon); and savanna fire management. CAM’s primary type of financing is upfront investment in return for future delivery of ERCs; in addition, equity investments are considered for commercially viable projects.12 Carbon Streaming Corporation (CSC) is a provider of ERC streaming and royalties financing for ERC activities across a diversified portfolio of 20 projects and 12 countries. CSC has provided over $117 million in upfront financing through streaming contracts with nine project partners and royalties contracts with two project partners.13 The largest contract is a $57.8 million stream with the Rimba Raya Biodiversity Reserve in Borneo, Indonesia, one of the largest REDD+ peat swamp forest projects in the world and the first to receive triple-gold validation under the Climate, Community, and Biodiversity Alliance Standard (CCBA). Under this streaming arrangement, CSC will receive 100% of the ERCs generated by Rimba Raya over the life of the project (estimated until 2073), minus up to 635,000 ERCs per annum that are already committed to other buyers.14 On the royalties side, CSC provided $3 million in upfront financing to Future Carbon Group in 2022 to support four REDD+ projects focused on preserving the Amazonian rainforest in Brazil. In exchange, CSC will receive a 5% royalty on ERC revenues generated by Future Carbon Group from the four projects, paid semi-annually over a period of 30 years.15 Green Star Royalties Ltd., a majority-owned subsidiary of Canadian precious metals company Star Royalties Ltd., pioneered some of the first ERC royalties transactions in the market, building upon the company’s experience creating bespoke royalties and streaming agreements in the precious metals sector. Green Star Royalties prioritizes nature-based carbon credit projects in North America, such as the Elizabeth Metis Settlement (EMS) Forest Carbon Project in Alberta, Canada. The EMS Forest Project, which covers over 15,000 hectares of boreal forest, is working with Anew Climate to generate ERCs that can be sold to regulated industrial emitters under Alberta’s compliance market. Green Star Royalties, which provided a total of C$900,000 to the project in 2021 and 2022, will receive 40.5% of gross revenue from ERC sales for a term of 10 years commencing with the first sale of ERCs from the EMS Forest Project, or until the first 225,000 ERCs are issued and sold by the project. Green Star Royalties’ portfolio allows Star Royalties to be effectively carbon negative by offsetting emissions from its precious metals portfolio and corporate activities.16 In more established ERC markets, there has been an uptick in operational funding for upstream ERC activities through large M&A and private equity transactions.17 This trend reflects the beginning of a shift in strategy among end users. While most corporates still prefer to purchase from existing pools of ERCs (i.e., on a spot basis), some are moving to secure long-term supply of ERCs by acquiring ERC project developers and getting involved earlier in the ERC activity development process. Others see an opportunity to consolidate ERC supply or become first movers in a high-value market with significant growth expectations (Box 2). Box 2 Examples of recent ERC-focused M&A. Mitsui, Nomura, and New Forests: In May 2022, Mitsui & Co. (Mitsui) and Nomura Holdings, Inc. (Nomura) acquired a 100% shareholding of New Forests, the largest forestry asset management company in Asia and Oceania and the second largest in the world. Under the agreement, Mitsui now owns 49% and Nomura owns 41% of the company, with the remaining 10% retained by New Forests’ staff. The acquisition is the latest development in Mitsui’s increasing involvement with New Forests since first becoming a shareholder in 2016, with approximately 23% ownership of the company.18 In December 2021, Mitsui invested AUD 50 million in a forestry carbon offset fund in Australia, developed in partnership with New Forests.19 Bluesource and Element Markets: In February 2022, Bluesource LLC—the largest ERC developer in North America—and Element Markets LLC—a renewable natural gas market and environmental commodities company—announced a merger to create the largest marketer and originator of ERCs in North America, backed by TPG Rise and NGP.20 Their new combined entity, Anew Climate, launched in June 2022 with a focus on providing “climate as a service” to support a wide range of public and private organizations in achieving their climate goals.21 KKR, OTPP, and GreenCollar: In April 2020, KKR—one of the four largest publicly traded private equity firms in the world—invested $100 million through its Global Impact Fund to acquire a 49% stake in GreenCollar, an experienced ERC project developer that accounts for nearly half of the market in Australia. The investment enabled GreenCollar to expand internationally through acquisitions of several companies, including Sigma Global, a carbon advisory and trading firm; Devine Agribusiness Carbon, an Australian carbon farming company; and Go Neutral, a consumer-facing offsets platform.22 In December 2021, Ontario Teachers’ Pension Plan (OTPP) invested $250 million through KKR’s Global Impact Fund to acquire an estimated 33% stake in GreenCollar.23 Temasek, Salesforce Ventures, and South Pole: In February 2022, Temasek—a Singapore-based global investment company—and Salesforce Ventures—the global investment arm of Salesforce—both acquired minority stakes in South Pole, a climate solutions company and carbon project developer. Temasek and Salesforce Ventures' investment, the amount of which was undisclosed, supported South Pole’s strategic objective to expand its climate solutions in Asia and North America.24 The increase in scale and diversity of ERC financing is partly driven by blurring between offtakers and financiers. The primary source of offtake for ERCs has historically been non-financial corporate entities. However, financial institutions are increasingly engaging as offtakers as well, in part to retire ERCs themselves. In fact, while 29% of capital commitments for ERC activities came from corporates between 2021 and June 2023, 71% came from financial investors.25 This is complemented by the recognition of ERCs as a valuable asset, which has led to an increased level of financial intermediation via ERC trading desks, hedge transactions, and other forms of financial institution participation in ERC transaction structures to secure a steady supply of ERCs to sell to clients or on the open market. Concurrently, some corporate offtakers are engaging more like investors, shifting strategy from ERC purchases to impact investing with ERC returns or co-benefits. Greater variation and experimentation in how investment returns are linked to ERCs, including through technological innovation, is also helping to expand access to capital. Different types of linkage (Figure 6) can help structure financing to meet different financiers’ preferences for how and how much they are exposed to ERC risk. Some types of linkages have been proven in the market (e.g., ERC coupon payments), some are nascent and currently being tested in the market (e.g., ERC-linked interest, ERC dividends), and some remain purely hypothetical, but have potential to unlock new types of ERC financing that better fit the needs of both investors and ERC activities (e.g., separable ERC rights, ERC-linked loan schedules). There are some examples of capital mobilized on the back of ERCs (as collateral) or future flow of ERCs (forward transactions as collateral), though this approach has not been implemented at scale. Recent innovations leveraging blockchain and other technologies are also emerging to facilitate new ways of linking finance and ERCs (e.g., Senken’s sale of carbon forward tokens tied to the Papariko - Vlinder Blue Carbon project in Kenya26, BIS Innovation Hub’s Project Genesis 2.027). Financing structures to address key risks discusses real-world examples that illustrate the potential for capital to be mobilized via different types of ERC linkage. Figure 6. Types of ERC linkage. _____________________ Footnote 1: Abatable, The State of the Carbon Developer Ecosystem, 2023. Footnote 2: Abatable, The State of the Carbon Developer Ecosystem, 2023. Footnote 3: Trove Research, Investment trends and outcomes in the global carbon credit market, 2023. Footnote 4: Trove Research, Investment trends and outcomes in the global carbon credit market, 2023. Footnote 5: Abatable, The Carbon Project Development Curve, 2022. Footnote 6: Ecosystem Marketplace, The Art of Integrity – State of the Voluntary Carbon Markets 2022 Q3, Forest Trnds Association, 2022. Footnote 7: Abatable, “Carbon project developer financing levels on track with last year,” 2023. Footnote 8: Climate Asset Management, “Climate Asset Management closes over $650 million for Natural Capital projects”, 2022. Footnote 9: ESG Today, “Carbon Growth Partners Raising $200 Million for Carbon Credit Fund”, 2023. Footnote 10: IFC, "Carbon Opportunities Fund Launches First-of-its-Kind Investment Platform to Issue Tokenized Carbon Credits", 2022. Footnote 11: Business Wire, "Carbon Opportunities Fund and Sumitomo Corporation of Americas Lead the Way with First Transaction of Tokenized Carbon Assets reflected in the Climate Action Data Footnote 12: Climate Asset Management, 2023. Footnote 13: Carbon Streaming Corporation, 2023. Footnote 14: Carbon Streaming Corporation, Corporate Presentation – May 2023, 2023. Footnote 15: Carbon Streaming Corporation, Carbon Streaming Announces Term Sheet and Royalty Agreement With Future Carbon Group, 2022. Footnote 16: Star Royalties, Elizabeth Metis Settlement Forest Carbon Project, 2023. Footnote 17: Abatable, The State of the Carbon Developer Ecosystem, 2023. Footnote 18: New Forests, “Mitsui and Nomura enter agreement to acquire New Forests”, 2022. Footnote 19: Mitsui & Co., “Mitsui to Participate in Forestry Carbon Credit Investment in Australia”, 2021. Footnote 20: BusinessWire, “Bluesource & Element Markets are Combining to Form a Global Decarbonization Platform Backed by TPG Rise”, 2022. Footnote 21: Anew Climate, “Element Markets and Bluesource Formally Merge to Create AnewTM”, 2022. Footnote 22: OTPP, “Ontario Teachers’ Joins KKR as an Investor in GreenCollar”, 2021. Footnote 23: OTPP, “Ontario Teachers’ invest $250M in Carbon Credits Developer”, 2021. Footnote 24: South Pole, “Raises new round of funding led by Temasek, adds Salesforce Ventures as minority investor”, 2022. Footnote 25: Trove Research, Investment trends and outcomes in the global carbon credit market, 2023. Footnote 26: Senken, “senken is launching the world’s first public sale of carbon forward tokens”, 2023. Footnote 27: BIS Innovation Hub, Project Genesis 2.0: Smart Contract-based Carbon Credits attached to Green Bonds, 2022.Introduction

