Project Finance – Key Concepts

Photo Credit: Image by Jan Vašek from Pixabay

One of the primary advantages of project financing is that it provides for off-balance-sheet financing of the project, which will not affect the credit of the shareholders or the government contracting authority, and shifts some of the project risk to the lenders in exchange for which the lenders obtain a higher margin than for normal corporate lending.

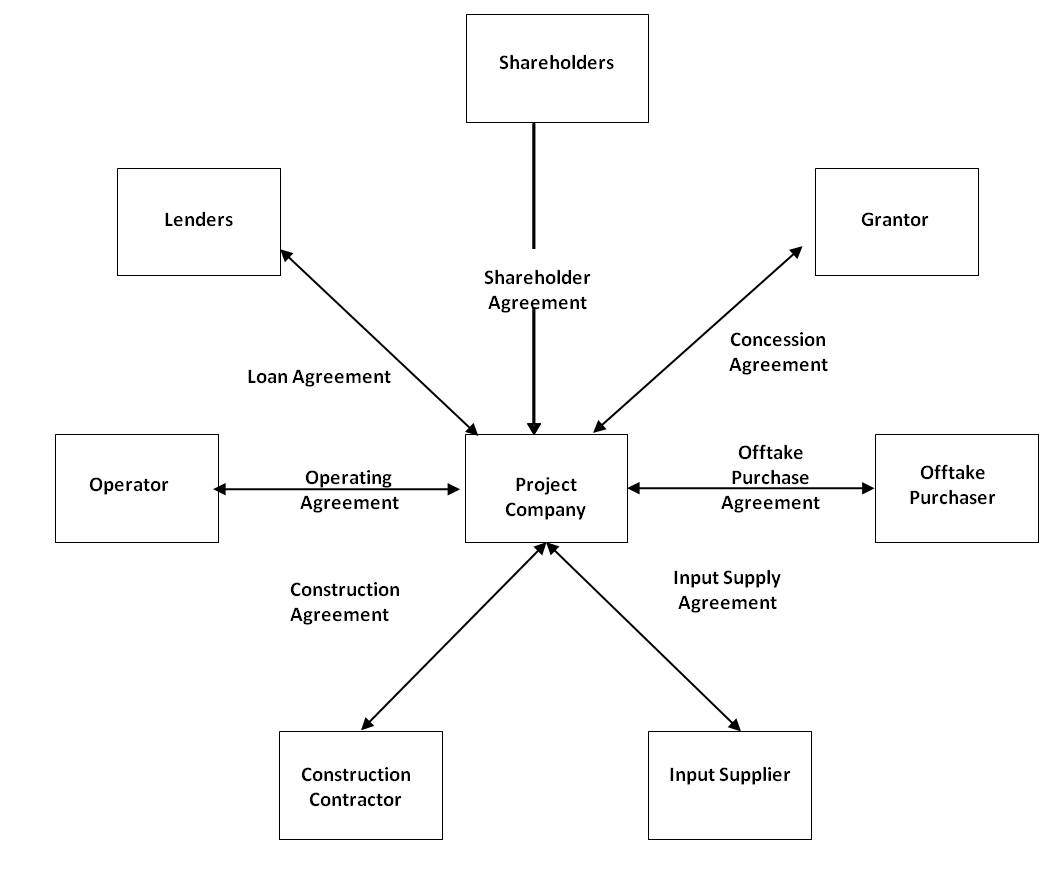

The typical project financing structure (simplified for these purposes) for a build, operate and transfer (BOT) project is shown below. The key elements of the structure are: Project financing may allow the shareholders to keep financing and project liabilities off-balance-sheet. Generally, project debt held in a sufficiently minority subsidiary is not consolidated onto the balance sheet of the respective shareholders. This reduces the impact of the project on the cost of the shareholder’s existing debt and on the shareholder’s debt capacity, allowing the shareholders to use their debt capacity for other investments. Clearly, any project structure seeking off-balance-sheet treatment needs to be considered carefully under applicable law and accountancy rules. To a certain extent, the government can also use project finance to keep project debt and liabilities off-balance-sheet, taking up less fiscal space. Fiscal space indicates the debt capacity of a sovereign entity and is a function of requirements placed on the host country by its own laws, or by the rules applied by supra- or international bodies or market constraints, such as the International Monetary Fund (IMF) and the rating agencies. Those requirements will indicate which project lending will be treated as off-balance-sheet for the government. Keeping debt off-balance sheet does not reduce actual liabilities for the government and may merely disguise government liabilities, reducing the effectiveness of government debt monitoring mechanisms. As a policy issue, the use of off-balance-sheet debt should be considered carefully and protective mechanisms should be implemented accordingly. For more on management of government risks and contingent liabilities, go to Management of Government Risks. Recourse financing gives lenders full recourse to the assets or cash flow of the shareholders for repayment of the loan in the case of default by the SPV. If the project or SPV fails to provide the lenders with the repayments required, the lenders will then have recourse to the assets and revenue of the shareholders, with no limitation. Project financing, by contrast is “limited” or “non-recourse” to the shareholders. In the case of non-recourse financing, the project company is generally a limited liability special purpose project vehicle, and so the lenders' recourse will be limited primarily or entirely to the project assets (including completion and performance guarantees and bonds) in the case of default of the project company. A key question in any non‑recourse financing is whether there will be circumstances in which the lenders do have recourse to part or all of the shareholders' assets. The type of breach of covenant or representation which gives rise to this would typically be a deliberate breach on the part of the shareholders. Applicable law may also restrict the extent to which shareholder liability can be limited, for example liability for personal injury or death is typically cannot be limited. [1]J Delmon - Private Sector Investment in Infrastructure, Project Finance, PPP Projects and Risk (2nd Ed) Kluwer Law InternationalProject Finance - Key Concepts[1]

Typical Project Finance Structure

As can be seen, there are a number of contracts and the arrangements are complex. The interrelation between the different parties needs to be carefully provided in the agreements.

As can be seen, there are a number of contracts and the arrangements are complex. The interrelation between the different parties needs to be carefully provided in the agreements.Off-Balance-Sheet

Non-Recourse Financing

Updated: July 22, 2024

Related Content

Financing and Risk Mitigation

Main Financing Mechanisms for Infrastructure Projects

Investors in Infrastructure in Developing Countries

Sources of Financing and Intercreditor Agreement

Key Issues in Developing Project Financed Transactions

Risk Allocation Bankability and Mitigation in Project Financed Transactions

Risk Mitigation Mechanisms (including guarantees and political risk insurance)

Government Support in Financing PPPs

Government Risk Management

Further Readings on Financing and Risk Mitigation