Core Principles for Applying CVC in Projects

Photo Credit: Image by Pixabay

On this page: Find core principles to consider when applying Commercial Value Capture in projects. Find more below or visit the Guidelines on Innovative Revenues for Infrastructure section or check the Content Outline.

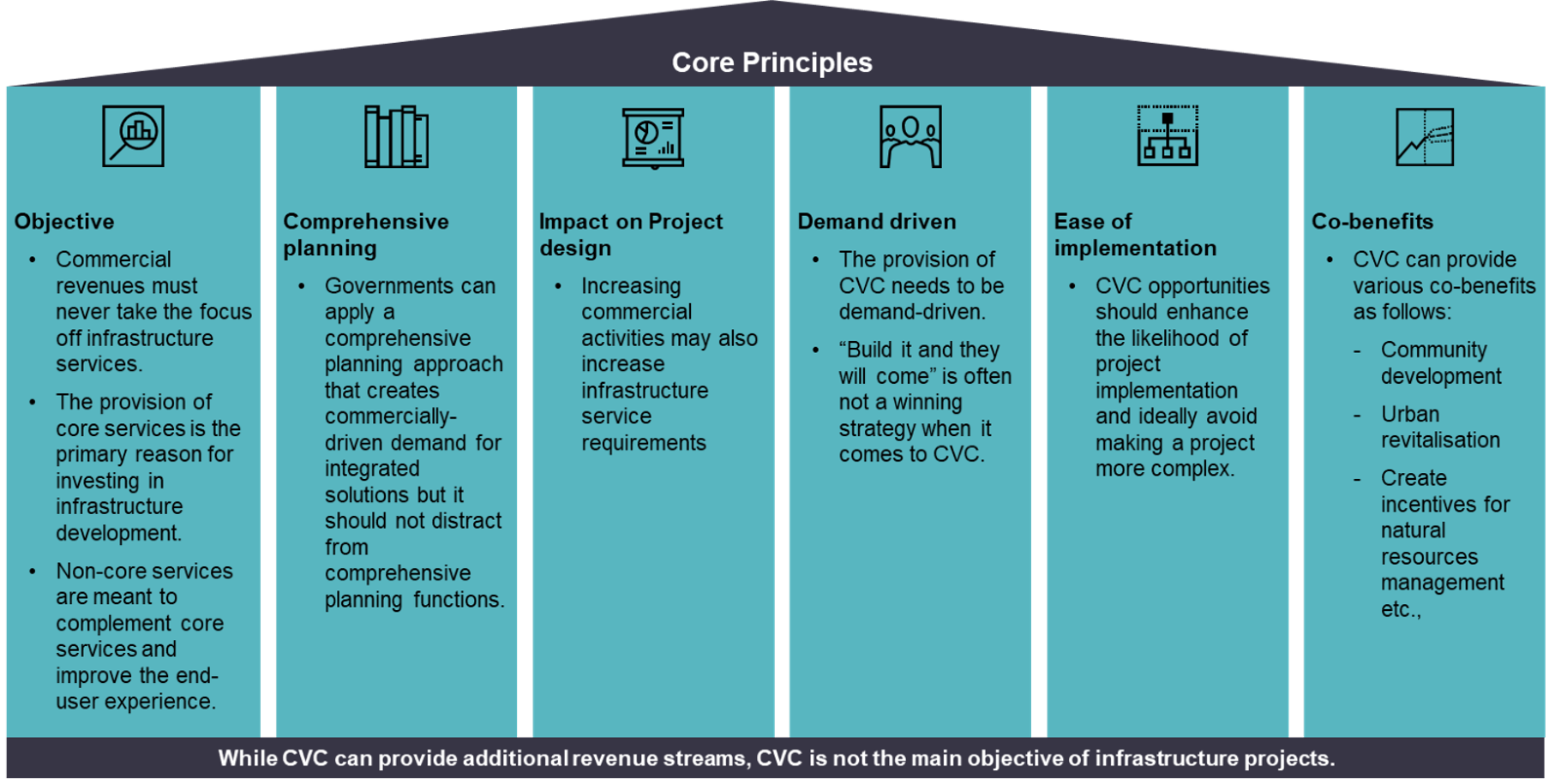

CVC is tricky, it can provide additional revenue streams, create new opportunities, economic development, jobs, but Project Owners must not lose perspective, CVC is not the main objective of an infrastructure project. To maintain balance, to improve the likelihood of success of the project and the CVC, Government should focus on the following core principles when incorporating CVC into a project: Figure 12: Core principles for application of CVC in projects Footnote 1: Module 17 – Capturing Commercial Value of the World Bank Municipal PPP Framework. Footnote 2: REC is a type of Energy Attribute Certificate (EAC) that represents the environmental attributes of the generation of a one-megawatt hour (MWh) of energy produced by renewable sources, according to the International REC Standard.

The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

Updated:

TABLE OF CONTENTS

I. Innovative Revenues for Infrastructure (IRI)

2. Introduction to Commercial Value Capture (CVC)

• Maximizing Revenue for Funding Infrastructure

• CVC Opportunities in Infrastructure

• Core Principles in Applying CVC in Projects

3. Applying CVC in Infrastructure Projects

3. Recommendations in Drafting ToRs with CVC

Related Content

Additional Resources

Climate-Smart PPPs

Type of ResourceFinance Structures for PPP

Type of ResourceFinancing and Risk Mitigation

Type of Resource