Equity: The London Stock Exchange and Foresight Sustainable Forestry

Photo Credit: Image by Freepik

On this page: The London Stock Exchange is the first exchange in the world to apply a securities market framework to Emissions reduction credit markets through its Voluntary carbon market designation. Read more below, or visit Strategic Guidance for Country System Assessments, Guidance for Countries in Assessing ERC Projects, or Mobilizing ERC Finance.

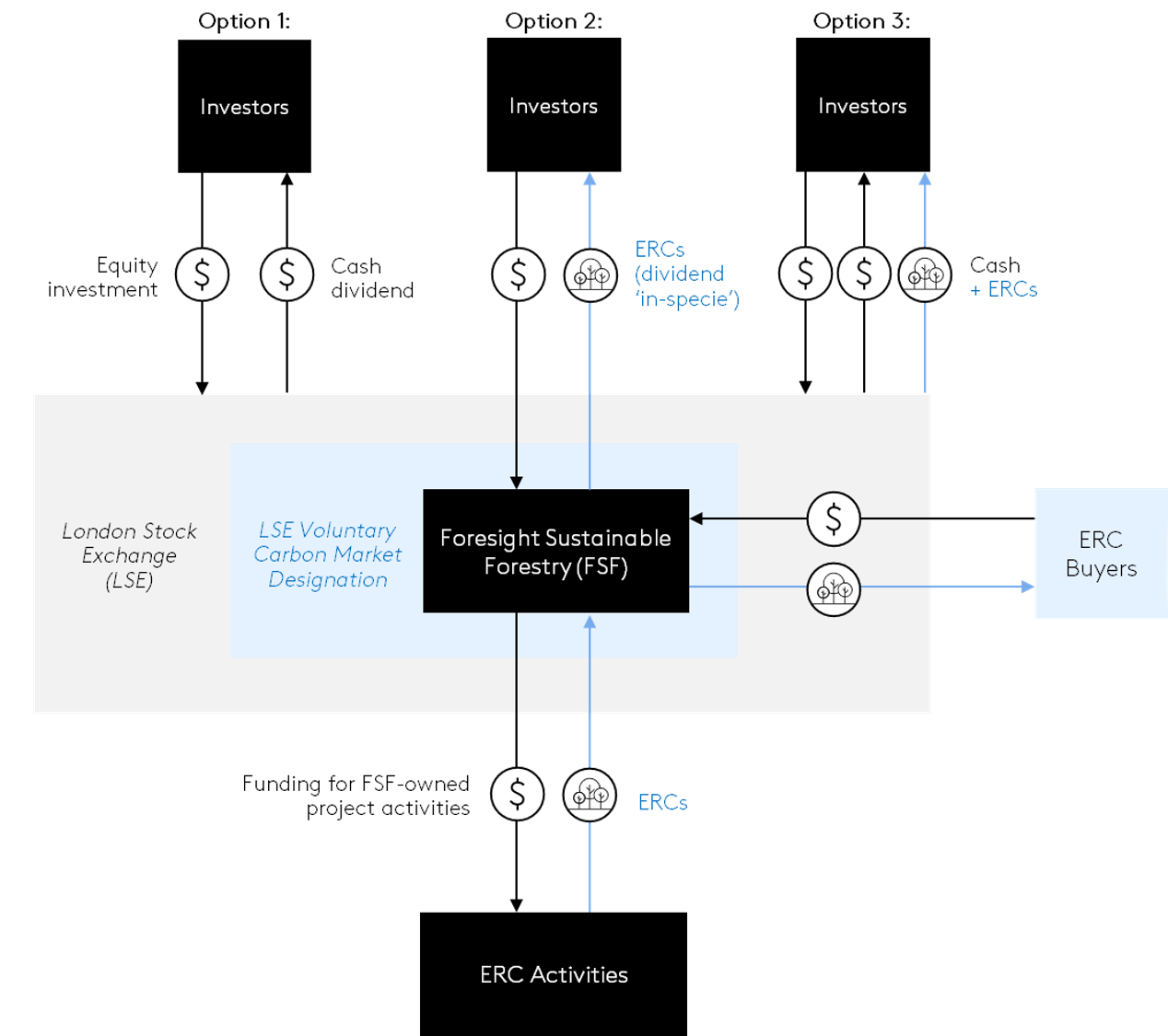

Issuer Foresight Sustainable Forestry (FSF) Key Lessons FSF’s success raising capital as the first company to receive the London Stock It also provides an example of where public equity investors are willing to The optionality of ERC returns offers investors a choice in terms of their level Instrument Publicly listed equity (London Stock Exchange) Return FSF does not pay regular dividends. As FSF’s The London Stock Exchange (LSE) is the first exchange in the world to apply a securities market framework to ERC markets through its VCM designation. The LSE VCM designation requires eligible issuers (companies and funds) to comply with all standard listing and disclosure rules of the exchange, plus additional rules related to the VCM. For example, a listed fund must have a transparent, board-approved carbon credit policy on whether and how it will sell on, retire, or distribute credits back to shareholders. Additional disclosure requirements include details of the projects the issuer is directly or indirectly financing, including but not limited to the qualifying bodies whose standards will be applied to the projects, project types, expected carbon credit yield, and the extent to which they are expected to meet the United Nations Sustainable Development Goals. Overall, the LSE VCM designation serves to (i) facilitate a liquid ERC market, (ii) generate more opportunities for investors to get involved in ERC transactions without taking on significant risk, (iii) create a clear and transparent price signal for the ERC market, and (iv) increase investor confidence in ERC markets by vetting high-quality ERC activities through a reputable institution with well-established regulatory frameworks.1 Foresight Sustainable Forestry (FSF) is the first company to receive the LSE VCM designation and will offer investors the option of a financial or an ERC dividend, or a mix (Figure 8). FSF invests in forestry and afforestation assets in the United Kingdom and is the first (and only, as of June 2023) company to receive the LSE VCM designation. A modest portion of FSF’s net asset value (NAV) is attributed to pending issuance units (PIUs). PIUs are a standardized “promise to deliver” a Woodland Carbon Unit (WCU), which is the verified ERC unit issued through the UK Woodland Carbon Code. As of March 2023, FSF had a total of 143,707 PIUs on its balance sheet valued at the then WCU market rate of £17.50 per unit and totalling £2.5 million.2 Once ERC activities begin to sequester carbon after approximately five years, PIUs will be converted into WCUs following a validation process that will recur at least every five years. FSF plans to hold WCUs generated by its activities on the company’s balance sheet until 2030 as the ERC market develops and the value of LSE VCM-endorsed credits increases. When FSF decides to distribute dividends, shareholders will have the option to receive a pure cash dividend based on the ERCs generated and sold by FSF, a pure in-kind ERC dividend, or a combination of cash and ERCs. LSE VCM designation provides a solution for investors seeking a long-term supply of ERCs without getting locked into less liquid private financing structures, and FSF’s success in raising capital is a strong indication that the model is effective at helping raise funds from capital markets for ERC activities. FSF raised £130 million through an IPO in October/November 20213 and an additional £45 million in June 2022.4 It used the proceeds quickly to acquire 65 properties as of March 2023 delivering a total NAV per ordinary share return of 10.6% since IPO, driven by revaluation of afforestation sites.5 FSF’s capital raising success reflects the significant investor demand for exposure to the ERC market and potentially access to high-quality ERCs (and, more generally, sustainable investment strategies). This demand signals growing investor willingness to take on ERC