Telecom Infrastructure Sharing, Thailand

Photo Credit: Image by evening_tao on Freepik

On this page: Infrastructure sharing of physical assets between different utility providers can maximize the utility of infrastructure and/or minimize costs needed to build and operate assets. Find case studies below, or visit the Guidelines on Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report.

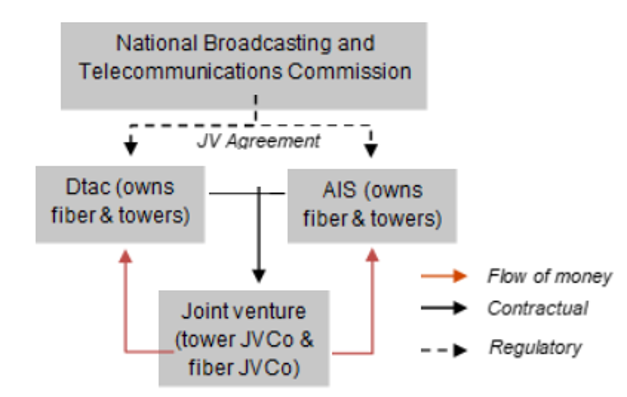

Project Summary: Background Infrastructure sharing of physical assets between different parties can maximize the utility of infrastructure or minimize costs needed to build and operate assets, creating a win-win situation for parties involved especially cost-savings from reduction in capital investment required for expanding, maintaining, and upgrading network connectivity. In the telecommunication industry, the rapid deployment and changes to technology can quickly render old telco infrastructure obsolete and operators are required to spend a large amount of capital on building new infrastructures. Tower sharing, for example, also reduces barriers to entry allowing new entrants to compete with incumbent companies and prevent market monopoly leading to improved service quality while keeping prices competitive. Moreover, as 5G technology is rolled out, the 5G technology needs a much high density of cell towers and antennas due to the shorter signal range. Therefore, there will be more significant commercial pressures on mobile telco network providers to minimize costs. Project Structure Tower companies in Thailand are subject to infrastructure sharing regulations which makes it mandatory to share telecom infrastructure assets on fair commercial terms with new players. Infrastructure sharing encourages collaboration across telco companies that guarantee faster and more efficient infrastructure procurement. This way, the national broadband target can be achieved in a timely manner. In 2015, Thailand’s second largest mobile operator Digital Total Access Communication (Dtac) has reached an agreement with larger rival Advanced Info Service (AIS) to share infrastructure (2,000 towers in 2015) in a bid to cut costs while expanding network coverage and capacity to keep pace with mobile broadband demand.1 Most of the towers are located in provincial areas. Under the collaboration, the operators will also jointly work to roll out new towers instead of duplicating the effort.2 Key players for delivering improved services The National Broadcasting and Telecommunications Commission (NBTC) is an operating body overseeing Thailand's broadcast and telecom industries. It aims to drive the digital connectivity and telecommunications coverage around Thailand and encourages infrastructure sharing to reach its goals. Accordingly, the NBTC has set out guidelines and regulations where incumbent MNOs must share their infrastructure unbiasedly with new entrants. There are over 60,000 telecom towers in Thailand, operated mainly by Advanced Info Services (AIS) which is part of Singtel group, Total Access Communication Plc (Dtac) which is a subsidiary of Norway’s Telenor, True Corporation Plc (True), and National Telecom (NT) a state-owned company.3 National Telecom was established in 2021 through the merger of CAT Telecom and TOT which were both state-owned companies and party to concessions with Dtac, AIS and True. Mechanism/s for Maximizing Funding for Infrastructure Infrastructure sharing can effectively reduce total cost of ownership (TCO) by up to 40% for operators, and significantly reduce OPEX relating to land lease, power and backhaul which typically comprise almost half of the OPEX in emerging markets.4 Typically, telcos generate revenue by providing consumers with different telecommunication services such as voice and data connectivity services. However, larger telcos can also share their infrastructures with small operators through a leasing or revenue-sharing model, which has gained traction in emerging markets, especially with the new 5G development, where a large amount of capital is needed to build the infrastructures. Aside from forming partnerships to share telco infrastructure, some telco companies are considering divesting their towers in sale-and-leaseback arrangements which free up capital for investment in other focus areas.5 Typical Business Model Apart from private telco infrastructure sharing partnerships, National Telecom (NT) which is a state-owned company is positioning as an infrastructure-sharing provider, seeking partnerships to develop sustainable revenue streams in the future as its spectrum-sharing concession contracts with three major mobile operators (Dtac, AIS and True Corporation Plc) are slated to expire in 2025.6 NT's assets comprise 25,000 telecom towers, nine routes of submarine cables, total spectrum of 600 megahertz of bandwidth on six spectrum ranges, 4,000 kilometers of cable conduits, 4 million fiber-optics cores and 13 data centers and international call services. NT aims to provide infrastructure-sharing services to operators to support effective cost management.7 Lesson Learned Managing the risks Replicability Footnote 1: DTAC confirms AIS network sharing, CAT joint venture deals Footnote 2: AIS, Dtac sign long-term tower sharing deal Footnote 3: Waves of fear over phone tower claims Footnote 4: Infrastructure Sharing: An Overview Footnote 5: Southeast Asia's telcos to look to tower, tech deals as 5G rollout costs add up Footnote 6: Building a brand identity

National Telecommunication Commission

Telco Companies

Joint Venture

The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the PPPLRC at ppp@worldbank.org.

Updated: February 26, 2024

TABLE OF CONTENTS

I. Innovative Revenues for Infrastructure (IRI)

2. Introduction to Commercial Value Capture (CVC)

3. Applying CVC in Infrastructure Projects

2. Case Studies in CVC from International Experiences

• Advertising and Marketing in High-Footfall Public Areas

• Naming Rights in Stations and City Icons

• Commercial Uses of Virtual Spaces

• Commercial Uses of Physical Places and Virtual Spaces Created on the Back of Public Infrastructure

• Control of Real Estate Development Rights to Enhance Value

• Leveraging Climate Opportunities

• Usage of Facilities During Off-Hours or Off-Seasons

• Repurposing or Adaptive Reusing of Old Assets