The concessions, Build-Operate-Transfer projects (BOT) and project Design-Build-Operate (DBO) are forms of public-private partnerships (PPP). For definitions of each type of agreement and their main features and get examples for each of them, please read the following. You will also find links to the checklists, toolkits and information about the PPP sector.

Overview concessions, BOT projects and BOD

A concession granted to an operator's long-term right to use all public service assets attributed to him, including the responsibility for the entire operation and investment, but the public authority retains the ownership of assets. At the end of the concession period, the assets revert to public authority, including those acquired by the operator. In a concession, the operator usually clears its revenue directly from consumers. Therefore, it has a direct relationship with that consumer. A concession covering the entire infrastructure system and may include the operation of existing assets by the operator as well as the construction and operation of new assets.

Project Build-Operate-Transfer (BOT) is usually used to develop a particular asset rather than an entire network. Generally, it is completely new or blank in kind (although it is possible to integrate the renovation). In a BOT project, the company or the project operator usually clears its revenue through a levy paid by the public service / government rather than through rates charged to consumers. A number of projects are called concessions, such as toll road projects newly built and are relatively similar to the BOT.

In a Project Design-Build-Operate (DBO), the public sector owns and finances the construction of new assets. The private sector designs, builds and operates the assets to achieve certain objectives. The record for a DBO project is generally easier to make that case for a project or for a BOT concession to the extent that any financing document is necessary. It will usually consist of a performance contract public works as well as a management contract or a section added to the contract covers operation. The operator takes no financial risk and will be paid the design and construction of the plant and then collect operating costs for the operating period.

This section examines in more detail the concessions and BOT projects. It contains references to the Power Purchase Contracts to Supply Fuel Contracts / Wholesale and Installation Contracts œuvredont use is widespread in the context of BOT projects which include power plants.

This section does not address the complex range of financial documents generally present in any concession or BOT project.

Main Features

- Concessions

- Grants a concession to a private operator responsibility, not only the operation and maintenance of assets, but also the funding and management of all necessary investments.

- The operator takes risks on the state of assets and for investment.

- It is possible to grant a concession in the framework of existing assets, an existing public service or for complete rehabilitation and extension of an existing asset (although new construction projects are often called concessions).

- Typically, a short concession over a period of 25 to 30 years (that is to say long enough to amortize all the major initial investments.).

- The contracting authority generally remains owner of the asset. All rights to these assets back to the contracting authority once the concession.

- The general public usually embodies the customer and source of income of the operator.

- Often, the operator will use the existing assets at the beginning of the concession: in this way, a cash flow will be immediately available to pay the operator to set aside to invest, pay off debt, etc.

- Unlike most management contracts, concessions are results-oriented: that is to say on the provision of a service in accordance with the performance standards. The concession is less emphasis on inputs, that is to say, the service provider itself determines how to achieve the agreed performance standards, although there may be some frequency Requirements contracting asset renewal and consultation with the government or the regulator on these main features are the maintenance and renewal of assets. There may also be requirements for increased capacity and replacement of assets by the end of the concession.

- Some infrastructure services are considered essential and others are monopolies. Limiting tariff levels will likely return to the operator, either through law, contract or regulation. The operator will be assured of its ability to finance its obligations and maintain an advantageous rate of return. It will therefore be necessary to include guarantees in the concession contract or in legislation.

- In many countries, tax collection in some areas do not cover the cost of operating assets, much less the additional investment. In this case, it will be necessary to give a precise basic alternative recovery costs in the concession, either from general subsidies, taxation or borrowing of the government or other sources.

- The concept of "concession" was first developed in France. As for the term leases, the law sets the concession framework and the contract contains specific provisions in the project. In the law, the focus is on the public nature of the provision (the operator having a direct relationship with the consumer) and the guarantees are enshrined in this law to protect the consumer. Similar legal frameworks have been introduced in other countries civil law systems.

- In French law, the dealer is obliged to ensure the continuity of public service to treat all consumers equally and adapt the service according to changing needs. In return, the dealer is protected against new concessions that would infringe its rights. Therefore, when considering the concessions under the civil law systems, it is important to understand what rights are already enshrined in law.

- As part of systems "common law" contract "BOT" is the nearest comparable legal structure. It is generally used to build a plant or system.

- BOT projects

- In a BOT project, the licensor grants the public sector to a private company the right to develop and operate a plant or system, which traditionally fall within the public sector for a certain period (concession period).

- This is usually an individual and blank project to build new infrastructure.

- The finance operator, owns and builds the plant or system and commercially exploits for the duration of the concession, after which the facility is transferred to the public authority.

- The contract "BOT" is a classic tool of project financing. Insofar as it relates to the construction of new infrastructure, no revenue stream is present from the start. Lenders are anxious to ensure that project assets earmarked for the project operating company and all risks associated with the project are taken up and transferred to the appropriate actor. Therefore, it is usually a special purpose company which is the operator.

- Income is often obtained from a single "original purchaser", as a public service or government, which buys the project results to the project company (which differs from a real concession where the product is sold directly to consumers and end users). In the energy sector, it will take the form of a Power Purchase Agreement.

