EV charging infrastructure, India

Photo Credit: Image by frimufilms on Freepik

On this page: Renewable energy projects can provide governments with an additional source of revenue from leasing land or water bodies to developers. Find case studies below, or visit the Guidelines on Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report.

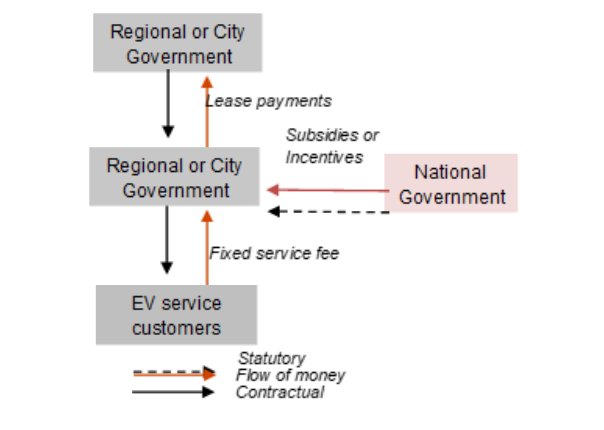

Project Summary: Background The cost of electric motorbikes and mopeds has now reached parity with the traditional internal combustion motorbikes and mopeds. Moreover, electric charging costs are relatively cheaper than gasoline. Consequently, there has been a sharp increase in the uptake of electric vehicles (EV), especially motorbikes and mopeds in Asia, not only in developed countries such as China and Japan but also in emerging markets such as India, Indonesia, and Thailand. Successful EV adoption requires a change in consumer behavior enabled by public policy to create an EV ecosystem that makes EV use affordable and reliable. The shift to EV use is imperative for countries with net zero commitments, given that transport is a leading source of greenhouse gas (GHG) emissions. Although a strong push toward EV would also create higher energy demand that could easily offset gains if energy sources are not clean. The charging infrastructure is the backbone of electric mobility. India perceives key barriers for EVs including high capital investment, lack of affordable land in dense urban areas with public charging seen as a standalone land use requiring dedicated space, limited power distribution capacity, and long charging times.1 Project Structure The Government of India supports the EV industry by encouraging electric and hybrid vehicle purchases through its Faster Adoption and Manufacturing of Electric Vehicles (FAME). FAME II is a 3-year program supporting electric and hybrid buses, electric 3W, 2W and 4W passenger vehicles.2 Under FAME I and II, about 371,000 EVs were supported with total incentive of around Rs. 634 Crore (~USD 79.6 million) as of July 2021, and 427 charging stations have been installed. Under FAME II, Rs. 1000 Crores (~USD 125.6 million) is allocated for the development of charging infrastructure in the country.3 The Government of India has set a target to electrify 70% of all commercial vehicles, 30% of private cars, 40% of buses, and 80% of two-wheeler and three-wheeler sales by 2030. This target entails simultaneous penetration of charging stations across India.4 In 2022, Tata Power has installed 150 EV charging points across residential societies, malls, commercial complexes and petrol pumps in Mumbai. The EV charging points are powered by renewable energy sources like wind, solar and hydropower.5 Key players for delivering improved services Ministry of Heavy Industries & National Real Estate Development Council assist the development of EV charging to achieve renewable targets. Tata Power, a subsidiary of Tata Group, has consolidated its position at the top of the sector, accounting for over 50% of PCPs in the country. Even in the home charging and fleet charging verticals, Tata Power’s market share is at ~40%.6 Mechanism/s for Maximizing Funding for Infrastructure The Memorandum of Understanding (MoU) between Tata Power and National Real Estate Development Council for 5,000 EV charging points across Maharashtra was signed to boost EV adoption in the state. Tata Power will provide comprehensive EV charging solutions across properties of member developers of National Real Estate Development Council (NAREDCO).7 While in Gujarat state, Ahmedabad Municipal Corporation (AMC) will lease land at adjusted rates of INR 10 (USD 13 cents) per sqm with an allotment of ~50 sqm for each charging station. The AMC plans to establish 25 charging stations in the first phase. The 10-year contract will be awarded to the bidder offering the highest fee, subject to a mid-term review at the end of five years. The charging rates to be paid by users will soon be decided by the state government.8 Typical Business Model Lessons Learned Implementation Replicability Footnote 1: India has made the right move on charging infrastructure for electric vehicles Footnote 2: Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) Scheme - Phase I & II Footnote 3: Rs.756.66 Crore allocated and Rs.53.27 Crore Utilized till June 2021 under FAME Scheme Footnote 4: Tata sets up 150EV charging points with green fuel in Mumbai Footnote 6: Low margins, high stakes: The Tata Power foundation to Tata Group’s electric empire Footnote 7: Tata Power signs MoU with NAREDCO for 5,000 EV charging points Footnote 8: https://www.inframationnews.com/news/11917236/indian-municipality-plans-ev-charging-stations-ppp.thtml

Regional or City government

National government

Private sector

The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the PPPLRC at ppp@worldbank.org.

Updated: February 26, 2024

TABLE OF CONTENTS

I. Innovative Revenues for Infrastructure (IRI)

2. Introduction to Commercial Value Capture (CVC)

3. Applying CVC in Infrastructure Projects

2. Case Studies in CVC from International Experiences

• Advertising and Marketing in High-Footfall Public Areas

• Naming Rights in Stations and City Icons

• Commercial Uses of Virtual Spaces

• Commercial Uses of Physical Places and Virtual Spaces Created on the Back of Public Infrastructure

• Control of Real Estate Development Rights to Enhance Value

• Leveraging Climate Opportunities

• Usage of Facilities During Off-Hours or Off-Seasons

• Repurposing or Adaptive Reusing of Old Assets