How innovative revenues for infrastructure can fundamentally reshape infrastructure funding

Photo Credit: Image by Freepik

Authored by: Jennifer Tay and Pajnapa Peamsilpakulchorn

This article has also been cross-published on the World Bank PPP Blog. Click here to view. To find out more, visit the Innovative Revenues for Infrastructure (IRI) online at the Public-Private Partnership Resource Center.

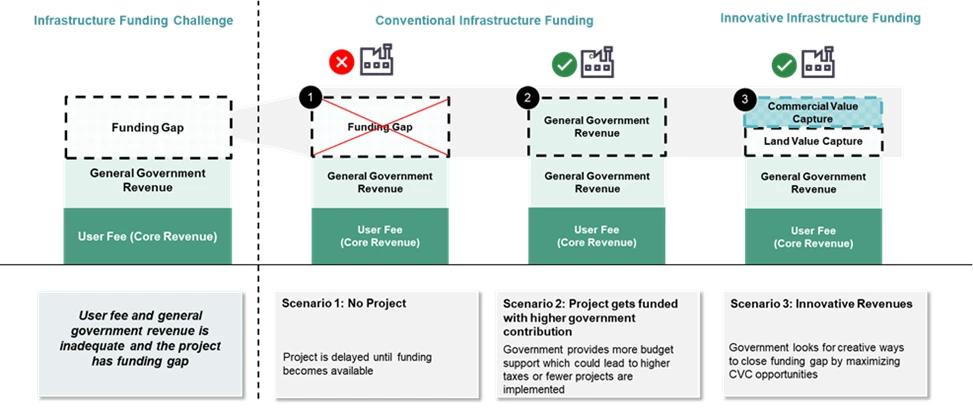

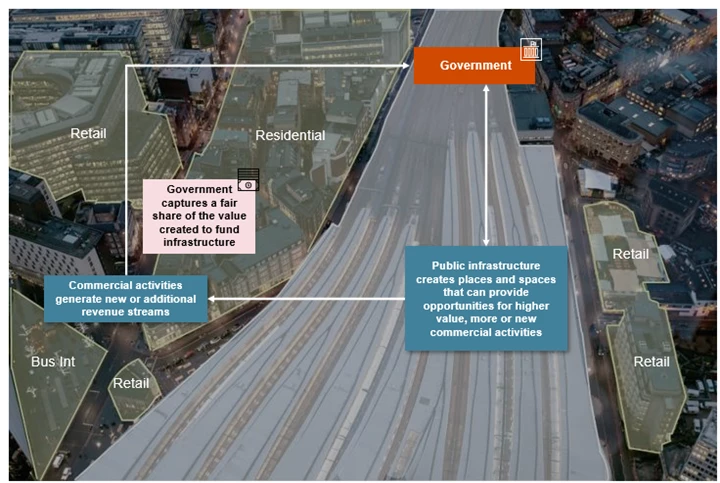

Take a step into a metro station today and there’s no doubt you’ll find countless advertisement banners. It turns out these advertisements play an important role in getting needed infrastructure funding for mass transit projects. We call these funding mechanisms Innovative Revenues for Infrastructure (IRI). Funding infrastructure is a challenge for many countries because of high upfront costs and uncertain demand, as experienced during the COVID-19 pandemic. Governments in developed countries may choose to subsidize infrastructure—but this option is limited for cash-strapped developing countries. Moreover, a warming climate is leading to a higher rate of flooding and wildfires, increasing costs due to repairs and investments in climate-resilient assets. As it stands, PwC estimates the global infrastructure funding gap to be a whopping $3.9 trillion per year. IRI as a novel funding mechanism IRI builds on conventional infrastructure funding through land value capture (LVC) and commercial value capture (CVC), novel mechanisms that can raise critical funds. They are more resilient in practice as they depend less on government budgets and more on demand for services, while opening another source of revenue. This is how it works: CVC is not limited to mass transit, it can also be applied to a variety of infrastructure from tourism and energy to telecommunications. For example, in wastewater treatment, CVC opportunities may include selling biogas for electricity, recovered phosphorous and nitrogen for fertilizers, or biosolids for biochar production or as compost for agriculture. In urban transit development projects, CVC can be used to enhance infrastructure funding including locating retail and residential areas at or near the transit hub. For example, in India, residential and commercial properties have been developed around the Hyderabad outer ring road, enhancing its value by providing more opportunities for CVC. Here’s an illustration of how CVC works in an urban transit development project: If you happen to visit Tengeh Reservoir in Singapore, you may also find that the reservoir is used for a floating solar farm. It was leased out by the Singaporean government in 2021 for a 60 MW floating solar farm that supplies green energy to water treatment plants. The project optimizes urban space in Singapore (a rare and expensive commodity) on an otherwise unused water body to generate commercially viable revenues as well as delivering sustainable development. The benefits of implementing CVC Other benefits of CVC in infrastructure projects may include: Further resources on CVC To better guide countries and interested stakeholders in assessing opportunities for CVC, the World Bank has developed a set of guidelines with assistance from PwC that aim to provide a framework to implement CVC opportunities. They encourage governments and project owners to be creative and develop solutions suitable to each country and project context. Intended to be aspirational and operational rather than detailed and exhaustive, the guidelines are relevant to those looking for alternative ways to increase public infrastructure funding or build a better business case for an infrastructure project. The guidelines and further resources can be found here: Notes about the authors Jennifer Tay, Partner, Asia Pacific Infrastructure Leader, PwC Singapore Jennifer is PwC’s Asia Pacific Infrastructure Leader and has more than 20 years of experience in advising both public and