- The project company receives financing for it, designs and builds the facilities and operates the facility during the concession period.

- The project company is a special purpose company. Often construction companies and / or exploitation of enterprises with input supply and companies that have the means to buy from are among its shareholders. Given the particular risks to specific aspects of a project BOT, it is also essential to include experienced shareholders in the management of such projects, as does working with various multicultural partners. To the extent that the project is likely to have been financed on the basis of expertise and financial stability of the shareholders, the original purchaser / public service will be anxious to ensure that the main shareholders remain in society project for a while.

- The project company will coordinate the construction and operation of the project as required by the concession agreement. The original buyer wish to know the identity of the subcontractor in charge of the construction and that of the operator.

- In a project in the field of energy, the project company (and lenders) will be keen to ensure it has a safe and affordable source of fuel. It usually enter into a supply contract for wholesale fuel. The supplier and buyer of electricity that has entered the power purchase agreement, namely the public electricity company, may be the same entity. For examples, click Fuel Supply Contracts / for Gros.L'électricité also the main operating cost of a water treatment plant or sewage. Operators will be safe as regards the cost and source of energy.

- Revenue generated by the exploitation phase are intended to cover operating costs, maintenance, repayment of debt principal (which is an important part of the costs of development and construction), financing costs ( including interest and costs) and a return to the shareholders of the special purpose company.

- Lenders provide financing without recourse or limited recourse to law financementsavec. Therefore, they assume any residual risk alongside the project company and its shareholders.

- The project company assumes many risks; it is keen to ensure that these risks, which remain the side of the licensor, are protected. It is common for a project company to require some form of government guarantee and / or, especially in the case of projects in the field of energy, government commitments that are recorded in a Down Agreement Artwork.

- To minimize such a residual risk (to the extent that lenders will want as much as possible will take a limited part of the commercial risk of the project), they insist on transferring the risk of the project company to other participants by through a contract as a construction contract or an operating and maintenance contract.

Contractual Structure

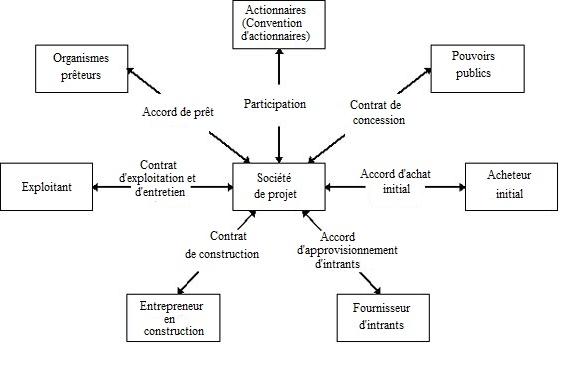

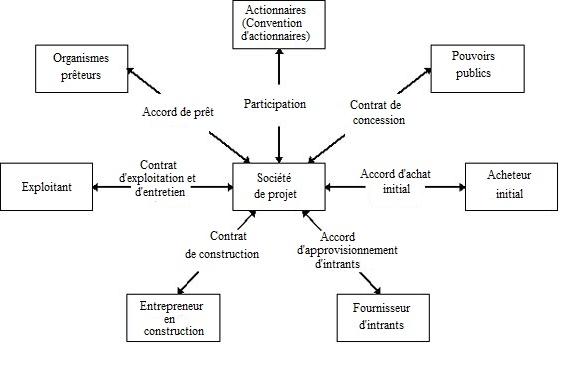

The diagram below shows the contractual structure of a BOT project or a typical concession, including loan agreements, the shareholders' agreement between the shareholders of the project company and outsourcing contracts operating contract and the construction contract, which will generally be between the project company and a member of the consortium of the project company.

Each project will adopt a variant of this contractual structure according to its specific needs: BOT projects do not require all the guarantee of a supply of inputs; therefore, a supply agreement inputs / fuel is not necessarily required. It is possible that the flow of payment comes in whole or in part tariffs of the general public rather than an initial buyer.

Examples

Transport Network

- Highways

- Railroads

- light rail, urban transport passengers, subway, tram

- ports

- airports

Water and sanitation

- Agreements power purchase

- Contracts for fuel / wholesale

- Implementation Agreements

- Land lease

Concessions Checklists

Additional Resources

- Types of PPP: Legal terminology and Comparison of PPP in French and Anglo-Saxon conceptions (Comparison of French and International Concepts of PPPs), Mission Support to Public Private Partnerships (MAPPP), May 2013 (French)

- Private Sector Investment in Infrastructure: Project Finance, PPP Projects and Risk. J. Delmon, 2 e edition, 2008.

- Project Finance, BOT Projects and Risk, V. Delmon 2005.

- The Partnership Contracts in France , Institute of Management Representative (IGD) - French PPP Institute, Cost control and performance for local authorities, in September 2008 (French)

- Paradoxes and Financial Traps Concessions Olivier Ratheaux, Landmarks for non-sovereign, No. 8, September 2005 (French). Examines the concept of concessions of a French legal perspective.

- Project Finance , A Legal Guide, D. Graham Vinter, 3 th edition, 2006.

For more information on funding agreements, see Credit .