Jurong Innovation District, Singapore

Photo Credit: Image by 4045 on Freepik

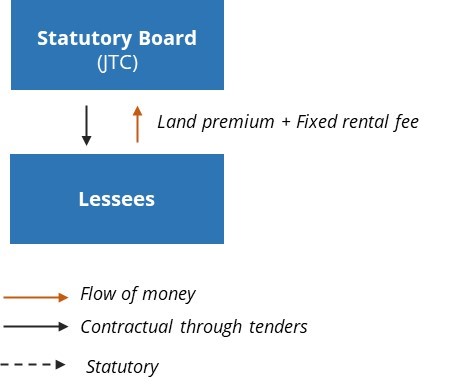

On this page: Illustration of how the popularity of innovation districts increases the rental revenue collected by the government. Find case studies below, or visit the Guidelines on Innovative Revenues for Infrastructure section.

Project Summary: Background Value Creation in the control of real-estate development rights can be well illustrated by considering hubs such as Education Hubs, Health hubs, Digital Hubs, Transit-Oriented Developments, Mixed-use Developments and Innovation Districts. Innovation districts are geographic areas where public and private stakeholders collaborate to attract entrepreneurs, start-ups, and business incubators to revitalize depressed downtown areas.1 The rise of innovation districts can be attributed to their inherent benefits. Innovation districts are well-equipped with state-of-the-art amenities and equipment that lessees can tap on, enhancing their corporate productivity and experience of workers, customers, and users. Consequently, the popularity of innovation districts increases the rental revenue collected by the government. Community-orientated value creation The manufacturing sector in Singapore contributes approximately 21% of Singapore's Gross Domestic Product (GDP) and employs almost 500,000 staff, making it a pivotal industry in Singapore.2 Jurong Innovation District (JID), Singapore's first 600-hectare innovation hub, was built to spur innovation in areas such as robotics, advanced manufacturing, urban solutions, clean technologies, and intelligent logistics. The hub is expected to create some 1,200 jobs in the next 18 months, with the district's workforce growing to over 4,500 once companies such as industrial developer Surbana Jurong and bicycle components heavyweight Shimano move their operations into the district.3 The construction of JID has revitalized Jurong from a brownfield area of old industries and low-productivity warehouses into a lively industrial park aimed at catalyzing innovation. Furthermore, concentrating all the manufacturing powerhouses of Singapore in a single district facilitates the creation of a manufacturing ecosystem. JID comprises five precincts: Nanyang Technological University, Cleantech Park, Bahar, Bulim, and Tengah. Presently, anchor tenants of Jurong Innovation District include Nanyang Technological University, Siemens, Shimano, and YCH Group. In 2020, JID continued to make strides to become Asia's advanced manufacturing hub. Over the past year, it attracted $420 million worth of new investments. Key players for delivering improved services JID is a development by JTC, a statutory board under the Ministry of Trade and Industry. JTC is in charge of Singapore's industrial progress developing and managing industrial estates and providing facilities to enhance operations of industries. For example, fully serviced plots and buildings that appeal to leading businesses to co-locate in a commercial ecosystem, attracting and retaining the best global talent. Mechanism for Maximizing Funding for Infrastructure Rental revenue earned by JTC ultimately flows to the government as JTC is a statutory board. Consequently, the government can utilize the revenue to develop more serviced plots for industrial development. In 2020, rental income from land and building contributed 88.7% to JTC's total operating revenue of SGD 2.3 billion.4 Typical Business Model In JTC Corporation's current business model, lessees are charged a fixed rental fee to lease land, office, or shared spaces in Jurong Innovation District. Size, location, and the availability of amenities are factors that determine the rental fee. Lessons Learned Confidence for sustainable delivery for communities Managing the risks Footnote 1: The rise of innovation districts Footnote 2: 5 things you should know about Jurong Innovation District - Singapore's advanced manufacturing hub Footnote 3: JTC Corporation Annual Report FY2020

Government

Landowner

Statutory Board

Responsible for industrial development

Lessees

Rents the space and pays a fixed rental fee

The Guidelines on Innovative Revenues for Infrastructure (IRI) is intended to be a living document and will be reviewed at regular intervals. They have not been prepared with any specific transaction in mind and are meant to serve only as general guidance. It is therefore critical that the Guidelines be reviewed and adapted for specific transactions.

To find more, visit the Innovative Revenues for Infrastructure section and the Content Outline, or Download the Full Report. For feedback on the content of this section of the website or suggestions for links or materials that could be included, please contact the Public-Private Partnership Resource Center at ppp@worldbank.org.

TABLE OF CONTENTS

I. Innovative Revenues for Infrastructure (IRI)

2. Introduction to Commercial Value Capture (CVC)

3. Applying CVC in Infrastructure Projects

2. Case Studies in CVC from International Experiences

3.100 Case Studies: Municipal PPP Framework

Related Content

Select WBG PPP Toolkits

Featured Section Links

Additional Resources

Climate-Smart PPPs

Finance Structures for PPP

Type of ResourceFinancing and Risk Mitigation