Legal and institutional frameworks for Public Private Partnerships in Africa: a new tool developed by the ALSF to compare them

Photo Credit: Image c/o ALSF

Authored by: Maude Vallée and Andrea Stucchi

To find out more, visit the PPP Country Profiles at the African Legal Support Facility or PPP Legal Framework Snapshots at the Public-Private Partnership Resource Center

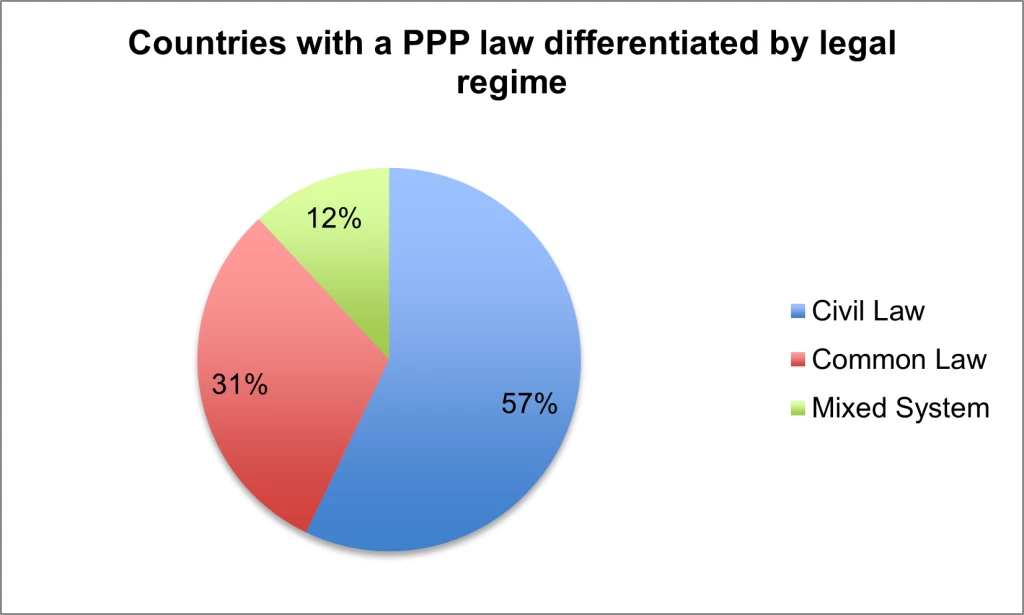

There is an unprecedented interest among African countries in attracting private investment in infrastructure and services to meet the growing national demand. However, while public procurement regulation is well established globally, the development of modern and secure legal and institutional PPP frameworks to facilitate private investments in infrastructure is progressing gradually throughout the continent. The responsibility of establishing legal and institutional PPP frameworks also lies with governments that must be capable of identifying and selecting suitable projects, conducting transparent tenders, structuring robust contracts, and implementing checks to ensure the proper execution of PPP projects. Against this backdrop, the African Legal Support Facility (ALSF) has developed country profiles to assess the progress of developing PPP legal frameworks in individual African nations. Furthermore, the ALSF has also collected data and carried out a comparative analysis of existing legal and institutional PPP frameworks in Africa, resulting in the recently published ALSF Survey, Public-Private Partnerships, Legal & Institutional Frameworks in Africa – a comparative analysis. The survey is primarily addressed to African governments that have already included or are considering including PPPs as a method for delivering public assets and services. National authorities and legislative bodies may also refer to this survey when developing PPP legal frameworks or assessing the effectiveness of existing ones. Additionally, international financial institutions and private sector investors who wish to gain a better understanding of how legal PPP frameworks operate across various African jurisdictions can also find value in the survey. Key findings of the survey include: • Out of the 54 countries in Africa, 42 have enacted PPP legislation. • Out of these 42 countries, 24 follow the civil law tradition, 13 have a common law legal system, and five have a bi-jural system. • Western and Central Africa have the highest percentage of economies that have enacted specific PPP laws, with all countries in the region having laws in place, except for Equatorial Guinea and The Gambia. • Conversely, countries in Eastern and Southern Africa have enacted the least-specific PPP laws. Among the 12 countries that make up the Southern Africa region, four remain without a PPP law: Botswana, Eswatini, Lesotho, and South Africa. • Other countries in Africa that have not enacted specific PPP laws include Comoros, Eritrea, Seychelles, and South Sudan in East Africa; and Algeria and Libya in North Africa. • Annual trends show that the highest rate of enacted laws was between 2015–2017 with 16 laws passed over the three-year span. The first African country to enact a specific PPP law was Mauritius in 2004, while the most recent is the Republic of Congo in 2022. • 41 of the jurisdictions surveyed have one or more dedicated PPP Unit. Composed of government teams focusing on PPPs, some units are independent institutions akin to other government departments, while others are either attached to Ministries of Finance, other technical ministries, or housed within the office of the prime minister or president. Finally, it is widely known that just as the signing of a PPP contract is not an end, but rather the beginning of a new endeavour, the adoption of a PPP framework does not, at least at this point, directly translate to increased deal flow. While three out of four countries in Africa have implemented PPP legislation, the number of financially closed PPP projects on the continent remains limited. Additionally, the PPP market in Africa is heavily concentrated in just a few countries, notably Egypt, Ghana, Morocco, Nigeria, and South Africa, which together represent more than half of all PPPs on the continent by value. This highlights the critical importance of African governments taking decisive actions to enhance