Institutional Responsibilities: Review and Approval

Photo Credit: Image by Pixabay

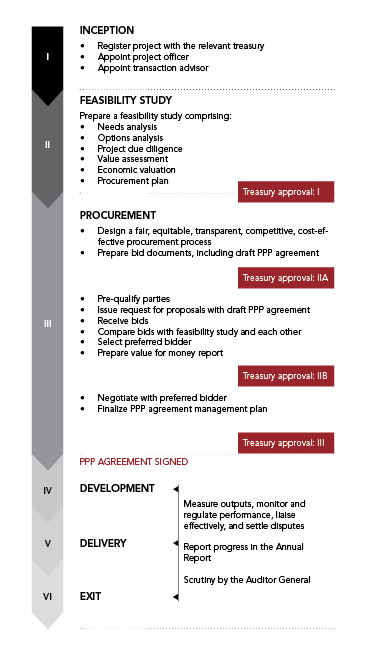

A PPP project is a specific type of public investment. Most governments have systems and standard procedures for reviewing and approving capital investment projects: to ensure all projects are effective at meeting strategic objectives; provide value for money; and in line with fiscal priorities. Because PPPs do not necessarily require capital investment by the government, they may not automatically be subject to these approval rules. Many governments therefore define similar review and approval requirements for PPPs. See Example PPP Approval Requirements for some examples. Often, several decision points are created, allowing weak projects to be stopped before they consume too many resources, or develop a momentum of their own. This is illustrated in Typical PPP Process. These iterative reviews are sometimes called gateway processes. Monteiro's article in IMF’s book on PPPs (Schwartz et al. 2008) describes a typical gateway process, and how this process works in Portugal. At a minimum, formal approval is typically needed to enter into a PPP transaction. Because the final cost of a project is not known until procurement is concluded, final approval may be needed before the contract is signed. The South African Gateway Process for PPPs describes this gateway process in South Africa (ZA 2004a, Module 1). Finance ministries typically have a leading role in this process, given their responsibilities for managing government resources, and (often) economic and fiscal policy. The IMF emphasizes the importance of the role of the finance ministry in its book on Public Investment and PPPs (Schwartz et al. 2008, 10). In France and many Francophone countries this role is split between the Ministries of Finance, Development and Planning. In a few other countries, another entity altogether has overall responsibility for overseeing the public investment program, and hence may play the same role for PPPs—such as the National Economic Development Agency (NEDA) in the Philippines. Many finance ministries have established special PPP units through which to carry out their filtering and monitoring functions, as described further below. Other oversight agencies can also have a role in reviewing and feeding into PPP project approvals, mirroring their roles in any major capital investment project. These can include: These additional reviews can be important checks on the quality and legality of the project appraisal and development process. However, they can also introduce delays at crucial points. Mechanisms for coordination can help. Capacity building may also be needed to ensure these institutions are able to fulfill their roles as they relate to PPPs. Ultimately approval may be by Cabinet and/or Parliament. Jurisdictions vary as to which entity can approve a PPP. A few countries require legislative approval of large projects. More often, approval may come from Cabinet or a Cabinet-level committee, the finance ministry, or a combination. As described in Irwin's paper on controlling spending commitments in PPPs (Irwin 2007, 113–114), approval power may depend on the size of the project, as is typically the case for other capital investments. Decision-making for public investment projects is typically articulated around the annual budget process. However, because PPPs often do not have immediate budget implications, specific coordination mechanisms are needed to ensure the projects are integrated into the Mid-Term Expenditure Framework (MTEF) and reviews and approvals proceed smoothly and do not hold up the project development process. In some cases, PPP units are assigned with a coordinating role, as described further in Dedicated PPP Units. Some governments also form interdepartmental committees to oversee each PPP transaction, to ensure the perspectives of oversight agencies are taken into consideration throughout the project development process rather than just at review points. PPP implementation rules (CO 2014, Section 3.2.3) Also set out in the National PPP Law (CO 2012c, Law 1508, Article 26) PPPs must be approved by: All national projects and projects over PHP200 million ($4.6 million) require approval from the Investment Coordination Committee (ICC) under the National Economic and Development Authority (NEDA) Board. The members of the NEDA Board are cabinet members responsible for the major infrastructure, economic and finance departments. PPP projects also require approval from both the NEDA Board and the President, upon recommendation by the ICC. The ICC's recommendation is in turn informed by a review by NEDA's technical staff, to check the project submission is complete, and adequately demonstrates the project complies with requirements for financial, economic, social, and environmental impacts.The South African Gateway Process for PPPs

Coordination

Example PPP Approval Requirements

COUNTRY

REFERENCE

APPROVAL REQUIREMENTS

State of Victoria, Australia

National PPP Guidelines-Partnership Victoria Requirements (VIC 2016, 5)

All high-value or high-risk projects—including PPPs—go through a gateway approval process, established by the Department of Treasury and Finance. A panel of experts that are not directly involved in the project carries out reviews at key stages in developing and implementing the project, called gates. For PPPs, there are five gates: strategic assessment, business case (before issuing the requests for expressions of interest), readiness for market (before issuing project briefs and contract), readiness for service (before the contract is executed), and benefits evaluation.

Chile

Concessions Law (CL 2010b, Law 20410, Articles 7, 20, and 28)

Final approval of a PPP—through signing the decree that formalizes the concession—rests with the President and the Ministry of Finance together. Contracts cannot be bid out unless the Ministry of Finance has approved the bidding documents. The Ministry of Finance must also approve any changes to economic aspects of the bidding documents, as well as certain changes during implementation.

Colombia

Philippines

The Philippines BOT Law (PH 2006, Rule 2, 16–19)

South Africa

Public Finance Management Act and Treasury Regulation 16 (ZA 2004a, 8–10)

PPP approvals are made by the Treasury, through its PPP Unit. Projects are submitted for approval at four points, after: (1) the feasibility study has been completed, (2) the bid documents have been prepared, (3) bids have been received and evaluated, and (4) negotiations have concluded and the PPP contract is in its final form.

Find in pdf at PPP Reference Guide - PPP Framework or visit the PPP Online Reference Guide section to find out more.

Updated: June 23, 2022

Related Content

INTRODUCTION

Page Specific DisclaimerVisit the PPP Online Reference Guide section to find out more.

PPP BASICS: WHAT AND WHY

Page Specific DisclaimerVisit the PPP Online Reference Guide section to find out more.

Featured Section LinksESTABLISHING THE PPP FRAMEWORK

Page Specific DisclaimerVisit the PPP Online Reference Guide section to find out more.

PPP Policy

PPP Legal Framework

PPP Processes and Institutional Responsibilities

Public Financial Management Frameworks for PPPs

Broader PPP Program Governance

Municipal and other subnational PPPs

Key References - PPP Framework

PPP CYCLE

Page Specific DisclaimerVisit the PPP Online Reference Guide section to find out more.