CVC for Wastewater Treatment Plant

Photo Credit: Image by fanjianhua on Freepik

On this page: A look at a hypothetical wastewater treatment facility in a developing country to demonstrate practical challenges and concrete opportunities of CVC. Read more below, visit the Guidelines on Innovative Revenues for Infrastructure section or check the Content Outline.

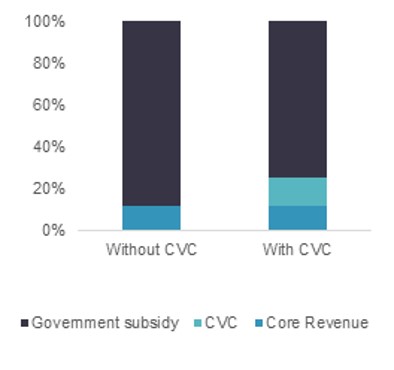

With growing populations and rapid urbanisation, an estimated 380 billion cubic meters of wastewater is generated annually worldwide and it is a growing concern for developing economies.1 Wastewater generation is expected to increase by 24% by 2030 and 51% by 2050.1 The need for improved sanitation and increased wastewater treatment coverage is vital. Despite growing demand for wastewater services, investment in wastewater has been lacking due to operational and financial constraints with low wastewater tariffs. In some developing countries, the construction of wastewater treatment plants (WWTPs) usually relies on overseas development assistance while cashflows from the projects exert a significant burden on local governments, as such facilities usually generate low tariffs. Local governments are likely to be interested in mobilizing private investment in the wastewater sector to achieve wider coverage and expansion, to meet their respective UN SDG goals. Local governments can consider various financial mechanisms to improve the attractiveness of the project. This Worked Example looks at a hypothetical case in wastewater treatment facility in a developing country. Project scope: A local government is planning to develop a centralized WWTP in the capital city as a PPP. The local government will procure the private party through a bidding process. Wastewater from households in the coverage area will be treated in the WWTP with the treated water being discarded in the surrounding environment such as rivers and streams. Some wastewater will be sold as reclaimed water to industrial users. Identifying CVC opportunities in WWTP: Core services: The project will provide wastewater treatment services to the public. Commercial potential and demand: The project is located in the southern area of the capital city with high economic growth and rapidly increasing wastewater. Industrial users in the area face water supply shortages which causes disruption in the manufacturing process. Hence, there is demand for reclaimed water among industrial users. Additionally, the sludge produced from wastewater treatment can be turned into compost or RDF (Refuse-Derived Fuel) for commercial purposes, as well as capturing methane for energy production and carbon credit generation. Beneficiary and stakeholder needs mapping Users Households benefiting from treated wastewater Access to sanitation N/A (core revenue) Wastewater tariff Water users (Industrial) Affordable and reliable water supply Sale of reclaimed water to industrial users (Instead of discarding treated water into rivers) Revenue from water reclamation Stakeholders Corporations wanting to reduce their carbon emissions Buy carbon credits to reduce their carbon footprints The project can reduce carbon emissions through methane capture Revenue from selling carbon credits Note: 1. Additional CVC revenues that can be explored for WWTP project include sale of biogas and electricity, sale of phosphorus as fertilisers and sale of biosolids as compost. 2. Besides CVC revenue, there are IRI opportunities such as betterment levies and development fees which involves collecting taxes and charges by the local government. Assessing the policy, legal, institutional readiness in the country Policy and planning CVC is a still a new concept, but government is willing to consider CVC mechanism to address financial constraint of WWTP investment. Legal Framework Current legal framework for PPPs is still nascent. However, government provides the flexibility to negotiate terms and conditions to make the project commercially viable. Institutional readiness Project Owner has limited technical capacity to consider CVC and institutional set up for wastewater is complex which affects the policy and implementation support required for CVC. Technical design: The identified CVC opportunities can be seamlessly integrated in the project design. Commercial feasibility: Based on a hypothetical financial assessment, the user fee will come from a wastewater tariff paid by households. As shown in the table below, the user fee is only 12% of total revenue required to exceed the hurdle rate in the hypothetical financial assessment. This might appear quite low but it is a typical scenario given the low appetite to charge wastewater tariffs. CVC in the form of asset use optimization and leveraging climate finance will add 13% of total revenue required. The remaining 75% of required total revenue will be paid by the local government as subsidy. A. Core Revenue User Fee 12% B. CVC Asset use optimization 3% Leveraging climate finance 10% C. Government subsidy Government subsidy N/A 75% Implementation: This project including CVC concept will be implemented through a PPP mechanism. Local government has the authority to procure the project though the PPP mechanism. Risks: Price of reclaimed water needs to be competitive with piped water supply or this could create demand and revenue risk. Carbon price fluctuation can affect revenue forecast. Operational risks regarding the standard of reclaimed water and separation of pipelines for treated and piped water supply needs to be part of performance standard agreed in the contract. Footnote 1: United Nations University, Valuable Energy, Nutrients, and Water Lost in World’s Fast-Rising Wastewater Streams, February 2020. Footnote 2: The Worked Examples is hypothetical project business cases and include hypothetical financial assessments with key project information.

Worked Example 1: Wastewater Treatment Plant

Groups

Description

Need

CVC Opportunities

Revenue Streams

Areas

Assessment

Revenue Category

Revenue Item

Expense Items

Net revenue as % of total revenue2

The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

Updated:

TABLE OF CONTENTS

I. Innovative Revenues for Infrastructure (IRI)

2. Introduction to Commercial Value Capture (CVC)

3. Applying CVC in Infrastructure Projects

• CVC for Wastewater Treatment Plant

3. Recommendations in Drafting ToRs with CVC

Related Content

Select WBG PPP Toolkits

Featured Section Links

Additional Resources

Climate-Smart PPPs

Type of ResourceFinance Structures for PPP

Type of ResourceFinancing and Risk Mitigation

Type of Resource