Joint Venture/ Joint Stock Company Checklist

Photo Credit: Image by namu0309 from Pixabay

Click to download word and pdf versions of the Joint Venture/Joint Stock Company Checklist

Introduction

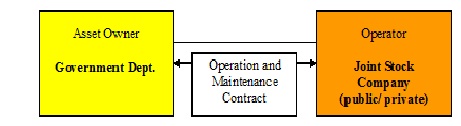

Joint venture arrangements in infrastructure projects were until recently generally only relevant to regulating the relationships between private parties to a project company in a Build-Own-Transfer (BOT) or concession project. There is increased use of them between public utilities and private parties, often in combination with or following the corporatization of a public utility.

Examples of this in the Water and Sanitation sector are:

- Cartegena, Colombia (expresa mixta)

- Tallinna, Vesi, Estonia

Below are a checklist of issues to consider when putting together joint venture arrangements – in the case of a joint venture or joint stock company, these will be generally found in the shareholder agreement, but will need to be consistent with the constitutional documents of the company and the law:

Preliminary issues

1. Structure of joint venture:

Should it take the form of:

- a joint venture company with its own legal identity separate from those of its shareholders, in which the parties will participate on an equity basis, and there is a limitation on liabilities – in the context of project finance or joint venture between the public and private sectors, this is recommended;

- a partnership arrangement – an arrangement with profit sharing between partners created for a specific purpose – no separate legal entity created and each of the partners with full legal responsibility for the project, generally there is no limitation on liabilities unless this is a formalized into a limited partnership;

- a contractual consortium – parties contract to work together on a specific project – there is no concept of sharing of pool of profits as there is with a partnership – each party likely to be remunerated for specific services provided to the consortium. No separate legal entity created and limitations of liability will be set out in the contract, if at all.

2. Purpose of the joint venture

- In the case of project financed transactions, the banks will be anxious to ensure that the joint venture does not diversify into any risky activities and so will impose restrictions on what the joint venture may engage in.

- Even where there are no bankability considerations, the parties should be clear as the objectives and purpose of the joint venture and whether the joint venture should be permitted to diversify etc.

Joint Venture Company – Key Issues

Assuming that the parties will want a separate corporate entity, we set out below the key issues to consider in establishing it:

If a minority participant is involved, it will wish to protect its interests through: The parties should have a common understanding about the dividend distribution policy to be adopted by the joint venture clearly setting out when dividends should be issued, particularly where profits need to be reinvested in the business. This is particularly important as distribution of dividends can only be made out of distributable profits and at the discretion of the board and shareholders. A private or minority party will also want to be sure that distribution of dividends will not be blocked by the other party(ies) if minimum profit levels are reached, although in some jurisdictions such a commitment may not be enforceable. It may be necessary to prevent or limit competition between one of the parties and the joint venture. Any non-compete obligations will need to be drafted carefully in terms of: When, and how, should a party be able to terminate its interest in the joint venture? (a) Unilateral exit or termination allowing one party to terminate and/or exit by notice. It usually involves a right to sell to a third party purchaser subject to a right of pre-emption (i.e. right of first refusal) in favor of the continuing party(ies). The parties may require consent of the other shareholder(s) for all transfers; the question then is whether a party should have a right to compel liquidation in certain circumstances. (b) Termination for cause or upon a “trigger event” This is where a particular event triggers the right of another party to institute a call option or other termination procedure. The ‘trigger event’ needs to be carefully defined e.g.: How items such as guarantees, defects and insurance will be handled after termination. Sometimes the parties will agree at the outset that one party will have a right, at a specified time and usually at a specified price or at a third party valuation, to ‘put’ its shares (i.e. to require the other party to buy its shares in the JVC) or to ‘call’ for the other party’s shares (i.e. to acquire that other party’s shares). It is common for joint ventures to include contractual provisions whereby, before a transfer of shares to a third party, the other shareholder(s) are given a pre-emption right. Points that arise include the following. The price may be set by reference to a price: Joint ventures have an inherent prospect of management deadlock, even if it is only on the issues where the minority party has a power of veto. The parties will need to decide whether, in the interest of certainty, to set a contractual solution for breaking the deadlock, or whether the parties will by necessity in a prolonged deadlock situation have to reach an agreed solution. Possible solutions could be: Personnel – will parties be contributing personnel – in the case of a utility, how will these be supplied to the JVC – by secondment or transfer, etc.? The business plan is rarely itself a legal document and failure to achieve future targets will not usually give rise to a legal claim. However, it can be a vital document to ensure that the joint venture parties have clear objectives for the venture. It is common to identify the opening business plan in the joint venture agreement. [2] Non-compete clauses may be found to be invalid in certain jurisdictions if too broad in scope – check with local lawyers1.Equity/ shares

2. Funding

3. Corporate Governance

4.Minority Protection

5.Dividend Policy

6. Non-compete clause

7. Termination/ Exit provisions

8. Put/call options

9. Pre-emption rights and drag-along and tag-along rights

10. Deadlock resolution

11. Business Plan

12. Liabilities

13. Accounting Policies

14. Intellectual Property

15. Dispute Resolution

16. Governing law

[1] The law may stipulate decisions that need to be decided by a super-majority.

Updated: November 30, 2020