Pilot Courier Hubs and Lockers in Residential Areas, Singapore

Photo Credit: Image by Freepik

On this page: Governments can leverage unproductive spaces in airports as high-traffic public areas for targeted leasing while keeping journeys comfortable for passengers. Find case studies below, or visit the Guidelines on Innovative Revenues for Infrastructure section.

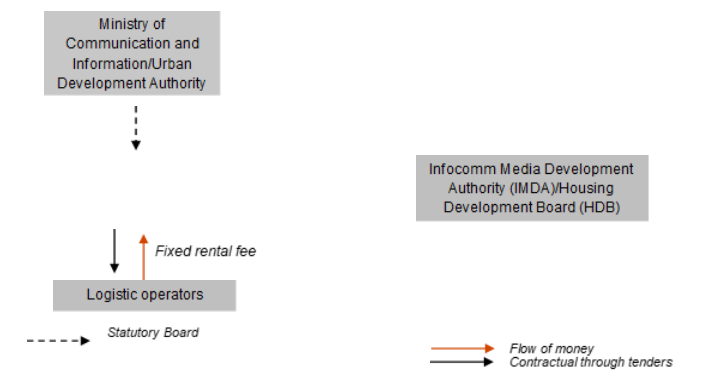

Project Summary: Background Increasing volume of online purchases and deliveries through e-commerce platforms have led to higher volume of delivery vehicles on the roads to residential areas. Almost all kinds of goods, from electronics to household items, can be delivered to people’s doorsteps. This acceleration in e-commerce in Singapore has made it difficult for delivery companies handling higher parcel volumes to find suitable spaces to fulfil consumers orders, especially in scheduling and achieving the last mile delivery in accordance with delivery slot availability. As a response, courier hubs in residential areas and parcel lockers in high footfall areas such as in malls and MRT stations have been deployed in Singapore. Project Structure Courier hub pilot aims to enhance last-mile business-to-consumer delivery operations. Courier hubs were rolled out at two multi-story carparks in Punggol Drive and Buangkok Link in 2021 with operational hours 9 am to 6 pm daily, and the four designated lots in each carpark can be used for regular parking outside of these hours.1 Suitable car park lots are designated to provide a safe and convenient area for the orderly sorting, holding, and dispatching of parcels on foot to nearby residents to complete deliveries. This could allow more deliveries to be completed and potentially reduce use of vehicles in last-mile deliveries to residential areas.2 Nationwide parcel lockers network run by Pick Network Pte Ltd (PICK) is a multi-agency effort with strong support within government. In 2021, 200 parcel lockers were placed island-wide with 1,000 lockers targeted to be deployed within the year. The lockers have been strategically placed such that one is only a 5-minute walk from residents who can then pick up their parcels whenever possible because the lockers are open 24 hours a day, seven days a week.3 Key players for delivering improved services Courier hubs pilot is a collaboration between the Urban Redevelopment Authority, HDB, Enterprise Singapore, Singapore Land Authority and logistics operators Ninja Van and Shopee Express.4 The Infocomm Media Development Authority (IMDA) is a statutory board under the Singapore Ministry of Communications and Information (MCI). The IMDA and PICK are working with HDB, Land Transport Authority, Ministry of Home Affairs, Ministry of National Development, Ministry of Transport, People’s Association, Singapore Civil Defence Force and the Singapore Police Force on processes such as the siting of lockers and the co-development of safety and security guidelines, to ensure the smooth implementation of Pick’s Nationwide Parcel Lockers Network.5 Pick is also partnering with logistics service providers (LSPs) such as FedEx, Huper Express, QXpress, S.F. International, UPS, WMG, XDel, and ZTO to enable seamless parcel drop-offs and returns through its lockers. Mechanism /s for Maximizing Funding for Infrastructure We understand that the HDB leases space and logistic operators assist the development of courier hubs, with standardized parking charges for delivery companies that use the facility. For parcel lockers, Infocomm Media Development provides the space as mandated by Ministry of Communication and Information, while PICK, as the locker provider, rents the space, installs the lockers, and ensures its operations throughout Singapore. PICK then charges the users of lockers. Typical Business Model Lessons Learned Implementation Footnote 1: Ghost of Tsushima review – Director’s Cut: a Samurai Next Gen Footnote 2: Singapore's Courier Hub Pilot Footnote 3: Pick Network launches first batch of over 200 parcel lockers Footnote 4: Singapore's Courier Hub Pilot Footnote 5: Singapore's nationwide parcel locker network launched

Government

Asset Owner

Line agency

Responsible for the core and non-core services

Lessee

Leases the space

The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

Updated:

TABLE OF CONTENTS

I. Innovative Revenues for Infrastructure (IRI)

2. Introduction to Commercial Value Capture (CVC)

3. Applying CVC in Infrastructure Projects

2. Case Studies in CVC from International Experiences

3.100 Case Studies: Municipal PPP Framework

Related Content

Select WBG PPP Toolkits

Featured Section Links

Additional Resources

Climate-Smart PPPs

Type of ResourceFinance Structures for PPP

Type of ResourceFinancing and Risk Mitigation

Type of Resource