CVC Opportunities in Infrastructure

Photo Credit: Image by Pixabay

On this page: Find insights and examples as to how governments could start thinking about Commercial Value Capture opportunities in infrastructure projects. Check the Innovative Revenues for Infrastructure section or visit the Content Outline.

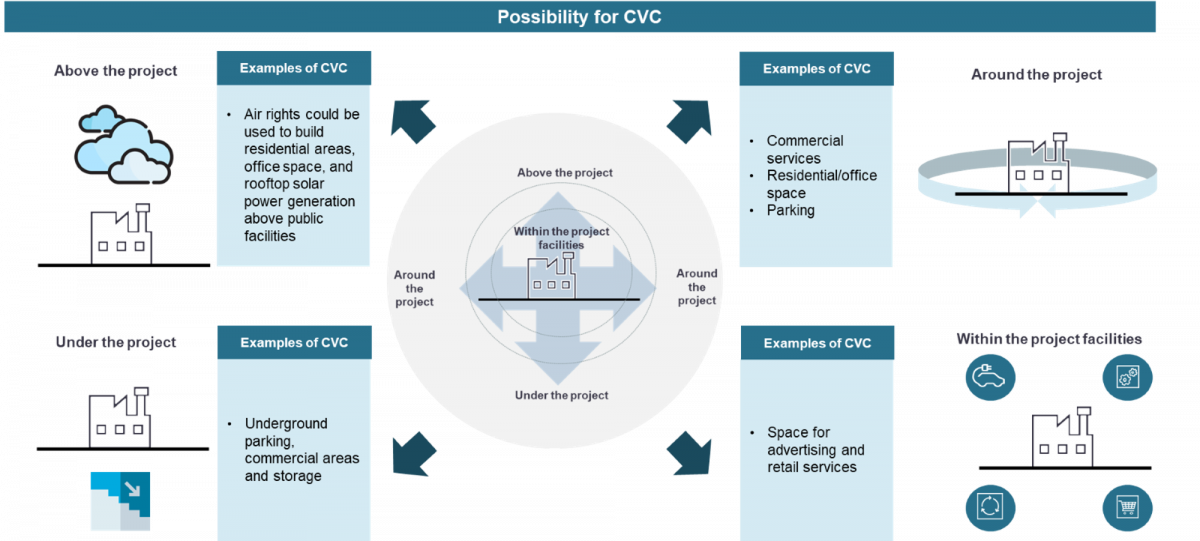

Opportunities for innovative revenues and CVC are rich and diverse. This section will provide examples of CVC opportunities in infrastructure drawn from various resources such as the World Bank’s Global Platform for Sustainable Cities1, the World Bank’s PPP Legal Resource Center2, the Global Infrastructure Hub3, local government websites, company websites, and case studies, as well as the Worked Examples in the Annexes of this report. This section will share insights and examples as to how governments should approach CVC. This section includes a broad but non-exhaustive set of CVC categories, to help the reader identify possible CVC models that might be relevant for a given project or portfolio of projects. It should be noted that not all of the examples and cases discussed and referenced here are successful cases, The Guidelines aim to provide a structured approach to apply success factors and lessons learned from other jurisdictions. CVC arises under, above, around or within project facilities as shown in Figure 5. For example, air rights can be used to build residential areas, office space, and rooftop solar power generation above public facilities, under the project, may be opportunities for underground parking, commercial areas and storage, within project facilities may be space for advertising and retail services, around the project may be space for commercial services, residential/office space and parking. Project Owners and governments should be creative and open minded, to identify potential CVC opportunities, while being careful to identify risks, assess market demand, gathering market feedback and testing the viability of the CVC opportunity at program design and project feasibility stages. Source: World Bank10 The following section of this report showcases six non-exhaustive, broad categories of CVC. These categories include: (i) commercial associated with core-services; (ii) commercial activities within the footprint of the infrastructure; (iii) asset and resource optimisation; (iv) leveraging green-house gas emissions reductions; (v) repurposing or adapting/reusing idle assets; and (vi) commercial activities outside of the footprint of the infrastructure. For each category, a broad definition will be provided, followed by some examples and case studies. However, not all examples will be able to show similar potential for all similar projects and each opportunity needs to be understood through a detailed project level assessment. Different examples may also require different supportive legal framework for the CVC opportunities to be implementable. Commercial activities associated with core-services: Core services can be provided for commercial purpose with improved facilities and services. For example, a public hospital which has a strong reputation for medical staff and medical care can generate additional revenue by adding space for private clinics with shorter waiting time and improved facilities to attract middle- and high-income groups. This type of revenue, however, has to be carefully managed so that it will not adversely impact quality of core-services. Commercial services can help cross-subsidize services provided to serve public purpose. See Figure 6 for examples and case study. Figure 6: CVC category - Commercial activities associated with core-services Examples Case Studies A public hospital enters into a Joint Venture (JV) with a private partner to construct a new hospital which co-locates with the existing public hospital. The new hospital will focus on providing healthcare services to high-income patients with better facilities and shorter waiting time at higher medical fees. Additional revenue generated from the new hospital will help fund public services in the existing hospital. (See Worked Example 3 in Annex 1) Commercial activities within the footprint of the infrastructure The development of infrastructure asset creates public and virtual space that can be used for commercial purpose. See Figure 7 for examples and case studies. Figure 7: CVC Category - Commercial activities within the footprint of the infrastructure Examples Hospitality and tourism (e.g. hotels, restaurants, cafes, catering) Vehicle services (e.g. petrol stations, garages, truck/bus parking) Case Studies Advertising and marketing in Singapore MRT station contribute to high