Changi Airport, Singapore

Photo Credit: Image by Ashi Evaristo

On this page: Governments can leverage unproductive spaces in airports as high-traffic public areas for targeted leasing while keeping journeys comfortable for passengers. Find case studies below, or visit the Guidelines on Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report.

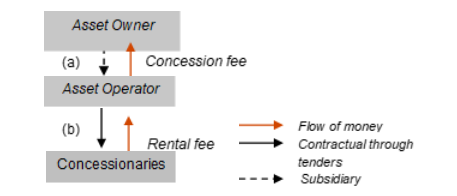

Project Summary: Background Traditionally, revenue generated from the aviation industry has been associated with aeronautical-related transactions (e.g. landing fees, passenger fees, etc). However, in recent years, airports have undergone retail development to be repurposed into multifaceted hubs that provide aviation services while offering retail functions. For instance, Airports Council International (ACI) reports that non-aviation revenue make up 62.5% of global revenue from airports.1 Governments can leverage unproductive spaces in airports as high-traffic public areas for targeted leasing while keeping journeys comfortable for passengers. Airports with a plethora of facilities provide a comfortable and luxurious experience to travellers who are thus more inclined to purchase from duty-free shops or dine at F&B restaurants. Consequently, concessionaries benefit from the increased revenue from retail sales while the government receives income from leases and taxes. Project Structure The Changi Airport is a crucial component of the government's strategy to sustain Singapore as a regional commercial hub. Changi Airport is one of the world's busiest airports, having served 68.3 million passengers in 2019. It comprises four terminals, with a fifth mega terminal currently under construction. More than 100 airlines operate from Changi Airport to destinations in Asia, Africa, Europe, the Middle East, Oceania, and the Americas. Changi Airport Group (CAG) has upgraded existing infrastructure in the Changi Airport Terminals to accommodate non-travel services such as retail and F&B to expand its consumer base to non-travellers. The construction of Jewel Changi Airport (Jewel) offered a whole new multi-dimensional experience at Jewel, with its array of shops, restaurants, best-in class attractions and lush verdant landscaping. CAG also enhanced the Changi Experience with more airport facilities within Jewel, such as early check-in and GST refund counters, a new Changi Lounge for passengers, as well as an expanded and refreshed Terminal 1.2 Attractions in Jewel3 What sets it apart? Key players for delivering improved services Changi Airport is operated by Changi Airport Group (CAG) which is directly owned by Singapore government. CAG, as asset owner, benefits from leasing real estate to private companies, which is a core component of CAG's revenues. CAG's in-house Commercial team is responsible for the retail planning and development of Jewel Changi and the four-passenger terminals. Moreover, the Commercial team is in-charge of managing retail concessions to maximize CAG's revenue streams from non-aviation transactions. Mechanism for Maximizing Funding for Infrastructure CAG generates over 40% of its total revenues from airport concessions and rental income. CAG has planned, built, and manages over 70,000 sqm of space for shopping and dining outlets across the four passenger terminals. Concessionaries pay fixed rental fee to lease concession spaces. The rental price is dependent on the size and location of the concession space, and the tenancy period is typically three years with the possibility of renewal. In the final two months of FY 2019/20 and consequently, concession revenue dived by 57.5% and Changi Airport registered a 4.1% y-o-y decline in airport concession and rental income to SGD 1.3 billion. The opening of Jewel in April 2019 created a new revenue stream for the Group and was the key driver for the increase in CAG's revenue. While sales at Jewel was also affected by Covid-19 in the last two months of Financial Year (FY) 2019/20, Jewel's higher than-expected number of visitors in its first year of operations helped to supplement the Group's topline with SGD129 million in revenue in FY 2019/20. CAG closed the financial year with total revenue of S$3.1 billion, 2.6% above the previous year, largely due to first-time contributions from Jewel.5 In 2021, from the total gross revenue of 696,748 million SGD, airport concessions and rental income contributed 43.8%. While airport service fees (i.e., landing, parking, aerobridge, passenger service, and security fees) contributed 24.8% and revenue from other airport services (i.e., cargo services, franchise fees, utility charges, consultancy fees, carpark revenue, and other sundry income) and interest income made up the remaining 31.4%.6 The Singapore government benefits from its investment in CAG through taxes and dividends. In FY 2019/2020, CAG recommended no dividend payout. Shareholder's equity increased marginally by less than 1% to reach S$7.9 billion.7 Typical Business Model Lessons Learned Managing the risks Ease of implementation Footnote 1: ACI’s Airport Economics Report is a benchmark for measuring the industry performance in post-COVID recovery Footnote 2: Annual Report of Changi Airport 2019/20 Footnote 3: Jewel of Changi Airport Footnote 4: How Covid-19 brought iShopChangi out of the airport

(a)

Concession agreement granting right to use and operate the assets to the Asset Operator

(b)

Lease agreement

Concessionaries

Rents the space and pay fixed rental fee

The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the PPPLRC at ppp@worldbank.org.

Updated: February 26, 2024

TABLE OF CONTENTS

I. Innovative Revenues for Infrastructure (IRI)

2. Introduction to Commercial Value Capture (CVC)

3. Applying CVC in Infrastructure Projects

2. Case Studies in CVC from International Experiences

• Advertising and Marketing in High-Footfall Public Areas

• Naming Rights in Stations and City Icons

• Commercial Uses of Virtual Spaces

• Commercial Uses of Physical Places and Virtual Spaces Created on the Back of Public Infrastructure

• Control of Real Estate Development Rights to Enhance Value

• Leveraging Climate Opportunities

• Usage of Facilities During Off-Hours or Off-Seasons

• Repurposing or Adaptive Reusing of Old Assets