CVC for Urban Transit

Photo Credit: Image by Freepik

On this page: A look at a hypothetical urban transit project in a developing country to demonstrate practical challenges and concrete opportunities of CVC. Read more below, visit the Guidelines on Innovative Revenues for Infrastructure section or check the Content Outline.

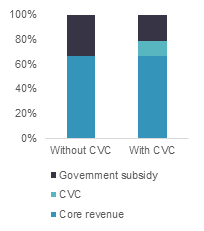

Large cities in developing countries typically lack effective public transport service with high dependency on cars. As a result, traffic congestion and long travel hours is common affecting cities’ livability and leading to productivity loss. In 2022, 56% of the world’s population lives in urban areas.1 It is predicted that 68% of all people would live in cities by 2050.2 Urban rail transit could help improve connectivity, reduce traffic congestion, improve air quality, and enhance economic development in the urban areas. Central and local government plan to increase investment in urban rail transit but they face several challenges including large investment, limited budget, delay in design and construction, and cost overrun. Governments are considering various solutions to implement urban transit projects such as mobilizing private investment, increasing non-fare revenue and transit-oriented development. This Worked Example looks at a hypothetical case in urban transit project in a developing country, to be developed as a PPP. Project scope: The project is a secondary mass transit system to support passengers in the eastern part of the city. The route will act as the feeder line to connect passengers with the main urban transit route and other secondary routes to alleviate traffic congestion in the urban areas. The project is owned by a local government. Given large investment needs and the limited budget of the local government, the project is proposed to be developed as PPP. Identifying CVC opportunities in urban transit: Core services: The project will provide urban transit service and improved connectivity to the public. Commercial potential and demand: The project is located in an area of the capital city with growing economic activities and rapid expansion of residential and commercial areas. However, with several commercial centres along the route, commercial activities in the project will face strong competition. Beneficiary and stakeholder needs mapping Users Commuters who use the transit system Improved connectivity, shorter travel time N/A (core revenue) Fare revenue Commuters who use the transit system Enhanced convenience Retail, banking, leisure, entertainment, food and beverages, advertising, office space, rooftop solar, co-located utilities (fibre cables, power, etc) Rental fee Commuters who use the transit system Seamless multi-modal connectivity Park and ride Carpark fee Beneficiaries Residents living around the stations Access to facilities and amenities Retail, banking, parking, transportation fee, leisure, entertainment, food and beverages Rental fee Stakeholders Nearby commercial buildings (shopping malls, office buildings) Seamless connection with the stations to increase traffic The project will provide seamless physical connection between commercial building and stations Connection fee Firms that want to reach target customers to advertise their products Access to high-footfall traffic areas The project will provide advertisement space on the interior and exterior of trains, station, depot, railway pillars. Advertisement revenue Assessing the policy, legal, institutional readiness in the country Policy and planning Clear policy direction from Ministry of Finance (MOF) for line agencies to maximize commercial opportunities in project and strong public support for CVC in urban transit projects. Project owner has limited implementation support to address institutional and legal barrier involving cross-agency coordination. Medium opportunity: Policy, legal and institutional frameworks are adequate and allow for CVC to be considered in the project. Some changes can be made for smoother implementation of the project. Next Step: Identify and analyse CVC in feasibility study. Requested planning agencies to provide implementation support and increase technical capacity of project owner. Legal Framework Clear legal framework to implement PPP. Legal barrier related to the use of public land belonging to different authorities for potential CVC opportunity in the project. Institutional readiness Project owner has some experience with PPP but requires third-party support on implementation. Project owner has contractual authority to implement CVC through PPP. Technical design: The CVC opportunities are integrated in the project design such as station area, train body and depot. However, additional CVC opportunities could be considered if nearby areas belonging to different government agencies are allowed to be used for the project. Commercial feasibility: Based on a hypothetical assessment, the user fee will come from fare revenue paid by commuters. As shown in the table below, user fees are 66% of total revenue required to exceed the hurdle rate in the hypothetical financial assessment. CVC opportunities have been further analysed and CVC in the form of commercial use of project space and infrastructure sharing will add 13% of the total revenue required. This has already considered additional capital and operating expenses required to perform CVC activities. The split between fare and non-fare revenue is in line with what is observed in urban transit projects where the share of non-fare revenue is around 10-20% of fare revenue depending on each project’s characteristics. The remaining 21% of total revenue required will be paid by the local government as subsidy. A. Core Revenue User Fee Fare revenue 66% B. CVC Commercial use of project space Rental fee of commercial space and Carpark fee 1% Advertisement Additional O&M cost in station, around train, pillar 11% Infrastructure sharing Connection fee Additional admin cost for stations with extended skywalk 1% C. Government subsidy Government subsidy Government subsidy N/A 21% Implementation: This project including CVC concept will be implemented through PPP mechanism. The private party will build and operate the core and non-core services with the local government providing construction subsidy to the project. Risks of the project: Demand risk from core-services and competition from nearby rail stations, such as shops, restaurant, shopping mall, could pose CVC market risk. Footnote 1: World Bank, Urban Development, October 2022 Footnote 2: United Nations, 68% of the world population projected to live in urban areas by 2050, says UN, May 2018 Footnote 3: The Worked Examples is hypothetical project business cases and include hypothetical financial assessments with key project information.

Worked Example 2: Urban Transit

Groups

Description

Need

CVC Opportunities

Revenue Streams

Areas

Assessment

Results

Revenue Category

Revenue Items

Expense Items

Net revenue as % of total revenue3

The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

Updated:

TABLE OF CONTENTS

I. Innovative Revenues for Infrastructure (IRI)

2. Introduction to Commercial Value Capture (CVC)

3. Applying CVC in Infrastructure Projects

• CVC for Wastewater Treatment Plant

3. Recommendations in Drafting ToRs with CVC

Related Content

Select WBG PPP Toolkits

Featured Section Links

Additional Resources

Climate-Smart PPPs

Type of ResourceFinance Structures for PPP

Type of ResourceFinancing and Risk Mitigation

Type of Resource