share of non-farebox revenue at over 40% of total revenue in Singapore (See Annex 2) Residential and commercial properties have been developed along railway line in Hong Kong. (See Annex 2) Parking fees provide additional revenue for Transmileno Bus Rapid Transit Project in Bogotá, Colombia. (See Annex 2) Asset and resource use optimisation Commercial opportunities can arise from existing operational asset or resource which are underutilized or has untapped potential. See Figure 8 for examples and case studies. Figure 8: CVC category - Asset and resource use optimisation Examples Case Studies A wastewater treatment plant project can find additional revenues from sales of reclaimed water (See Worked Example 1 in Annex 1) Renewable energy projects can provide governments with an additional source of revenue from leasing water bodies to developers for floating solar (See Annex 2) Leveraging green-house gas emissions reduction To meet global climate targets, infrastructure has an important role to play to contribute to emission reductions through adoption of green technology. Some of these efforts can deliver emissions reductions that generate carbon credits and an additional reveue stream for the project. See Figure 9 for examples and case studies. Figure 9: CVC category - Leveraging green-house gas emissions reduction Examples Adding renewable energy production in existing areas or buildings Supporting EV ecosystems (eg EV charging stations, battery swap facilities) Case Studies A wastewater treatment plant project sells carbon credits from methane capture. (See Worked Example 1 in Annex 1) Repurposing or adapting/reusing idle assets Some public assets can lie idle in city centre or areas with high economic value due to outdated use or lack of funding for renovation of the facilities. These assets can be repurposed or adapted for commercial use to respond to changing environments. See Figure 10 for examples and case studies. Figure 10: CVC category - Repurposing or adapting/reusing idle assets Examples Case Studies To refurbish the library and fire station, Washington D.C. awarded the bid to private partner by leveraging adjacent, privately controlled parcels along with the District-owned parcels, to deliver a new fire station and library, residential condominiums, retail space, and residential rental units affordable to households earning at or below median income on the fire station site. (See Annex 2) The municipal authority in Turkey granted a PPP to private developer to restore the Akaretler Row Houses, a cultural and historic structure in Istanbul. The PPP includes refurbishing and maintaining historical and cultural assets, while diversifying revenue streams from spaces above and around the historic site, such as office buildings, retail spaces, hotels, residential units and parking areas. (See Annex 2) Commercial activities outside of the footprint of the infrastructure: CVC opportunities may be located some distance from the project footprint, for example where the activity requires too much land to be located near the project, where the CVC activity would be too loud or polluting, or where land is only available far from the project footprint.. See Figure 11 for examples and case studies. Figure 11: CVC category - commercial activities outside of the footprint of the infrastructure Examples Case Studies Jurong Innovation District (JID), Singapore's first 600-hectare innovation hub, was built to spur innovation in areas such as robotics, advanced manufacturing, urban solutions, clean technologies, and intelligent logistics. (See Value creation proposition (Case Study: Jurong Innovation District, Singapore)) To provide additional revenue to a private party to develop affordable housing, the local government provides additional land parcels as part of the contract for the private developer to generate revenue from retail and office space. (See Worked Example 4 in Annex 1) Footnote 1: Global Platform for Sustainable Cities Footnote 3: Global Infrastructure Hub Footnote 4: Module 17 – Capturing Commercial Value of the World Bank Municipal PPP Framework.

The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

Updated:

TABLE OF CONTENTS

I. Innovative Revenues for Infrastructure (IRI)

2. Introduction to Commercial Value Capture (CVC)

• Maximizing Revenue for Funding Infrastructure

• CVC Opportunities in Infrastructure

• Core Principles in Applying CVC in Projects

3. Applying CVC in Infrastructure Projects

3. Recommendations in Drafting ToRs with CVC

Related Content

Additional Resources

Climate-Smart PPPs

Type of ResourceFinance Structures for PPP

Type of ResourceFinancing and Risk Mitigation

Type of Resource