private sector stakeholders—particularly in large-scale financial transactions and strategic advisory, supporting both public and private sectors across Asia. She has diverse experience across energy transition, project finance, deal structuring, strategy development, and mobilizing private capital. Her sector expertise includes Power & Energy (electricity generation/transmission/distribution and gas pipelines), Transport (urban rails, toll roads and bridges, and ports/terminals), Water, and Telecommunications/Fiber Network. Jennifer helped the World Bank develop the Commercial Value Capture (CVC) guidelines. Pajnapa Peamsilpakulchorn, Director, Capital Projects & Infrastructure, PwC Thailand Pajnapa has over 20 years of experience in infrastructure policy, legislation, economics, and project finance in East Asia. Her expertise includes advising governments and the private sector on infrastructure policy frameworks, strategic investment projects, and increasing private sector participation in infrastructure. Pajnapa supported the World Bank in developing guidelines on Commercial Value Capture as a novel infrastructure funding mechanism.

You can find the section on Innovative Revenues for Infrastructure (IRI) online at the Public-Private Partnership Resource Center.

Updated:

Related Content

Innovative Revenues for Infrastructure (IRI)

Page Specific DisclaimerThe Guidelines on Innovative Revenues for Infrastructure (IRI), prepared with the assistance of PWC, is intended to be a living document and will be reviewed at regular intervals. They have not been developed with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

KeywordsFeatured Section LinksTable of contents TitleTable of ContentsTable of contents link/Innovative_Revenues_Infrastructure/Table_of_ContentsBanner Notice

Watch this space. The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals.

Visit the Content Outline to find out more, or let us know what you think by taking a Quick Survey.

Overview and Structure of IRI Guidelines

Page Specific DisclaimerThe Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

KeywordsTable of contents TitleTable of ContentsTable of contents link/Innovative_Revenues_Infrastructure/Table_of_ContentsBanner Notice

Watch this space. The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals.

Visit the Content Outline to find out more, or let us know what you think by taking a Quick Survey.

Introduction to Commercial Value Capture (CVC)

Page Specific DisclaimerThe Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

KeywordsTable of contents TitleTable of ContentsTable of contents link/Innovative_Revenues_Infrastructure/Table_of_ContentsBanner Notice

Watch this space. The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals.

Visit the Content Outline to find out more, or let us know what you think by taking a Quick Survey.

Applying CVC in Infrastructure Projects

Page Specific DisclaimerThe Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

KeywordsTable of contents TitleTable of ContentsTable of contents link/Innovative_Revenues_Infrastructure/Table_of_ContentsBanner NoticeWatch this space. The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals.

Visit the Content Outline to find out more, or let us know what you think by taking a Quick Survey.

A roadmap for programmatic roll-out of CVC

Page Specific DisclaimerThe Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

KeywordsTable of contents TitleTable of ContentsTable of contents link/Innovative_Revenues_Infrastructure/Table_of_ContentsAnnex for IRI Guide

Page Specific DisclaimerThe Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

KeywordsTable of contents TitleTable of ContentsTable of contents link/Innovative_Revenues_Infrastructure/Table_of_ContentsBanner Notice

Watch this space. The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals.

Visit the Content Outline to find out more, or let us know what you think by taking a Quick Survey.