St. James Power Station, Singapore

Photo Credit: Imageby fanjianhua on Freepik

On this page: Lessons learned on repurposing or adaptive reusing of old assets as they give second chances for revenues to the government, otherwise idle. Find case studies below, or visit the Guidelines on Innovative Revenues for Infrastructure section.

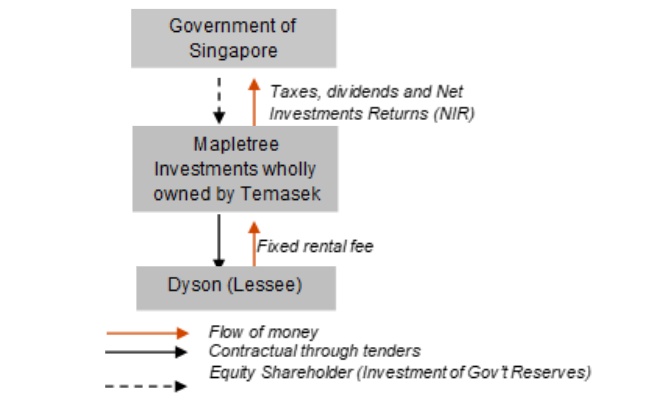

Project Summary: Background Repurposing or adaptive reusing of old assets is becoming popular as they give second chances for revenues to the government, otherwise idle. For example, government of Singapore leased St. James Power Station into a productive asset by awarding development rights through which upfront payments and/or lease revenues can be generated to restore and preserve the historical assets. Project Structure James Power Station, which was previously a power station and gazetted in 2009 as a national monument. The building, a historical and unused old asset, was turned into a technology-intensive Dyson headquarters giving the asset a second life. The restoration work of 110,000 sq. ft office space at St James Power Station included repainting and replacing building materials to preserve the original architecture of the building.1 In the newest phase of its S$4.9bn global investment programme, Dyson is investing S$1.5b into its future in Singapore over the next four years. This restoration of St James Power Station into Dyson's headquarter is one of the first phases included in the investment. Dyson's ultimate aim is to hire more than 250 engineers and scientists, with roles spanning robotics, machine learning, AI, high-speed electric digital motors, sensing and vision systems, connectivity, software, power electronics, and energy storage. The investment will also support ongoing university research programmes to drive technology development, building on its existing global programmes. As Dyson's global headquarters, Singapore is a hub for Dyson's research and engineering teams, as well as commercial, advanced manufacturing, and supply chain operations. Over 1,400 Dyson people work in Singapore, 560 engineers and scientists. What sets it apart? Brand new integration strategy of a company to the new locality To successfully integrate the Singaporean market, Dyson is environmentally conscious and understands the historical structure of St James Power Station; this new headquarters is an inspiration for sustainable workplaces and preserving local heritage. This is a sensible move of a global company to safeguard the rooted history of where the business takes place while transforming the old asset into a productive headquarter. Key players for delivering improved services Government of Singapore owns the asset St. James Power Station, while the real estate development rights were transferred to Mapletree Investment as the landlord. Mapletree Investment, wholly owned by investment holding Temasek, currently manages four Singapore-listed Real Estate Investment Trust (REITS) and six private real estate funds. Mapletree owned and managed S$55.7 billion of properties as of 2019.2 Mechanism/s for Maximizing Funding for Infrastructure Mapletree Investments leases the old asset to Dyson for use as the Dyson global headquarters. The Singapore government benefits from Mapletree Investment revenues through taxes, dividends, and Net Investment Returns (NIR) paid by Temasek. What is the rationale for setting up a sovereign wealth fund? From 2000 to 2015, Temasek was under a government spending framework, where up to 50% of dividends from Temasek could be used by the Singapore Government for budget spending. The remaining dividends were locked up as past reserves of the Singapore Government. Since Temasek's inclusion in the NIR Framework in 2019, the Singapore Government may spend up to 50% of Temasek's expected long-term returns, net of inflation. NIR Contribution is the single largest contributor to Singapore Government revenues, at 21% of the 2022 Government Budget.3 Typical Business Model Lesson Learned Managing the risks Replicability Footnote 1: Dyson is hiring: Here’s how its new 110,000 sqft global HQ at St James Power Station looks like Footnote 2: Mapletree eyes S$10b of deals a year as more funds planned Footnote 3: Ins & Outs of Temasek

Ministry

Asset Owner

Investment Company

Responsible for the core services

Lessee

Rents the space and pays fixed rental fee

The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

Updated:

TABLE OF CONTENTS

I. Innovative Revenues for Infrastructure (IRI)

2. Introduction to Commercial Value Capture (CVC)

3. Applying CVC in Infrastructure Projects

2. Case Studies in CVC from International Experiences

3.100 Case Studies: Municipal PPP Framework

Related Content

Select WBG PPP Toolkits

Featured Section Links

Additional Resources

Climate-Smart PPPs

Type of ResourceFinance Structures for PPP

Type of ResourceFinancing and Risk Mitigation

Type of Resource