Examples of ERC financial intermediaries

Examples of recent ERC-focused M&A

Trust", 2023.

This section is intended to be a living document and will be reviewed at regular intervals. The Guidelines have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions. Unless expressly stated otherwise, the findings, interpretations, and conclusions expressed in the Materials in this Site are those of the various authors of the Materials and are not necessarily those of The World Bank Group, its member institutions, or their respective Boards of Executive Directors or member countries. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the PPPLRC at ppp@worldbank.org.

Updated: June 3, 2024

TABLE OF CONTENTS

UNLOCKING GLOBAL EMISSION REDUCTION CREDIT

1. Introduction to Emission Reduction Credits

• The World Bank's Emission Reduction Program

• Classification of Emissions Reduction Credit

• Policy Context of Emissions Reduction Credit

• Current Landscape of ERC Financing

• Financing structures to address key risks

• Equity: The London Stock Exchange and Foresight Sustainable Forestry

• Fund: Liveligoods Carbon Fund 3

3. Key Enablers of ERC Finance

• Credit Risk in ERC Finance Transactions

• Political Risk for ERC Activities

• Rights to ERCs and Their Benefits

• Government Engagement and Public Sector Participation

4. Scaling Finance for ERC Generation

• Key Findings to Scale Up Private Sector Capital for ERC Activities

• Expand ERC-Backed Debt Issuance