SP Digital, Singapore

Photo Credit: Image by rawpixel.com on Freepik

On this page: Case study of CVC and the commercial uses of digital platforms and virtual spaces. Find case study below, or visit the Guidelines on Innovative Revenues for Infrastructure section.

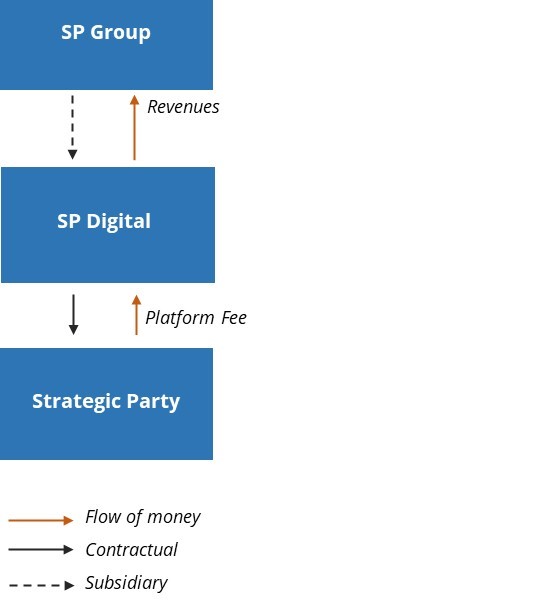

Project Summary: Background Launching services on a digital platform can help companies grow their core business, support expansion into new products and services and generate new revenues. These digital platforms can host customer-paid services (sale of new products or services), merchant-paid usage (e.g. registration or listing fee) and third-party-paid data monetization (e.g. advertisements).1 Project Structure Community-orientated value creation SP Group provides utility services to most of Singapore’s retail customers. From this platform, SP Digital, a subsidiary of SP Group, provides digital solutions driven by data, an Artificial Intelligence (AI) & Internet of Things (IoT) that supports customers in their journey towards energy efficiency, cost optimization and occupant well-being covering residential, commercial and industrial needs. SP Utilities App SP Digital has created an app for retail customers to manage their customer accounts, including payment management and having up-to-date information on utilities consumption that allows them to understand and optimise their utility consumption. The SP app provides a platform with near universal retail customer coverage that offers a channel for which other merchants/business partners pay SP Digital fees to be able to market their goods and services. When retail customers meet milestones for reducing carbon footprint they can redeem points for rewards provided by merchants/business partners on the platform.2 SP Digital, with its 'big data' resource on consumer behavior in Singapore, can monetize partnerships with merchants who use the SP Digital platform to reach retail customers by participating in SP Digital’s instant rewards program. SP App Dashboard Energy Tech Solutions Considering that buildings account for about 40% of energy-related carbon emissions, SP Digital offers business solutions leveraging digitalization and big data analyses to enable building owners and facility managers to improve building performance. SP Digital’s suite of Green Energy Tech (GET™) solutions integrates different building systems and diverse data sources to make utilities management experience seamless.3 SP Digital has partnered with Changi Airport to pilot smart meters that monitor energy use and flag sudden spikes which may be a sign of leaks. The smart meters have helped the airport cut operational costs significantly.4 Key players for delivering improved services SP Digital is a wholly owned subsidiary of Singapore Power Limited (SP Group) which is wholly owned by Temasek. Mechanisms for Maximizing Funding for Infrastructure From the digital services, SP Digital's revenue in 2020 is estimated at 4.4 million SGD.5 In addition, SP Digital receives platform fee revenues from strategic partners that will benefit from each transaction used via the App. Typical Business Model The Singapore government benefits from SP Group revenues through taxes, dividends, and Net Investment Returns (NIR) paid by Temasek. From 2000 to 2015, Temasek was under a government spending framework, where up to 50% of dividends from Temasek could be used by the Singapore Government for budget spending. The remaining dividends were locked up as past reserves of the Singapore Government. Since Temasek's inclusion in the NIR Framework in 2019, the Singapore Government may spend up to 50% of Temasek's expected long-term returns, net of inflation. NIR Contribution is the single largest contributor to Singapore Government revenues, at 21% of the 2022 Government Budget. Lessons Learned Replicability The Singapore energy market works on a full cost recovery basis. Thus, there is no revenue share back to government in this model. Instead, the value capture mechanism for Temasek and its subsidiaries is largely due to Singapore government's policy led by MOF for investing government reserves and balancing current and future use of dividends and investment returns. In many developing countries subsidies are provided to their energy sector. This value creation mechanism can provide alternative funding and can be captured as a revenue share that could lessen government subsidies or limit user tariffs. The SP app is also an example of bundling the utility retail functions, such as monitoring, invoicing and revenue collection. Bundled utility retail can increase revenue collection rates as consumers are inclined to pay for core utility services such as power, piped town gas and water, but are then also more inclined to pay for other services such as sanitation and waste management services and discretionary services such as telecoms. Footnote 1: How do companies create value from digital ecosystems? Footnote 2: SP app - Convenient utilities management with tips and insights Footnote 3: GET Green Energy Tech Footnote 4: How Singapore is powering its sustainable energy vision Footnote 5: SP Digital Company Overview

SP Group

A commercial entity responsible for energy management in Singapore

SP Digital

Strategic Partners

Partners with SP Digital to market their brands in exchange to assistance in improving digital services in SP Digital App

The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

Updated:

TABLE OF CONTENTS

I. Innovative Revenues for Infrastructure (IRI)

2. Introduction to Commercial Value Capture (CVC)

3. Applying CVC in Infrastructure Projects

2. Case Studies in CVC from International Experiences

3.100 Case Studies: Municipal PPP Framework

Related Content

Select WBG PPP Toolkits

Featured Section Links

Additional Resources

Climate-Smart PPPs

Type of ResourceFinance Structures for PPP

Type of ResourceFinancing and Risk Mitigation

Type of Resource