Stellar Ace, Singapore

Photo Credit: Image by tawatchai07 on Freepik

On this page: High footfall areas within public transit are perfect locations to promote a product, service, or cause and are effective customer touchpoints for brands. Find case studies below, or visit the Guidelines on Innovative Revenues for Infrastructure section.

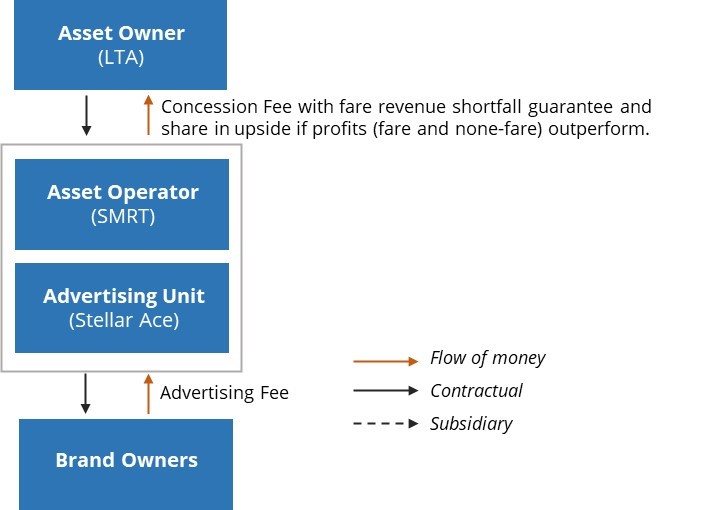

Project Summary: Background Advertising is a well-established business segment for operators of public transit stations, terminals, and airports. High footfall areas within public transit are perfect locations to promote a product, service, or cause and are effective customer touchpoints for brands. Communities in high-mobility cities often regard advertising in public transit stations as quick reflections of what is in the market. In considering potential revenues from advertising and marketing, governments can leverage high footfall public areas for use in advertising and marketing while keeping journeys comfortable for passengers and avoiding uncomfortable distractions from advertising and marketing activities. Community-orientated value creation SMRT Corporation Ltd. (SMRT) manages and operates train services on the North-South (NS), the East-West (EW), the Circle (CC), the new Thomson-East Coast Mass Rapid Transit (MRT) Lines and the Bukit Panjang Light Rail Transit (LRT). The rail network is complemented by SMRT bus, taxi and private hire vehicle services. Trains 95 MRT stations 513 million in 2020 Buses 88 bus service routes 1,200 buses 240 million passenger journeys Source: https://www.smrt.com.sg/News-Room/Information-Kit Stellar Ace, a subsidiary of SMRT, is the operator for advertising and marketing of the broader public transportation network covering the NSEW, CC Lines, and the Bukit Panjang LRT trains and stations, as well as media advertising assets on buses, taxis, and in malls, among others. With SMRT's out-of-home advertising assets, advertisers can reach out to their target audience via multiple touchpoints nationwide. The ads are placed throughout the assets using interactive LEDs, motion sensors, and other technology. The advertisers pay a monthly service fee to Stellar Ace as the operator of the advertising in the stations. Advertising in Stations Source: Stellar Ace, 2021 Key players for delivering improved services Since 2016, the Land Transport Authority (LTA) owns the rail operating assets and SMRT is responsible for maintaining the rail infrastructure. SMRT is a wholly-owned subsidiary of Temasek Holdings which is a Singaporean state holding company. Under the New Rail Financing Framework (NRFF), effective in January 2022, SMRT is granted the right to use the assets and operate the lines for 15 years (with potential for a five-year extension).1 What sets Stellar Ace apart? Leveraging an established and extensive infrastructure asset network: Stellar Ace manages and markets advertising solutions in the SMRT network covering 95 stations with ~500 million annual ridership and 88 bus routes with ~240 million annual passenger journeys. Connected Experience: Integration of various customer touchpoints through a digital network including digital screens in high footfall areas, mobile app and eCommerce platform.2 Mechanism for Maximizing Funding for Infrastructure As an asset owner, LTA shares in fare revenue shortfall and potential upside if SMRT profits outperform. SMRT payments to LTA goes for the right to use LTA rail operating assets is earmarked for asset replacement and repair. SMRT pays an annual Licence Charge into the Railway Sinking Fund, which will fund the replacement and repair of operating assets. The Licence Charge which SMRT pays LTA increases with higher profits (fare and non-fare).3 LTA shares in fare revenue risk and fares are regulated separately by the Public Transport Council. Through the Licence Charge mechanism LTA shares in fare revenue shortfall and in the upside if profits (especially from non-fare revenues since fare revenues are regulated) outperform. Before COVID-19, non-farebox income contributed around SGD 270 million or 40% of the total revenues while farebox revenue amounted to around SGD 700 million.4 Non-farebox revenues come from taxi operations, rental of commercial and office space leases, vending, ATM spaces, engineering services, and advertising. Advertising revenues contributed around SGD 30 million or 12% of the total non-farebox revenue. Typical Business Model Lessons Learned Managing the risks Demand risk: LTA shares some risk in shortfall of SMRT's fare revenues which are regulated. Revenue capture: Through the License Charge mechanism LTA shares in the upside if profits outperform expectations (especially from non-fare revenues since fare revenues are regulated). Ease of implementation - Implementation model is relatively straightforward but knowledge of the commercial revenues that can be captured would be needed in public sector to set reasonable expectations and private sector needs expertise in advertising to manage commercial risks. A dedicated unit or subsidiary, similar to Stellar Ace, would need to be set up to manage marketing and advertising activities. Footnote 1: New Rail Financing Framework Footnote 2: Stellar Ace breaks into HDB OOH space in North-East district of SG Footnote 3: SMRT Trains and SMRT Light Rail to Transit to New Rail Financing Framework Footnote 4: SMRT Corporation LTD Group Review 2020/2021

SMRT Modes

Network information

Annual ridership

(a)

Concession agreement granting right to use and operate the assets to the Asset Operator

(b)

Advertising contracts

Advertising Unit or Subsidiary

Operates advertising & marketing services

Brand owners

Advertising concessionaries who must comply with the standards

The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

TABLE OF CONTENTS

I. Innovative Revenues for Infrastructure (IRI)

2. Introduction to Commercial Value Capture (CVC)

3. Applying CVC in Infrastructure Projects

2. Case Studies in CVC from International Experiences

3.100 Case Studies: Municipal PPP Framework

Related Content

Select WBG PPP Toolkits

Featured Section Links

Additional Resources

Climate-Smart PPPs

Finance Structures for PPP

Type of ResourceFinancing and Risk Mitigation