This is a new section of the website and is currently in draft form. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the PPPLRC at ppp@worldbank.org.

This is a new section of the website and is currently in draft form. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the PPPLRC at ppp@worldbank.org.

To find out more: Search the PPPLRC Library. Subscribe to the PPPLRC Newsletter. Contact us.

In Indonesia, the World Bank has established the Indonesia Infrastructure Finance Development (IIFD) multi-donor trust fund funded by the Government of Canada’s (GOC) Department for Foreign Affairs, Trade and Development (DFATD) in the amount of US$15 million, to be implemented during 2016-2020.

The Program Development Objective for IIFD Trust Fund is to assist Indonesia in closing its large public infrastructure gap by supporting the flow of private capital into infrastructure development and improving the institutional, legal, and regulatory framework to enhance the ability of private capital and public institutions to work together for infrastructure development.

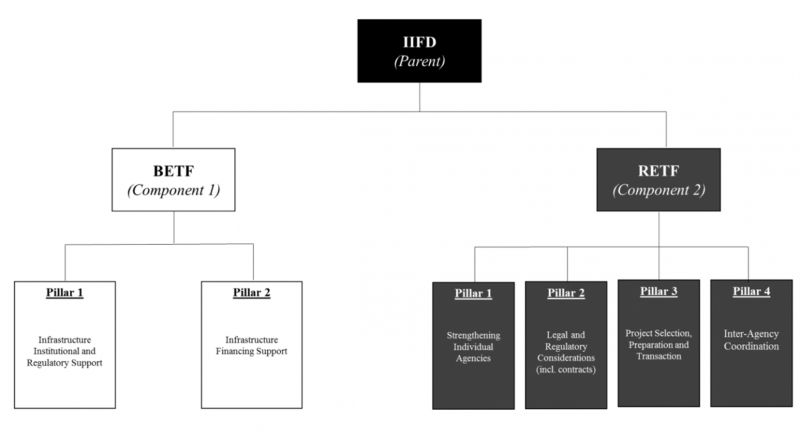

The IIFD Trust fund is aimed at addressing key bottlenecks constraining infrastructure financing in Indonesia, and providing consistent policy- and transaction-level advice to Government of Indonesia (GOI) on channeling private finances into infrastructure. These activities will be implemented though two distinct, but complementary vehicles – a Bank-Executed Trust Fund (BETF) and a Recipient Executed Trust Fund (RETF), with an approximate 40:60 split of trust fund monies.

Specific activities under each BETF and RETF Pillar are outlined below in Figure 1:

This is a new section of the website and is currently in draft form. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the PPPLRC at ppp@worldbank.org.