activity risk and market risk, even without clear risk mitigation mechanisms or concessional participation, when the broader enabling environment is in place. The optionality of ERC returns offers investors a choice in terms of their level of control over their exposure to ERC market dynamics. By electing to receive ERC dividends, investors receive ERCs whenever a dividend is paid, which they can themselves retire, or if they decide to sell on the secondary market, they control when and at what price to sell. By electing to receive cash dividends linked to the sale of ERCs, investors implicitly give FSF more control. Furthermore, the speed at which FSF has been able to deploy capital to afforestation and mature forest activities is a testament to the significant unmet need for ERC financing in the UK. As of June 2023, FSF remains the only LSE VCM-endorsed company, and thus the only company able to provide ERC returns to investors on the exchange. However, as more companies obtain this designation in the coming years, the LSE could become an effective avenue for attracting greater levels of commercial capital to high-quality ERC activities. Various other securities markets and market regulators are exploring if and how they may engage with carbon markets.6 Figure 8. Financing structure of Foresight Sustainable Forestry Footnote 1: London Stock Exchange, “London Stock Exchange's Voluntary Carbon Markets solution – accelerating the availability of financing for projects supporting the low-carbon transition”, 2021. Footnote 2: Foresight Sustainable Forestry Company Plc, “Announcement of half-year results for the period to 31 March 2023”, 2023. Footnote 3: Foresight Sustainable Forestry Company Plc, “Results of Initial Public Offering”, 2021. Footnote 4: Foresight Sustainable Forestry Company Plc, “Results of Placing, Offer for Subscription and Total Voting Rights”, 2022. Footnote 5: Kepler Trust Intelligence Unit, “Results Analysis: Foresight Sustainable Forestry”, 2023. Footnote 6: The United Nations Sustainable Stock Exchanges Initiative published a VCM introduction for exchanges and launched its carbon market advisory group at COP27 in November 2022. The International Organization of Securities Commissions released a report on compliance carbon markets in July 2023.

FORESIGHT SUSTAINABLE FORESTRY (FSF)

Exchange’s VCM designation reflects the significant investor demand for

exposure to the ERC market and potentially access to high-quality ERCs.

take on ERC activity risk and market risk, even without clear risk mitigation

mechanisms or concessional participation, when the enabling environment is

in place.

of control over their exposure to ERC market dynamics, catering to a wider

range of potential investors.

afforestation projects mature, investors will have

the option to receive either (i) ERCs as a dividend

‘in-specie’, (ii) cash dividends tied to the sale of

ERCs, or (iii) a combination of both.

This section is intended to be a living document and will be reviewed at regular intervals. The Guidelines have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions. Unless expressly stated otherwise, the findings, interpretations, and conclusions expressed in the Materials in this Site are those of the various authors of the Materials and are not necessarily those of The World Bank Group, its member institutions, or their respective Boards of Executive Directors or member countries. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the PPPLRC at ppp@worldbank.org.

Updated: June 3, 2024

TABLE OF CONTENTS

UNLOCKING GLOBAL EMISSION REDUCTION CREDIT

1. Introduction to Emission Reduction Credits

• The World Bank's Emission Reduction Program

• Classification of Emissions Reduction Credit

• Policy Context of Emissions Reduction Credit

• Current Landscape of ERC Financing

• Financing structures to address key risks

• Debt: Example of Emission Reduction-Linked Bond from Vietnam

• Equity: The London Stock Exchange and Foresight Sustainable Forestry

• Fund: Liveligoods Carbon Fund 3

3. Key Enablers of ERC Finance

• Credit Risk in ERC Finance Transactions

• Political Risk for ERC Activities

• Rights to ERCs and Their Benefits

• Government Engagement and Public Sector Participation

4. Scaling Finance for ERC Generation

• Key Findings to Scale Up Private Sector Capital for ERC Activities

• Expand ERC-Backed Debt Issuance