Assessing Commercial Feasibility of CVC

Photo Credit: Image by Freepik

On this page: Analyse if the Commercial Value Capture (CVC) opportunity is commercially feasible, its benefits outweigh costs and if it provides value for money. Find more below, visit the Guidelines on Innovative Revenues for Infrastructure section or check the Content Outline.

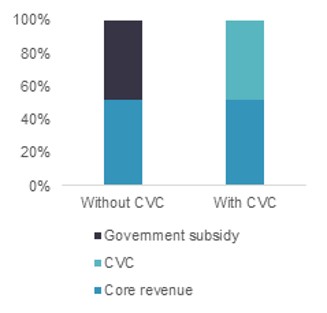

After the Project Owner concludes that the CVC opportunities are technically, legally, institutionally, environmentally and socially feasible, the next step will be to analyse if the opportunity is commercially feasible, and if its benefits outweigh the costs and it provides value for money. This step and the previous steps can be iterative. Feedback from market sounding and preliminary financial analysis can provide new ideas for CVC opportunities and inputs to the technical design to further maximize CVC. Proactively engage with the private sector. Market sounding should be conducted to seek inputs from the private sector and assess if there will be appetite from investors at the bidding stage. (See Box 8) Box 8: Project Owners should conduct market sounding to seek private sector inputs on CVC Objective of market sounding: The market sounding process involves reaching out to potential investors commercial banks, operators, developers, suppliers and other private parties to gather the private sector’s views and inputs on commercial potential, commercial viability, bankability as well as other technical suggestions which can benefit project design. How to conduct market sounding: Market sounding can be done through public seminars, small group meetings and one-on-one meetings. It is important that market sounding is open and provides equal access to interested parties. To ensure that market sounding is effective, Project Owners should identify the players with potentials to participate in the project. The market sounding should be informative and provides essential information about the project, such as the project background, proposed project scope, initial project design, project timeline, initial financial assessment results, environmental and social assessment, risk assessment and a scope for private participation or risk allocation for a PPP project. It should also highlight any issues on which the Project Owner wishes to seek feedback from the participants. To encourage active participation, the materials should be shared with the participants in advance of the meeting to give them sufficient time to review. The event should provide enough time for a Q&A session to allow participants to share their thoughts about the project. The Project Owner can also use this opportunity to provide further clarification and address any concerns participants may have. Comments and feedback received from the event should be analysed and incoporated into the feasibility study and final project structure. Quantify the potential net revenue contribution based on key financial metrics. This will involve a financial assessment to quantify the cost of implementing the CVC opportunity and the revenue that is likely to be generated. This net revenue assessment, even if preliminary, will help to guide the planning process. Box 9 provides an example of how a preliminary financial assessment can be carried out. The amount of additional revenue generated from CVC is not likely to be sufficient to fully fund public infrastructure projects, but it can usually make a material contribution to the overall project economics and increase the project’s commercial viability. Box 9: Preliminary financial assessment can indicate net revenue contribution of CVC to the project Background: To meet with rising demand for affordable housing in a satellite city located near a capital city with growing economic activities, a local government wishes to develop a large-scale affordable housing PPP project. The project will include a CVC element to provide an additional source of revenue for the private developer and therefore reduce the need for the government to provide subsidy for low-income housing. The government designs a project to include two residential complexes where one complex will serve low-income groups and another complex will serve middle-income groups. Also, the project includes key community infrastructure services and premium amenities such as healthcare centres, primary schools, shopping complexes, banks, and public institutions like post offices to attract residents and non-residents and generate additional revenues In addition, a separate piece of land adjacent to the project site will be allocated to the private developer to develop office space for IT industry, a thriving industry in the new satellite city, as part of the PPP concession. CVC contribution: The preliminary financial assessment suggests that without CVC, the core revenue will provide 52% of total revenue required to exceed the hurdle rate and the project will require subsidy to fund the remaining 48% of total revenue required. If CVC is added to the project in the form of commercial use of physical space, infrastructure sharing and development of nearby IT office spacein an additional iece of land, CVC can generate additional revenue stream to cover the funding gap. With CVC, government subsidy will not be required for the project. (See Worked Example 3 in Annex 1 for further details) Consider how CVC revenue can be allocated to support core services (in cases where CVC generates additional revenue). CVC can generate additional revenue or reduce government subsidies for the project. See Box 10 for an example of how additional revenue from CVC is directed to support core services. Box 10: Revenue from CVC directed back to support core services Wembley Stadium hosts major football matches, including home matches of the England national football team and the FA Cup final. However, during the off-season, the space hosts concerts and entertainment events that draw a high number of visitors from overseas who tend to extend their stay in England resulting in tourist spending associated with these events. During the 2017/18 season, the Football Association (FA) generated a record revenue of GBP 376m (USD 445.7m) from the Football Association Limited, Wembley National Stadium Limited, and the National Football Centre Limited. The FA has reinvested a record GBP 128m (USD 151.7m)1 into football. For example, the FA’s Full-Time mobile app has been a game-changer for grassroots football, helping to make the management of teams much more efficient and effective. (See Annex 2 for further details) Footnote 1: A record £128M has been invested back into every level of football

The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

Updated:

TABLE OF CONTENTS

I. Innovative Revenues for Infrastructure (IRI)

2. Introduction to Commercial Value Capture (CVC)

3. Applying CVC in Infrastructure Projects

• Identifying Potential CVC for Projects

• Assessing Readiness of Enabling Environment to Support CVC

• Conducting Technical Assessment of CVC

• Assessing Commercial Feasibility of CVC

• Planning for Implementation of CVC

• Assessing and Mitigating CVC Related Risks

3. Recommendations in Drafting ToRs with CVC

Related Content

Additional Resources

Climate-Smart PPPs

Type of ResourceFinance Structures for PPP

Type of ResourceFinancing and Risk Mitigation

Type of Resource