CVC in Affordable Housing

Photo Credit: Image by lifeforstock on Freepik

On this page: A look into a hypothetical affordable housing project in a developing country to demonstrate practical challenges and concrete opportunities of CVC. Read more below, visit the Guidelines on Innovative Revenues for Infrastructure section and check the Content Outline.

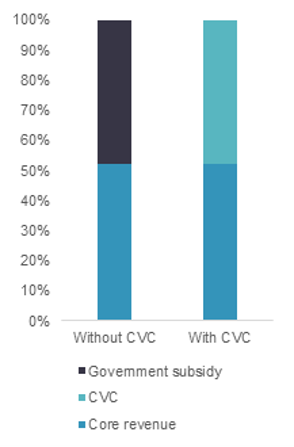

According to the World Bank, 1.6 billion people around the world are estimated to be affected by the global housing shortage by 2025.1 In most countries, the cost of housing has grown faster than income.2 Having access to quality affordable housing is essential to decrease poverty, provide equal opportunities and guarantee sustainable growth. Although there is high demand for housing in many countries, low-income households cannot afford to buy houses with high urban land prices while commercial developers focus on serving the more profitable higher-income market. The government faces the challenge of providing affordable housing for lower- and middle-income groups as public investment is constrained. Governments are looking for innovative mechanisms to fund affordable housing including increasing private participation in the sector. This Worked Example looks at a hypothetical affordable housing project in a developing country which is proposed to be developed as PPP with strong commercial elements. Project scope: The project is located in a satellite city of the commercial center with growing economic activity and housing demand. The project consists of two residential complexes where one complex includes one-bedroom housing units (targeting low-income groups) and the other complex has two-bedroom housing units with parking facilities (targeting middle-income groups). In addition, the project includes key community infrastructure services and premium amenities like healthcare centre, primary school, shopping complex, banks and public institutions such as post offices. Identifying CVC opportunities in affordable housing: Core services: The project will provide affordable housing for low- and middle-income groups. Commercial potential and demand: As the project is located in a planned satellite city near the capital city with growing economic activities, there is a strong demand for both housing and related amenities. Beneficiary and stakeholder needs mapping: Users Low- and middle-income households Housing in a new satellite city with easy access to jobs/amenities N/A (core revenue) Sales of affordable housing units Low- and middle-income households living in the project Access to facilities and amenities Healthcare centre, shopping complexes, primary school, fitness clubs, entertainment centres, car parking Rental fee of commercial space Low- and middle-income households living in the project Access to basic infrastructure Post offices, drinking water supply, road, street lighting Rental fee and utilities fee Stakeholders Residents living in the satellite city and the nearby capital city Access to facilities and amenities Healthcare centre, shopping complexes, primary school, fitness clubs, entertainment centres, car parking Rental fee of commercial space IT corporations looking to expand operations in new city Office space for IT industry Development of office space for the IT industry near the project area Rental fee of commercial space Note: The project can include additional CVC revenue such as selling solar energy, water recycling, and solid waste recycling. Assessing the policy, legal, institutional readiness in the country Policy and planning There is clear policy direction to consider PPP and CVC in affordable housing projects in the country. There is strong public support for CVC in housing project which meets the need of urban residents. High opportunity: Policy, legal and institutional framework are supportive and allow for CVC to be considered in the project. Next Step: Identify and analyse CVC in feasibility stage. Legal Framework Legal framework allows local government to set up a new state-owned entity to oversee the project and enter into PPP contract with the private sector. Institutional readiness A new state-owned entity can recruit personnel with commercial experiences to oversee the project. Technical design: The residential units and the public infrastructure/amenities are designed and planned together to integrate commercial activities and core services in the early planning stages to provide a holistic user experience. A separate piece of land outside the project area is allocated to the private developer to develop office space for the IT industry, a driving force in the new satellite city, as part of the contract to provide additional incentives to the private developer. Commercial feasibility: Based on a hypothetical financial assessment, the core revenue is the user fee which will come from sale of affordable housing units for low- and middle-income households. As shown in the table below, core revenue is 52% of total revenue required. So, 48% of total revenue is required to exceed hurdle rate in the hypothetical financial assessment. Typically, renting a high-end space can yield significantly greater financial benefits compared to other costs, often surpassing 20% to 100% of what people spend on a more affordable space. Analysis of the project’s CVC potential finds that CVC in the form of commercial use of physical space, infrastructure sharing and development of a nearby IT office project on an additional piece of land will add 48% of total revenue required so government subsidy will not be required for the project. A. Core Revenue User Fee Sales of affordable housing units 52% B. CVC Commercial use of physical space Rental fees of commercial space providing amenity services to residents and non-residents 8% Infrastructure sharing Rental fees of public infrastructure (post office) 2% Carpark fee 1% Utilities fees 2% Others Rental fee from high-end IT office space development 35% Implementation: This project including the CVC concept will be implemented through a PPP mechanism. A state-owned entity will be set up to manage the infrastructure development and select the private sector developer under PPP procurement. Risks: Risk that the private developer will develop the more commercially attractive element of the project first (IT office space) while postponing the development of the project’s less profitable element (affordable housing). This can be mitigated through putting in place contractual terms so that both projects are developed in parallel. Footnote 1: World Economic Forum, What has caused the global housing crisis - and how can we fix it?, Jun 2022 Footnote 2: International Monetary Fund (IMF), Housing Prices Continue to Soar in Many Countries Around the World, October 2021 Footnote 3: The Worked Examples is hypothetical project business cases and include hypothetical financial assessments with key project information.

Worked Example 4: Affordable Housing

Groups

Description

Need

CVC Opportunities

Revenue Streams

Areas

Assessment

Level

Revenue Category

Revenue Item

Expense Items

Net revenue as % of total revenue3

The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

Updated:

TABLE OF CONTENTS

I. Innovative Revenues for Infrastructure (IRI)

2. Introduction to Commercial Value Capture (CVC)

3. Applying CVC in Infrastructure Projects

• CVC for Wastewater Treatment Plant

3. Recommendations in Drafting ToRs with CVC

Related Content

Select WBG PPP Toolkits

Featured Section Links

Additional Resources

Climate-Smart PPPs

Type of ResourceFinance Structures for PPP

Type of ResourceFinancing and Risk Mitigation

Type of Resource