the credibility and significance of their PPP frameworks. The ALSF's PPP Frameworks Survey emerges as a tool for ensuring that adopted PPP laws effectively promote a pipeline of bankable projects likely to attract investors. It offers a comprehensive assessment of existing PPP frameworks and serves as a platform to encourage both reflection and the development of legislative solutions that contribute to addressing complex challenges facing states, including climate change and energy transition. The survey aims to contribute to the development of innovative PPP frameworks, paving the way for socially responsible and successful projects. Notes about the authors Andrea Stucchi is a solicitor licensed to practice law in England and Wales. Andrea offers legal services in support of PPP infrastructure financing including project preparation and transactions, project structuring, preparation of bidding documents, PPP agreements and legal due diligence in the context of feasibility studies. Andrea specializes in enhancing the legal and institutional frameworks of countries to support infrastructure investments, including establishing PPP Units at Ministerial level and working on legislation which is conducive to private sector infrastructure investments. He has worked on legal and institutional PPP framework projects for The World Bank, the African Legal Support Facility, USAID, and the US Government. Maude Vallée is Division Manager & Head of Operations at the African Legal Support Facility (ALSF), an international organization hosted by the African Development Bank, which comprised 53 member countries. Maude Vallée joined the ALSF in April 2012. She leads a team of 25 lawyers, which provide legal and transaction advisory support to African countries. She oversees the implementation of more than 120 projects and capacity building programs in the areas of natural resources and extractive industries, infrastructure, and Public-Private Partnerships (PPP), and sovereign finance, across over 45 countries (USD 100 billion worth of transactions). She regularly advises senior government officials on negotiation strategy, project structuring, and related legal issues. She also assists with the development of strategies and management of partnerships with key institutions and organizations. Prior to joining the ALSF, she served as Legal Counsel at Agence française de développement (AFD) where she worked on the structuring of projects financed by AFD in Africa, Middle East, and Asia. She has also worked at Frilet Law Firm in Paris, a boutique law firm specializing in large-scale infrastructures, PPP, and mining projects. During this time, she was Chief representative of the French Institute of International Legal Experts (IFEJI). Maude Vallée is a business lawyer with over 20 years of experience. She is a member of the Quebec and Paris Bars. Maude Vallée holds a Bachelor’s degree in law (LL.B) and a Master’s Degree (LL.M.) in Business Law from University of Montreal, Quebec.

Disclaimer: The content of this blog does not necessarily reflect the views of the World Bank Group, its Board of Executive Directors, staff, or the governments it represents. The World Bank Group does not guarantee the accuracy of the data, findings, or analysis in this post.

You can find the PPP Legal Framework Snapshots online at the Public-Private Partnership Resource Center.

Updated:

Related Content

PPP Legal Framework Snapshots (A-C)

Page Specific DisclaimerContinue to view PPP Legal Framework Snapshots (D to R) and PPP Legal Framework Snapshots (S to Z).

Country Profile: Sub-Saharan Africa (SSA)

Type of ResourcePublic-Private Partnerships Laws / Concession Laws

Type of ResourceCountry Profiles

Page Specific DisclaimerThis is a new section of the Public-Private Partnership Resource Center website and is currently in draft form. Your feedback is welcome: If you would like to comment on the content of this section of the website or if you have suggestions for links or materials that could be included please contact us at ppp@worldbank.org.

KeywordsPPP Units Around the World

Type of ResourceLegal and Regulatory Issues Concerning PPPs

Additional Resources

Legal & Institutional Frameworks in Africa: A comparative analysis

About PPP Resource Center

Type of ResourceAbout Public-Private Partnerships

Type of Resource